Appeal Panel Decisions XX PDF

Preview Appeal Panel Decisions XX

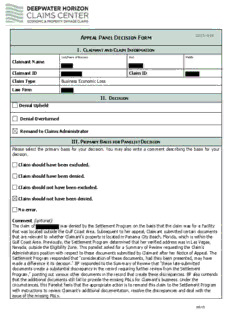

APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Denial Upheld Denial Overturned Remand to Claims Administrator III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Claim should have been excluded. Claim should have been denied. Claim should not have been excluded. Claim should not have been denied. No error. Comment (optional): The claim of was denied by the Settlement Program on the basis that the claim was for a Facility that was located outside the Gulf Coast Area. Subsequent to her appeal, Claimant submitted certain documents that are relevant to whether Claimant's property is located in Panama City Beach, Florida, which is within the Gulf Coast Area. Previously, the Settlement Program determined that her verified address was in Las Vegas, Nevada, outside the Eligibility Zone. This panelist asked for a Summary of Review requesting the Claim's Administrators position with respect to these documents submitted by Claimant after her Notice of Appeal. The Settlement Program responded that "consideration of these documents, had they been presented, may have made a difference it its decision." BP responded to the Summary of Review that "these late-submitted documents create a substantial discrepancy in the record requiring further review from the Settlement Program," pointing out various other documents in the record that create these discrepancies. BP also contends that the additional documents still fail to provide the missing P&Ls for Claimant's business. Under the circumstances, this Panelist feels that the appropriate action is to remand this claim to the Settlement Program with instructions to review Claimant's additional documentation, resolve the discrepancies and deal with the issue of the missing P&Ls. 5/5/15 APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Denial Upheld Denial Overturned III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Claim should have been excluded. Claim should have been denied. Claim should not have been excluded. Claim should not have been denied. No error. Comment (optional): This panelist adopts the analysis, reasoning and decisions in Claims ID #s and 5/5/15 APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Denial Upheld Denial Overturned III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Claim should have been excluded. Claim should have been denied. Claim should not have been excluded. Claim should not have been denied. No error. Comment (optional): See Decision Comment uploaded. 5/5/15 Claim No. - Claimant appeals the denial of its BEL claim. The Claims Administrator (“the CA”) based the denial on its conclusions that was an Entity excluded from the Economic Class under Section 2.2.5. of the Settlement Agreement (“the SA”), as a Governmental Organization. Because the parties invoke, and argue competing construction of, several pertinent provisions of the SA, they are here set out verbatim: 38.77. Governmental Organization shall mean: (a) the government of the United States of America, (b) any state or local government, (c) any agency, branch, commission, department, or unit of the government of the United States of America or of any state or local government, or (d) any Affiliate of, or any business or organization of any type that is owned in whole or at least 51% in part by the government of the United States of America or any state or local government, or any of their agencies, branches, commissions, departments, or units. 38.3. Affiliate means with respect to any Natural Person or Entity, any other Natural Person or Entity that directly, or indirectly, through one or more intermediaries, controls, or is controlled by, or is under common control with, such Natural Person or Entity. 38.65. Entity shall mean an organization or entity, other than a GOVERNMENTAL ORGANIZATION, operating or having operated for profit or not-for-profit, including a partnership, a corporation, a limited liability company, an association, a joint stock company, a trust, a joint venture or an unincorporated association of any kind or description. Although the CA’s successive denial notices never specified which of the various types of Governmental Organization of §38.77 the CA considered to represent, BP argues only that qualifies as an “Affiliate,” principally of the State of Louisiana but also, secondarily, of the . As a threshold argument, contends that it could not be an Affiliate of either government because an affiliate has to be an “Entity” under §38.3 (the “Natural Person” alternative not being implicated) and §38.65 says an “Entity” can’t be “a Governmental Organization.” The panelist does not accept that construction of the terms, and his reasons for doing so parallel those concisely expressed by BP in its Supplemental Memorandum, which he hereby adopts: Claimant ignores that the definition of “Governmental Organization” expressly includes an Affiliate “of the United States of America or any state or local government, or any of their agencies, branches, commissions, departments, or units.” Id. at § 38.77(d). Thus, the definition of Governmental Organization expressly applies the definition of Affiliate to various governmental bodies, even 5/5/15 though the term Affiliate, standing alone and without its use in the definition of Governmental Organization, would not apply to governmental bodies. Claimant’s argument would render the use of the term Affiliate in the definition of Governmental Organization entirely meaningless. As multiple Appeal Panel decisions have found, a claimant that is controlled by a federal, state or local government is a Governmental Organization under the Settlement Agreement and is excluded. Turning to the more substantive issue of the character of an Affiliate, this panelist understands the meaning and interaction of the referenced provisions of the SA to be, as applicable to this appeal, that is due to be classified an Affiliate of the State of Louisiana and/or the if it is “controlled by” either or both. (The panelist rejects the construction of § 38.77(d) which puts forth as part of its argument, and at least one other panelist appears to have adopted in the past, whereby for an Entity to be an Affiliate, it has to be owned (or controlled) “at least 51% in part” by a government.) The only basis BP cites for recognizing Parish control over is that the largest source of funding comes from an ad valorem tax on property in the Parish. submissions demonstrate, however, that the Parish Council certified on December 3, 2008 that the citizens of the Parish had voted at a special election held November 4, 2008 for the benefit of “beginning with the year 2010 and ending with the year 2019.” The tax revenues are collected by the Parish, but then remitted by it to with only cost of collection withheld. The Parish has no say in how spends the funds and they will flow to for use as it sees fit (subject to State controls, as discussed hereafter) until at least 2019. Therefore, the consolidated Government does not exercise any meaningful control over With respect to the relationship between the State of Louisiana and the following facts are relevant: provides services to the elderly residents of and was created to fulfill the State of Louisiana’s responsibilities under the Federal Older Americans Act. Combining the revenue receives with the funding it receives from the State, 96% of 2010 revenue came from public sources. In the Independent Auditor’s Report to Board of Directors for the year ended June 30, 2010, this informative history and statement of status was presented: 5/5/15 The statutory authorization for parish councils on aging is found at La.Rev.Stat. §46:1606 et seq. §1604 commences, “It shall be the duty of each parish voluntary council on the aging [followed by a long list of prescribed duties].” §1605 provides, in pertinent part: A. The functions of each parish voluntary council on the aging shall comply with the objectives of state laws and shall be governed by the policies and regulations established by the [Governor’s Office of Elderly Affairs] and upon review and recommendation of the Louisiana Executive Board on Aging as provided in R.S. 46:934. · · · B. The office, with approval of the governor, and upon review and recommendation of the Louisiana Executive Board on Aging, may revoke the charter of any parish voluntary council on the aging for noncompliance with the provisions of this Chapter or the policies, regulations, or amendments thereto established by the office. . . . Upon revocation or surrender of the charter, a parish council shall cease to function under the provisions of this Chapter. The panelist is persuaded by the totality of the circumstances of the creation, mission, funding, state oversight, and potential dissolution by the state, of that is properly deemed an Affiliate of the State of Louisiana and, therefore, excluded from the Economic Class. Appeal denied. 5/5/15 APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $14,400 BP’s Final Proposal Risk Transfer Premium 1.25 Prior Payment Offset $0 Compensation Amount $27,401.99 Claimant’s Final Proposal Risk Transfer Premium 1.25 Prior Payment Offset $0 Remand to Claims Administrator III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): See Separate Decision 5/5/15 BP appeals this award to a truck driver from Patterson, La. Appellant, raised three issues, the failure to reconcile tax returns with the monthly P&L’s, the alleged incorrect characterization of expenses, and the failure to adequately evaluate whether any claimed losses were due to the federal moratoria. There is a finding herein that the reconciliation of the financials and the categorization of expenses were properly assessed by the Claims Administrator and no further examination of these issues is required. The moratoria question calls for more extended analysis. There is no question that entities and individuals are not entitled to recover under the Settlement Agreement for losses attributable to the federal moratoria. Section 38.93 of the Agreement defines moratoria losses as any loss” whatsoever “caused by or resulting from federal regulatory action or inaction directed at offshore oil industry activity in the Gulf. In this case, claimant’s counsel made the following damning statement in various submissions to the Claims Administrator: is the owner and driver of a truck and trailer that service(s) the hauling needs of the oil and gas industries in the Gulf of Mexico…Due to the closure of the oil and gas industries in the Gulf following the oil spill, services drastically declined over the past 17 months. Additionally, in documents provided to the GCCF, claimant explained that “he has been working in the Oil Field for the past 20 years” and that he owns “a 18 wheeler and I run it in the Oil Field.” These statements certainly seem to run afoul of the prohibition on recovery for moratoria related losses. The Settlement Agreement references any losses “whatsoever” caused by the federal moratoria. Whatsoever is a broad word and when claimant suggests his business declined “due to the closure of the Oil and Gas industry in the Gulf following the oil spill”, this clearly seems to fit. Initially, claimant’s counsel submitted no substantive response to BP’s argument other than to say this claim was already reviewed by the Claim Administrator’s office. Subsequently, claimant filed a comprehensive memorandum on the moratoria issue authored by Class Counsel. In the submission, Class Counsel went through an exhaustive analysis of all provisions of the Settlement Agreement relating to the moratoria exclusion. The salient arguments are as follows: In the Agreement, there is a portion of the Moratoria section which addresses Support Services to the Oil and gas Industry. This category is defined and limited by the following two situations: a) The claims administrator determines that the claiming entity of claiming job employer falls within the NAICS Codes and descriptions marked with an “X” in Section I of “industry types subject to review by Claims Administrator for potential moratoria losses in Exhibit 19, or b) The Claims Administrator determines that the claiming entity or claiming job employer falls within the NAICS codes and descriptions marked with an “X” in Section II of “industry types subject to review by the Claims Administrator 5/5/15 for potential moratoria losses” in Exhibit 19, and (ii), the BEL claimant or IEL employer responds affirmatively that, in 2009, your business provided significant services, goods and/or supplies to businesses in the offshore oil and gas industry in the Gulf of Mexico. Therefore, by extension, claimant in this case argues that only those industry types precisely identified in Exhibit 19 are properly considered as subject to the moratoria exclusion. Admittedly, trucking is not one of the specifically enumerated industries listed in Exhibit 19. Additionally, claimant argues that it responded negatively to the question of whether the company provided significant services, goods and/or supplies to businesses in the offshore oil and gas industry in the Gulf. Despite these contentions, there is a finding herein that a claimant’s industry type does not have to be specifically marked in Exhibit 19 in order to be subject to the moratoria exclusion. There is nothing in the Settlement Agreement which dictates that the list in question is an exhaustive one. This perspective is supported by other panel decisions dealing with this issue. Moreover, claimant cannot escape the circumstances to which he concedes: He services the needs of the oil and gas industry and has done so for over 20 years and his business has suffered as a result of the moratoria in the Gulf. No other concessions could square more firmly with the outlines of the moratoria provisions. Additionally, claimant’s reliance on his earlier statement that he did not provide significant services, goods and/or supplies to businesses in the offshore oil and gas industry in the Gulf is clearly misplaced since, subsequently, this assertion was firmly contradicted by claimant in this proceeding. It should be noted that this panelist asked for a Summary of Review detailing whether a moratoria analysis had been performed. The Claims Administrator responded as follows: “This business was not automatically referenced( emphasis added) to the moratoria team for potential moratoria review because (1) it’s NAICS Code 484122 (General Freight Trucking Long Distance, less than truckload) is not included in the Exhibit 19 list of NAICS Codes triggering moratoria scrutiny and (2) the claimant answered BEL Claim Form Question No. 10 “No”, denying that it provided significant goods and/or supplies to businesses in the offshore oil and gas industry in the Gulf of Mexico in 2009. While it may be true that this claim was not subject to “automatic review”, due to the NAICS code not matching with any listed in Exhibit 19, this does not mean that a review is not called for if otherwise appropriate. 5/5/15 This assessment is consistent with Exhibit 18 of the Settlement Agreement under the heading of Support Services to the Oil and Gas Industry. In the first provision, it states only businesses whose NAICS codes match up to the list are subject to “automatic review”. However, the provision also references “or other evidence of the business’s activities that allow the Claims Administrator to determine whether a business falls under the Support Services to Oil and Gas Industry “ thus requiring moratoria scrutiny. . The next provision of Exhibit 18 also references other evidence of the business’s activities and says potential moratoria affected claimants should be asked the following: In 2009, did your business provide significant services and goods and/or supplies to businesses in the offshore oil and gas industry in the Gulf of Mexico? We know from claimants’ subsequent submissions, the initial negative response to this question was inaccurate. Due to the claimant’s initial negative indication on this issue, the claim was not automatically routed to the Moratoria team. However, based on the totality of evidence of the claimant’s business activities, a moratoria review is appropriate. For the foregoing reasons, this claim is remanded so it may be evaluated for a determination of what losses were due to the federal moratoria. 5/5/15

Description: