Appeal Panel Decisions X PDF

Preview Appeal Panel Decisions X

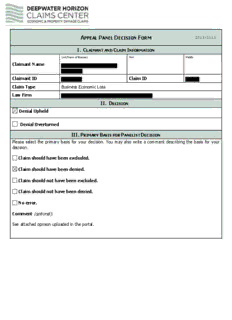

APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Denial Upheld Denial Overturned III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Claim should have been excluded. Claim should have been denied. Claim should not have been excluded. Claim should not have been denied. No error. Comment (optional): See attached opinion uploaded in the portal. DWH: Claim ID: Written Reasons and Opinion: Claimant, an oil and gas distributor located in , appeals the denial of a Business Economic Loss claim which it submitted to the Settlement Program. The record reflects that the claim was denied upon a finding by the Claims Administrator that the Claimant is a business in the oil and gas industry and, in keeping with Section 2.2.4.5 of the Settlement Agreement, it is excluded from the Economic Class. Following Request for Reconsideration and the submission of additional documentation, the Claims Administrator performed a Reconsideration Review and declined to change his original conclusion. On appeal, Claimant argues that it owns and operates multiple gas stations in the Gulf Coast area, a significant number of which sell gasoline and other petroleum products at retail and, as such, are businesses declared by the Settlement Agreement to be part of the Tourism industry. Since it is submitting claims based upon losses suffered by only those individual retail establishments owned by it, the Claims Administrator committed error in denying recovery for the losses they allegedly suffered. In opposition, BP points to record evidence indicating that Claimant’s business operations include extensive wholesale distribution of petroleum products and maintains supply and distribution agreements throughout the southeast United States. For that reason, it agrees that the business operated by Claimant falls within the oil and gas industry exception contained in the Settlement Agreement. While acknowledging that it does sell both wholesale and retail fuel, Claimant insisted that it had been unable to effectively communicate to the Claims Administrator that it was only pursuing claims for the six gasoline stations where it owns and sells retail fuel to the public. All are located in the greater Baton Rouge area. For that reason, it urges this Panelist to remand its claim to the Claims Administrator for further evaluation. After careful review of the record and considering these opposing positions, this Panelist was reluctant to render a decision without hearing further from the Claims Administrator. Accordingly, he requested and, in due course, received, a Summary of Review. That document was posted to the Claimant’s appeal file and distributed to the Claimant and to BP. It is very thorough. Without repeating here, in its entirety, that which is contained in the summary, it is clear to this Panelist that the Claims Administrator conducted a thorough analysis of the documentation submitted by this Claimant which led to the conclusion that its primary business activity is the wholesale distribution of petroleum and petroleum products. For example, in the year 2010, Claimant earned income of $124,113,621 from fuel sales and $1,536,459 from other income sources, including items for rental income, fuel rebates, jobber incentives and warehouse inventory adjustments. Claimant did not provide separate profit and loss statements for any retail facilities, nor did it distinguish between wholesale and retail fuel sales on its consolidated profit and loss statements. However, the income and expense items included in the consolidated statements provided by it do not include items typically associated with retail operations, such as cigarette rebate income or expenses associated with retail operations, such as drive-offs or returned checks. Instead, Claimant identifies such “other income” items as rent, fuel rebates and jobber incentives, items which arise from wholesale distribution operations. Furthermore, on its website, Claimant states that it “delivers over 100 million gallons of fuel every year to clients throughout the southeast United States,” and that it “maintains supply and distribution agreements throughout the southeast.” It also has link on its website entitled “ .” The website does not, however, mention direct retail sales to customers and the “Dealers” section discusses joining “the family of proud station owners,” which supports the view that Claimant’s status is that of a jobber/wholesale distributor. Insofar as Claimant argues that it is submitting claims for losses on behalf of its six retail locations only, the Claims Administrator states that the Settlement Program evaluates exclusions on the “Entity” level, not on a facility level. Settlement Agreement Sections 2.1 and 2.2 refer to excluded “Entities”, not excluded locations or facilities. For that reason, Claimant’s status as an excluded fuel wholesaler was not determined on the basis of the stations for which it chose to submit a claim, but rather on the entirety of Claimant’s wholesale and retail operations. After careful study of the Summary of Review and re-examination of Claimant’s briefs, this Panelist is convinced beyond any doubt that the Claims Administrator was correct in determining that this Claimant operates a business in the oil and gas industry and consequently is excluded from the Economic Class. Its appeal cannot be sustained and judgment must be entered herein upholding the denial of its claim. It is so ordered. Decision: October 17, 2013 APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $0 BP’s Final Proposal Risk Transfer Premium 1.50 Prior Payment Offset $0 Compensation Amount $501,681.17 Claimant’s Final Proposal Risk Transfer Premium 1.50 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): Claimant, is a legal practice located in . BP appeals the Eligibility Notice issued on July 12, 2013 for Claimant’s Business Economic Loss claim, citing two points not foreclosed by the Court’s prior orders. First, BP argues that this claimant should be subject to review for possible exclusion of any oil drilling moratoria losses. The Settlement Agreement describes which industries (identified by NAICS codes) are subject to moratoria review. Claimant, a law firm, does not have an NAICS code identified in the Settlement Agreement as “Support Services to Oil & Gas Industry”. The record does not support exclusion for oil drilling moratoria losses. BP asserts a calculation error of $17,500 for misclassification of “Professional Fees” expense as fixed. Claimant has conceded this point, agreed to have the “Professional Fees” line item treated as a variable expense, and to have its Compensation Award reduced by the $17,500. Claimant adjusted its Final Proposal accordingly. This renders the point moot. The Appeal Panelist hereby selects Claimant’s Final Proposal. APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Business Economic Loss Law Firm II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $0 BP’s Final Proposal Risk Transfer Premium 0 Prior Payment Offset $0 Compensation Amount $686,116.59 Claimant’s Final Proposal Risk Transfer Premium .25 Prior Payment Offset $0 Remand to Claims Administrator III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): BP appeals this BEL award to a law office on 5 grounds. Two of these are familiar revenue smoothing claims previously foreclosed by prior orders of the Court. This panelist further finds that BP's argument that Claimant cannot show a Spill-related loss of revenue is another attempt to reargue causation, also foreclosed by orders of the Court. Of the two remaining arguments, BP first alleges that when Claimant went to work as an associate at another firm that he must have ceased soliciting individual business or operating as a law firm other than accepting fees from cases he had handled before joining the firm in 2006. on that basis, BP asserts that Claimant was not a "business" at relevant times, and therefore not entitled to assert a BEL claim. This record does not support that assumption, and in fact Claimant has asserted that at no time did he discontinue his separate law practice, which he continues to this day. This panelist must agree with Claimant on the record presented. BP's final assertion is that the accounting support award of $13,190.00 was undocumented and was not based upon an invoice itemized by date as required in Sections 4.4.13 and 4.4.13.9 of the Agreement. This panelist has reviewed the invoice in the record (dated May 28, 2013) and agrees with BP. Said invoice is essentially "block" billed, and after handling numerous prior BEL claims, this panelist finds that the amount charged easily is several times larger than almost any other BEL accounting invoice he has seen approved, even for awards in the multi-million-dollar range. For this reason alone, the matter is remanded to allow the Administrator to review and verify the basis of the accounting invoice. APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Coastal Real Property Law Firm Street Parish/ County Parcel Address City State Zip Code Property Tax Parcel ID Assessment ID II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $52.83 BP’s Final Proposal Risk Transfer Premium 2.50 Prior Payment Offset $0 Compensation Amount $636.43 Claimant’s Final Proposal Risk Transfer Premium 2.50 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error. Comment (optional): This is a Coastal Real Property Compensation claim where the Claimant contends that the Settlement Program should have used "Total Parcel Value" as opposed to "True Value." There is no error and it is so ordered. APPEAL PANEL DECISION FORM I. CLAIMANT AND CLAIM INFORMATION Last/Name of Business First Middle Claimant Name Claimant ID Claim ID Claim Type Coastal Real Property Law Firm Street Parish/ County Parcel Address City State Zip Code Property Tax Parcel ID Assessment ID II. DECISION Select the Compensation Amount set forth in either BP’s Final Proposal or the Claimant’s Final Proposal as the final outcome on the claim and check the appropriate box to signify your decision. Compensation Amount $52.83 BP’s Final Proposal Risk Transfer Premium 2.50 Prior Payment Offset $0 Compensation Amount $636.43 Claimant’s Final Proposal Risk Transfer Premium 2.50 Prior Payment Offset $0 III. PRIMARY BASIS FOR PANELIST DECISION Please select the primary basis for your decision. You may also write a comment describing the basis for your decision. Error in documentation review. Error in calculation. Error in RTP multiplier. Error in Prior Spill-Related Payment Amount. No error.

Description: