Appeal Panel Decisions XXII PDF

Preview Appeal Panel Decisions XXII

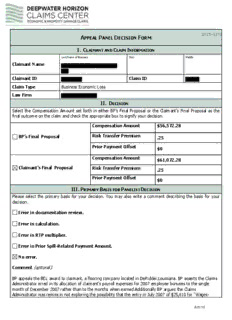

APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $56,572.28 BP’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Compensation Amount $61,072.28 Claimant’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): BP appeals the BEL award to claimant, a flooring company located in DeRidder,Louisiana. BP asserts the Claims Administrator erred in its allocation of claimant's payroll expenses for 2007 employee bonuses to the single month of December 2007 rather than to the months when earned.Additionally BP argues the Claims Administrator was remiss in not exploring the possibility that the entry in July 2007 of $25,610 for "Wages- 8/31/15 Administrative" was also a bonus payment not properly allocated. The eligibility notice issued acknowledged the claim was sufficiently matched and used the general BEL methodology to calculate a reduced award.Claimant responds the Claims Administrator properly evaluated the claim in light of the dictates of policy 495 and relies on a previous panel decision involving a similar fact pattern rejecting BP's argument. A review of the record discloses the Claims Administrator determined the claim was sufficiently matched and that none of the seven criteria of policy 495 was triggered. The calculation notes of the program accountants and correspondence between them and claimant disclose that bonuses and administrative wages were treated on claimant's tax returns as costs of goods sold(COGS) and this classification was accepted.Given this treatment, program accountants deemed these expenses as properly allocated and sufficiently matched, requiring no further application of policy 495. This panelist agrees.There is no error. Remand is not warranted.The award is affirmed and the appeal of BP is denied. 8/31/15 APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name . Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $59,184.34 BP’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Compensation Amount $59,184.34 Claimant’s Final Proposal Risk Transfer Premium 1.25 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): See Decision Comment uploaded. 8/31/15 Claim No. – BP appeals the BEL claim award to contending only that the Settlement Program (“the SP”) erred in according a Tourism designation. is a travel service based in New Albany, Mississippi. The SP determined that the most appropriate NAICS Code assignment for it was “561520 – Tour Operators.” Exhibit 2 to the Settlement Agreement specifies that if a claimant’s properly assigned NAICS Code is one of those listed in the exhibit, that claimant is “in the Tourism Industry.” Policy 289 v.2 explains: (a) Exhibit 2 provides that “Tourism means businesses which provide services such as attracting, transporting, accommodating or catering to the needs or wants of persons traveling to, or staying in, places outside their home community.” (b) Exhibit 2 then provides a list of NAICS codes which qualify a claimant for inclusion in the Tourism category. The Claims Administrator finds that the list of NAICS codes is illustrative, not exhaustive. (c) If the most appropriate NAICS code for a claimant is one of the codes listed on Exhibit 2, that claimant will be considered to fall within the Tourism definition. (d) If the most appropriate NAICS code for a claimant is not one of the codes listed on Exhibit 2, that claimant may still be considered to fall within the Tourism definition if the Claims Administrator determines in his discretion that the claimant’s business meets the definition outlined in Subsection (a) above. (e) The Claims Administrator has established a specialized team to assess Tourism issues on a case-by-case basis. (f) Characterization of a claimant’s business as Tourism vs. Non-Tourism shall be based on the totality of circumstances, including consideration of the business' activities during the Benchmark Period and the Class Period. In deciding on a claimant’s NAICS Code, the SP is guided by Policy 480 v.2, which provides, in pertinent part, “The appropriate NAICS Code for an Entity shall be the NAICS Code that most accurately describes the Entity’s primary business activities, which are the activities in which the Entity was primarily engaged during the operative Benchmark, Compensation, and Class Periods.” NAICS Code 561520 is among those listed in Exhibit as Tourism businesses; therefore, if the SP’s assignment of that code was not erroneous, Exhibit 2 and Policy 289 v.2, subparagraph (c), dictate a Tourism classification for BP argues that the SP should have chosen NAICS Code “485519 – Charter Bus Company” for That Code is not listed in Exhibit 2. The SP noted in its analysis of business activities that it had consulted website “listing its bus tour services.” That website touts 30-year experience in the travel 8/31/15 business and its membership in the National Tour Association (“the premier association of escorted group travel operations in North America”) and explains that over the course of its history it has provided tours to all of the United States, all the provinces and territories of Canada, and several overseas destinations. The site states that “can arrange tours for your group, providing the hotel accommodations, tickets, tours, motorcoach, an escort, a professional driver and other special requests.” also offers its motorcoaches for charter, with attendant services such as pricing for hotel rooms and tickets, meals and trips tailored to include the “attractions” the customers would like to visit. BP points out that P&L income line item “chartered trips” represents well over half of its reported revenue, thus weighing in favor of a “charter bus company” code assignment. However, that category would seem to include chartered tours, whether by bus or otherwise, as well as bus charters per se, because none of the other income line items can account for the revenue that should result from chartered tours. BP argues that only five of the P&L income line items can be considered as “tour revenue,” to-wit: baggage handling, motel revenue, food revenue, tour guide revenue and admission revenue, but those items total only a very small percentage of annual income. For example, only $120,435 out of $918,354 in 2007; $75,721 out of $899,301 in 2008, and $52,166 out of $889,575 in 2009. motorcoaches can seat 55 passengers and its 2015 tour rates include $3,745 per person for the New England tour and $2,910 per person for the New York City tour. Even if each coach was only half filled, those two tours alone would generate over $175,000 in tour passenger revenue. Additionally, website describes a wide variety of “School Tours” available, to dozens of cities, with guided tours of some of the local attractions. That apparently is a substantial part of business, yet the income derived cannot be accounted for within the P&L income line items if “chartered trips” is deemed to represent only non-tour bus charters. BP asserts that because NAICS Code 485510, Charter Bus Company, isn’t listed in Exhibit 2, “therefore, Claimant is not eligible for a tourism designation.” This overlooks the discretion granted the Claims Administrator by subparagraph (d) of Policy 289 v.2, quoted above. BP makes other arguments against the grant of the Tourism classification to with the force of logic behind some of them, but they all are trumped by the fact that if an Exhibit 2 NAICS Code was permissibly assigned to by the SP in the exercise of its Policy 480 v.2 discretion to identify the NAICS Code which most accurately describes the entity’s primary business activities, that settles the matter. The panelist has reviewed on line all of the NAICS Code descriptions at issue and, although a close question is presented, it cannot be said that the SP erred in settling on NAICS Code 561520 – Tour Operators, as the most appropriate one, under all of the circumstances. Appeal denied. 8/31/15 APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $0 BP’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Compensation Amount $46,582.37 Claimant’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): See Decision Comment uploaded. 8/31/15 Claim No. - In this appeal, the panelist has struggled to understand when and why a claim might properly be questioned as “implausible” and/or “suspicious.” The panelist’s difficulty arises from the discussion of those types of claims, either expressly or indirectly, in the various writings of the participating judges in the decisions of the United States Court of Appeals for the Fifth Circuit in the sequential decisions In re Deepwater Horizon, 732 F.3d 326 (October 2, 2013), 744 F.3d 370 (March 3, 2014) and 753 F.3d 509 (May 19, 2014). In particular, the panelist has attempted to discern the implications of these two statements: (1) [W]e conclude the Settlement Agreement does not require a claimant to submit evidence that the claim arose as a result of the oil spill. Each claimant does attest, though, under penalty of perjury, that the claim in fact was due to the Deepwater Horizon disaster. The attestation, of course, applies to all assertions on the claims form, including the financial figures and other details. Suspicious forms would be subject to investigation. 744 F.3d 370, 376-77 (2) Though we are reluctant to say that all claims must be accepted no matter how clear the absence of the required nexus may be, no one has concerned itself in this appeal with the when, by whom, and how of analyzing such suspicious claims after they are submitted. It seems to us that absent any specific provision in the Settlement Agreement, and no one suggests there is one, such concerns are to be addressed in the usual course of processing individual claims. The Settlement Agreement contained many compromises. One of them was to provide in only a limited way for connecting the claim to the cause. The claims administrator, parties, and district court can resolve real examples of implausible claims as they resolve other questions that arise in the handling of specific claims. 744 F.3d 370, 378 In the present appeal, Claimant is a medical equipment and supplies provider located in Rolling Fork, Mississippi (Zone D). Contrary to Claimant’s sworn attestations that it suffered losses due to the spill, Claimant’s attorney admitted in writing that Claimant’s decline in 2010 revenue and profits was the direct result of Claimant’s failure to file the necessary paperwork with Medicare (its primary source of revenue) and its ensuing loss of Medicare accreditation. P&Ls reflect that during 2007, 2008 and 2009, Medicare fees constituted roughly two-thirds of its total revenue, but from November of 2009 until July 2011, it received not a penny from Medicare. 8/31/15 Based on that clear-cut picture, the panelist remanded the appeal in February of 2015 for the SP to investigate and consider whether the claim was “implausible” and “suspicious.” On April 19, 2015, the SP issued its lengthy “Response to Remand,” which the panelist now sets out in full: Certain Business Economic Loss (“BEL”) claims that were on appeal before the Settlement Program’s Appeal Panel, including this one, have been remanded with a request that the Settlement Program investigate and consider whether the claimants’ claims are “implausible” and/or “suspicious.” The Settlement Program considers its analysis of causation to be properly limited to the application of the objective causation test set out at Exhibit 4B of the Settlement Agreement. As reflected by the Claims Administrator’s Policy 308, as far back as 2012 both Class Counsel and BP agreed that no causation analysis beyond that contained in the Settlement Agreement was required or intended. Thus, Policy 308 – to which neither BP nor Class Counsel objected – stated: “The Settlement Agreement does not contemplate that the Claims Administrator will undertake additional analysis of causation issues beyond those criteria that are specifically set out in the Settlement Agreement. Both Class Counsel and BP have in response to the Claims Administrator’s inquiry confirmed that this is in fact a correct statement of their intent and of the terms of the Settlement Agreement. The Claims Administrator will thus compensate eligible Business Economic Loss and Individual Economic Loss claimants for all losses payable under the terms of the Economic Loss frameworks of the Settlement Agreement, without regard to whether such losses resulted or may have resulted from a cause other than the Deepwater Horizon oil spill provided such claimants have satisfied the specific causation requirements set out in the Settlement Agreement. Further, the Claims Administrator will not evaluate potential alternative causes of the claimant’s economic injury, other than [as specifically required with respect to certain Individual Economic Loss claims].” That policy was recognized and upheld by the District Court in its April 9, 2013 opinion, In re Deepwater Horizon, No. 10-MDL-2179 (E.D.La., filed April 9, 2013), was again recognized in its December 24, 2013 opinion, No. 10- MDL-2179 (E.D.La., filed December 24, 2013), and was recognized and quoted by the Fifth Circuit in In re Deepwater Horizon, 739 F.3d 790 (5th Cir. 2014). The Fifth Circuit’s rulings on this issue became final with the Supreme Court’s denial of certiorari. As the Settlement Program understands the governing orders of the Courts, causation determinations are dictated solely by the agreed upon objective criteria set out in Exhibit 4B. The Claims Administrator is not to perform a gatekeeping function that would add an additional level of subjective causation analysis beyond the objective terms and conditions of Exhibit 4B. The Settlement Program addresses issues of implausible or suspicious assertions made by claimants in the normal course of claims processing. That analysis, however, 8/31/15 does not characterize claims as “suspicious” or “implausible” when the submitted financials satisfy the objective causation criteria set out in Exhibit 4B. In the instant claim, the Claims Administrator did not determine that there was anything presented by the claimant that would render the claim “implausible” or “suspicious” under the parameters outlined above. The ensuing “Eligibility Notice After Remand Appeal” awarded the same Compensation Amount as before and BP appeals, asserting that the SP had failed to investigate whether attestation was implausible and suspicious. BP argues that: The Claims Administrator’s position, that the Settlement Program categorically will not find a false or baseless attestation of a spill-related loss to be implausible or suspicious if the Claimant satisfies the applicable Exhibit 4B test, runs directly counter to the holdings of the Fifth Circuit. Had the Fifth Circuit intended for the Settlement Program to accept all attestations regardless of their veracity, provided only that the claim satisfies the mathematical requirements of Exhibit 4B, there would have been no need for the Fifth Circuit to hold that implausible and suspicious attestations of a spill-related loss should be investigated, as Exhibit 4B would necessarily provide the mathematical answer in every case. · · · This is not a matter of debating “alternative causation,” where the parties have competing, good-faith arguments as to whether the alleged loss was or was not caused by the spill, and the Claims Administrator uses the economic tests set forth in Exhibit 4B to decide the matter. Rather, it is a situation where the foundational sworn attestation required by the Settlement Agreement and emphasized by the Fifth Circuit is demonstrably untrue and is therefore by definition suspicious and implausible. BP notes that in the Appeal Panel Decision previously issued in Claim ID the conclusion reached was “The Claims Administrator is not prohibited by the Settlement Agreement from investigating and denying suspicious or implausible claims. To the contrary, it is part of his duties.” BP requests a further remand, with a renewed instruction to the SP that it investigate whether the attestation by was implausible and suspicious or, failing that, calls upon the panelist to deny the claim on that basis. There was not presented to the SP a “suspicious form,” in the words of the Fifth Circuit, in the sense that within its four corners there was some obvious misrepresentation or contradiction. Facially, the claim form would arouse no suspicion. Having cleared that hurdle, should the claim itself have been investigated as implausible and suspicious when facts surfaced during the claims handling process which seemingly refuted causation, given that the submitted financials otherwise satisfied the causation criteria of Exhibit 4B? The panelist remanded for that reason. Now, in light of the SP’s Response to Remand, and having painstakingly parsed all 8/31/15 of the writings of the Fifth Circuit judges on point, the panelist does not consider that he independently should undertake, or order the SP to undertake, an analysis beyond what has taken place. It may just be that the Fifth Circuit’s observation that “the claims administrator, parties, and district court can resolve real examples of implausible claims as they resolve other questions that arise in the handling of specific claims,” essentially assigns the issue to the exercise of discretion and professional judgment by the SP. The panelist notes that the SP has created the Fraud, Waste and Abuse Department, staffed by a number of experienced investigators and headed up by former law enforcement executives, with the mission to protect the process from fraudulent claims. Declining to order further “investigation,” the panelist denies the request for a second remand and, as between Final Proposal in the amount of the SP’s award, and BP’s Final Proposal of a complete denial of the claim, adopts that of Appeal denied. 8/31/15

Description: