Appeal Panel Decisions XXX PDF

Preview Appeal Panel Decisions XXX

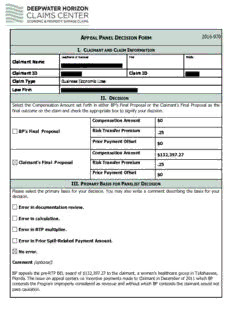

APPEAL PANEL DECISION FORM 2016-970 I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $0 BP’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Compensation Amount $132,397.27 Claimant’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): BP appeals the pre-RTP BEL award of $132,397.27 to the claimant, a women’s healthcare group in Tallahassee, Florida. The issue on appeal centers on incentive payments made to Claimant in December of 2011 which BP contends the Program improperly considered as revenue and without which BP contends the claimant would not pass causation. The record shows that Claimant implemented electronic health record (EHR) technology in 2011. By doing so, and upon meeting certain benchmarks, Claimant qualified for incentive payments, four of which were received in December, 2011 totaling $85,000. BP maintains that these payments, which BP refers to as “grants,” were not “typically earned as revenue” and should have been excluded under Policy 328. In order to achieve the maximum benefits under the EHR Incentive Program, physicians were encouraged to implement it early in 2011 or 2012. Claimant changed its practice with this in mind and qualified for benefits that continue into 2016, assuming Claimant continues to make its benchmarks. Contrary to BP’s assertion that this is a one-time “grant” payment, it is merely the beginning of a shift in Claimant’s practice designed in part to take advantage of the incentives offered and which span several years after the initial payments in 2011. The Program investigated the nature of the payments and properly concluded that it should be included as revenue. Accordingly, the claimant’s final proposal is the correct result and the appeal is denied. APPEAL PANEL DECISION FORM 2016-971 I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Subsistence Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $1,659.98 BP’s Final Proposal Risk Transfer Premium 2.25 Prior Payment Offset $0 Compensation Amount $10,000 Claimant’s Final Proposal Risk Transfer Premium 2.25 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): Claimant has signed and filed the "Claimant Final Proposal Acceptance Form" confirming his acceptance of a pre-RTP Compensation Amount of $1,659.98, together with a RTP of 2,25, which is the amount and RTP contained in BP's Final Proposal. Accordingly the appeal is now moot, but for the sake of formal closure of record, the appeal is denied. APPEAL PANEL DECISION FORM 2016-972 I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Wetlands Real Property Law Firm Street Parish/ County Parcel Address City State Zip Code Property Tax Parcel ID Assessment ID II. DECISION Denial Upheld Denial Overturned III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Claim should have been excluded. Claim should have been denied. Claim should not have been excluded. Claim should not have been denied. No error. Comment (optional): appeals the denial of his Wetlands Real Property Claim. His Notice of Appeal merely lists the address of the parcel and did not file a memorandum in support of his position. A review of the record reflects that Claimant’s property is outside the claim zone and he has offered no documentation to support its inclusion. The Claims Administrator properly denied the claim and the appeal is likewise denied. APPEAL PANEL DECISION FORM 2016-973 I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $0 BP’s Final Proposal Risk Transfer Premium 1.50 Prior Payment Offset $0 Compensation Amount $33,645.53 Claimant’s Final Proposal Risk Transfer Premium 2.50 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): . - Claim ID The Claims Administrator denied the BEL claim of this commercial property lessor in Gulf Shores, Alabama (Zone A). The Administrator was unable to determine that apparent related party transactions were made at arms length and therefore excluded all of Claimant’s rental revenue. Claimant appeals. Claimant operates a commercial real estate holding company that leases various properties to its parent entity, . The parent, in turn, operates retail businesses on the property. This appeal concerns the property located at Gulf Shores, Alabama and is one of several related appeals in which identical issues are raised. The program accountant’s exclusion of the rental revenue resulted in Claimant having no other revenue and therefore, no compensable loss. Claimant’s principal substantive argument does not address the related party issue. Rather, Claimant argues that the spill caused its property value to diminish which resulted in financial losses associated with obligations under financing agreements. On the issue of whether the rental revenue was the product of a related party product transaction, the Calculation Notes disclose the following: The Claimant owns several related entities that own and operate businesses as well as the commercial structures in which they are located. The Claimant’s accountant explained, “the monthly charges represent charges to the other sister company that operates the store for enough rent to cover the mortgage payments and real estate taxes. Revenues are charges to affiliates. The company does not have any other revenues.” An additional diagram was also provided to illustrate the relationship between the different entities. Based on the correspondence received, Accounting Review was unable to determine the arm’s length nature of the related party transactions. All rental has been excluded pursuant to Policy 328 v.2. (Contact ID: & DOC ID’s: ) In addition, there is overlapping ownership as the Claimant and have the same shareholder. The Claims Administrator responded to several requests for additional information and also provided a Summary of Review. After careful consideration of the Administrator’s responses and de novo review of the record, it is clear to this panelist that the Administrator was correct in identifying the rental revenue as the product of a related party transaction that was not made at arm’s length. Accordingly, no basis for overturning the program accountant’s treatment of the rental income has been demonstrated. Any loss of property value is more properly addressed in Claimant’s Coastal Real Property claim. Accordingly, the denial was proper which requires that BP’s Final Proposal be selected. 2 APPEAL PANEL DECISION FORM 2016-974 I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $91,349 BP’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Compensation Amount $255,370.53 Claimant’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Remand to Claims Administrator III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): See attached opinion uploaded into the portal. DWH: Claim ID: Written Reasons and Opinion: This is a BP appeal from a Business Economic Loss award to a Sarasota, Florida, based brokerage firm. BP argues that, after the Claims Administrator determined CAO Approved Policy 495 criteria were triggered, he erred in utilizing the Annual Variable Margin Methodology, as opposed to the Professional Services Methodology, for the purpose of achieving the requisite matching of expenses and revenues. According to Claimant, it is a business brokerage service which brings buyers and sellers of businesses together, in the same fashion that a real estate agent works to unite buyers with sellers of property. It asserts that the two industries are very similar and have similar fluctuations in revenue. In response to a specific inquiry from the Administrator, on this subject, it stated: The claimant didn’t have any periods of dormancy as indicated by the operating expenses reported every month, but the claimant only gets paid when a deal closes. It is common every year for a few months to not have any closings there therefore there is no income those months. That is what happened in January, February, June, July, September, October and November, but the claimant was still in operations during those months. Document ID page 2. Thus Claimant contends the Administrator made no error in utilizing the AVM Methodology. The record reflects that the claims analyst analyzed this issue. The Calculation Notes contain the following entry: This claim was classified under a Professional Services NAICS code. The DWH Accountant has utilized the Annual Variable Margin (AVM) methodology based on the following factors: the business operates on a short earnings cycle with revenue recorded in the month when the services were performed (See Calculation Note 6). Accordingly, services are rendered on a more consistent monthly basis and therefore, the AVM methodology was applied. Document ID Note 11, Professional Services – AVM Methodology Applies. To the contrary, BP argues strenuously that the Administrator misunderstood the facts; that significant lapses of time existed between when Claimant provided services to its clients and when it ultimately received payment, or in some instances, partial payment, in compensation. For that reason, it insists that the Professional Services Methodology should have 1 been utilized, instead. Had that been done, Claimant’s award would have been significantly less. Review of the record persuaded this panelist that input from the Claims Administrator would be helpful in resolving this issue. Accordingly, a Summary of Review was requested and promptly provided: The Claims Administrator submits the following response to the Appeal Panel’s request for further information on the claim referenced above. Specifically, the Appeal Panelist asked whether the Program Accountants should have used the Professional Services Methodology for the purpose of achieving the requisite matching of expenses and revenues. Per Doc ID: the Claimant stated "Sometimes the claimant receives a deposit and then receives the remainder of the commission at closing... The claimant is cash basis but does record the commissions during the month of closing, so there will be some payments received one month but recorded as income in another month." Per the bank statements, Doc ID: deposits were received in July while the final commission payment was received in August. DWH Accountant would need to perform additional outreach to confirm whether the revenue recognized relates to work performed in that month, and as such, whether the Professional Services methodology would be more appropriate to sufficiently match the claim under Policy 495. This panelist is mindful of the very strong similarity between this Claimant’s business enterprise and that of real estate agents. Claimant is correct in asserting that Appeal Panelists have uniformly rejected BP’s argument that the Professional Services Methodology ought be utilized in analyzing Business Economic Loss claims of realtors. BP makes the same argument here. For that reason, this panelist is very reluctant to accept it. On the other hand, the Claims Administrator advises further outreach must be undertaken in order to determine its applicability to this Claimant’s business. After further consideration, this panelist has reluctantly concluded it must be done. For the foregoing reasons, this BP appeal is sustained and the matter is remanded to the Claims Administrator with instructions to perform the outreach described in his Summary of Review. Decision: July 1, 2016 2

Description: