ALIC Quarterly Statutory Statement PDF

Preview ALIC Quarterly Statutory Statement

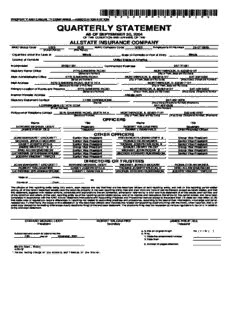

(cid:1)(cid:2)(cid:3)(cid:4)(cid:5)(cid:4)(cid:4)(cid:6)(cid:6)(cid:7)(cid:4)(cid:6)(cid:2)(cid:6)(cid:6)(cid:2)(cid:6)(cid:5)(cid:1) PROPERTY AND CASUALTY COMPANIES —ASSOCIATION EDITION QUARTERLY STATEMENT AS OF SEPTEMBER 30, 2004 OF THE CONDITION AND AFFAIRS OF THE ALLSTATE INSURANCE COMPANY NAIC Group Code 0008 0008 NAIC Company Code 19232 Employer’s ID Number 36-0719665 (Current Period) (Prior Period) Organized under the Laws of Illinois , State of Domicile or Port of Entry Illinois Country of Domicile United States of America Incorporated 02/09/1931 Commenced Business 04/17/1931 Statutory Home Office 2775 SANDERS ROAD , NORTHBROOK, IL 60062-6127 (Street and Number) (City or Town, State and Zip Code) Main Administrative Office 2775 SANDERS ROAD NORTHBROOK, IL 60062-6127 847-402-5000 (Street and Number) (City or Town, State and Zip Code) (Area Code) (Telephone Number) Mail Address 3075 SANDERS ROAD, SUITE H1A , NORTHBROOK, IL 60062-7127 (Street and Number or P.O. Box) (City or Town, State and Zip Code) Primary Location of Books and Records 2775 SANDERS ROAD NORTHBROOK, IL 60062-6127 847-402-5000 (Street and Number) (City or Town, State and Zip Code) (Area Code) (Telephone Number Internet Website Address Allstate.com Statutory Statement Contact LYNN CIRRINCIONE 847-402-3029 (Name) (Area Code) (Telephone Number) (Extension) [email protected] 847-402-0508 (E-mail Address) (FAX Number) Policyowner Relations Contact 3075 SANDERS ROAD, SUITE H1A NORTHBROOK, IL 60062-7127 800-949-2287 (Street and Number) (City or Town, State and Zip Code) (Area Code) (Telephone Number) (Extension) OFFICERS Name Title Name Title EDWARD MICHAEL LIDDY , President ROBERT WILLIAM PIKE , Secretary JAMES PHILIP ZILS , Treasurer DANNY LYMAN HALE , Chief Financial Officer OTHER OFFICERS JOAN MARGARET CROCKETT , Senior Vice President FREDERICK FLORIAN CRIPE # , Group Vice President MICHAEL JERALD MCCABE , Senior Vice President RONALD DEAN MCNEIL , Senior Vice President CASEY JOSEPH SYLLA , Senior Vice President THOMAS JOSEPH WILSON, II , Senior Vice President JAMES MAX PLOTTS # , Group Vice President SAMUEL HENRY PILCH* , Group Vice President ERIC ALLEN SIMONSON , Senior Vice President MICHAEL JOHN ROCHE # , Group Vice President CATHERINE SPEARMAN BRUNE , Senior Vice President GEORGE EDWARD RUEBENSON , Senior Vice President JOSEPH VINCENT TRIPODI , Senior Vice President , DIRECTORS OR TRUSTEES JOAN MARGARET CROCKETT EDWARD MICHAEL LIDDY MICHAEL JERALD MCCABE RONALD DEAN MCNEIL ROBERT WILLIAM PIKE CASEY JOSEPH SYLLA THOMAS JOSEPH WILSON, II ERIC ALLEN SIMONSON CATHERINE SPEARMAN BRUNE DANNY LYMAN HALE GEORGE EDWARD RUEBENSON JOSEPH VINCENT TRIPODI State of Illinois ss County of Cook The officers of this reporting entity being duly sworn, each depose and say that they are the described officers of said reporting entity, and that on the reporting period stated above, all of the herein described assets were the absolute property of the said reporting entity, free and clear from any liens or claims thereon, except as herein stated, and that this statement, together with related exhibits, schedules and explanations therein contained, annexed or referred to, is a full and true statement of all the assets and liabilities and of the condition and affairs of the said reporting entity as of the reporting period stated above, and of its income and deductions therefrom for the period ended, and have been completed in accordance with the NAIC Annual Statement Instructions and Accounting Practices and Procedures manual except to the extent that: (1) state law may differ; or, (2) that state rules or regulations require differences in reporting not related to accounting practices and procedures, according to the best of their information, knowledge and belief, respectively. Furthermore, the scope of this attestation by the described officers also includes the related corresponding electronic filing with the NAIC, when required, that is an exact copy (except for formatting differences due to electronic filing) of the enclosed statement. The electronic filing may be requested by various regulators in lieu of or in addition to the enclosed statement. EDWARD MICHAEL LIDDY ROBERT WILLIAM PIKE JAMES PHILIP ZILS President Secretary Treasurer a. Is this an original filing? (cid:1)(cid:2)(cid:3)(cid:4)(cid:5)(cid:4)(cid:6)(cid:4)(cid:7)(cid:4)(cid:8)(cid:9)(cid:4)(cid:5)(cid:4)(cid:4)(cid:4)(cid:7) Subscribed and sworn to before me this b. If no, 11th day of November, 2004 1. State the amendment number 2. Date filed 3. Number of pages attached (cid:10)(cid:11)(cid:12)(cid:3)(cid:13)(cid:11)(cid:4)(cid:14)(cid:15)(cid:11)(cid:3)(cid:16)(cid:17)(cid:4)(cid:8)(cid:9)(cid:15)(cid:11)(cid:12)(cid:18) (cid:19)(cid:20)(cid:21)(cid:22)(cid:20)(cid:21)(cid:23) (cid:24)(cid:4)(cid:25)(cid:2)(cid:12)(cid:3)(cid:9)(cid:26)(cid:4)(cid:13)(cid:11)(cid:27)(cid:16)(cid:26)(cid:28)(cid:4)(cid:29)(cid:13)(cid:11)(cid:12)(cid:28)(cid:2)(cid:4)(cid:9)(cid:30)(cid:4)(cid:15)(cid:13)(cid:2)(cid:4)(cid:11)(cid:29)(cid:29)(cid:9)(cid:31)(cid:26)(cid:15)(cid:3)(cid:4)(cid:11)(cid:26) (cid:4)(cid:30)(cid:16)(cid:26)(cid:11)(cid:26)(cid:29)(cid:2)(cid:3)(cid:4)(cid:9)(cid:30)(cid:4)(cid:15)(cid:13)(cid:2)(cid:4)(cid:16)(cid:26)(cid:3)(cid:31)(cid:12)(cid:2)(cid:12)! STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY ASSETS Current Statement Date 4 1 2 3 December 31 Net Admitted Assets Prior Year Net Assets Nonadmitted Assets (Cols. 1 - 2) Admitted Assets 1. Bonds "(cid:23)(cid:17)(cid:23)"#(cid:17)(cid:19)#(cid:19)(cid:17)(cid:22)(cid:21)$(cid:4) "(cid:23)(cid:17)(cid:23)"#(cid:17)(cid:19)#(cid:19)(cid:17)(cid:22)(cid:21)$(cid:4) "(cid:22)(cid:17)%(cid:23)$(cid:17)(cid:23)(cid:23)(cid:19)(cid:17)(cid:23)%$(cid:4) 2. Stocks: 2.1 Preferred stocks &(cid:19)#(cid:17)#$#(cid:17)%#&(cid:4) &(cid:19)#(cid:17)#$#(cid:17)%#&(cid:4) &(cid:23)#(cid:17)"(cid:19)%(cid:17)""(cid:23)(cid:4) 2.2 Common stocks %(cid:17)"##(cid:17)$(cid:22)(cid:22)(cid:17)(cid:22)%(cid:21)(cid:4) %(cid:17)#$(cid:19)(cid:17)##(cid:23)(cid:4) %(cid:17)"(cid:22)#(cid:17)(cid:22)(cid:19)(cid:21)(cid:17)%"&(cid:4) %(cid:17)(cid:19)(cid:23)(cid:21)(cid:17)(cid:19)(cid:19)"(cid:17)(cid:23)(cid:21)%(cid:4) 3. Mortgage loans on real estate: 3.1 First liens &"(cid:22)(cid:17)$(cid:23)#(cid:17)&$%(cid:4) &"(cid:22)(cid:17)$(cid:23)#(cid:17)&$%(cid:4) #&(cid:17)(cid:23)##(cid:17)%&(cid:19)(cid:4) 3.2 Other than first liens (cid:21)(cid:4) (cid:21)(cid:4) (cid:21)(cid:4) 4. Real estate: 4.1 Properties occupied by the company (less $ encumbrances) &"(cid:19)(cid:17)(cid:21)$$(cid:17)(cid:21)(cid:22)(cid:21)(cid:4) &"(cid:19)(cid:17)(cid:21)$$(cid:17)(cid:21)(cid:22)(cid:21)(cid:4) &&%(cid:17)(cid:22)(cid:23)%(cid:17)"(cid:22)#(cid:4) 4.2 Properties held for the production of income (less $ encumbrances) (cid:21)(cid:4) (cid:21)(cid:4) 4.3 Properties held for sale (less $ encumbrances) (cid:21)(cid:4) (cid:21)(cid:4) 5. Cash ($ ’#(cid:19)&(cid:17)(cid:21)%(cid:19)(cid:17)(cid:19)$(cid:23)(), cash equivalents ($ $(cid:17)&)"(cid:17)(cid:22)"(cid:19)(cid:17)(cid:22)%(cid:19)(cid:4) ) and short-term investments ($ "%(cid:17)$(cid:19))(cid:17)(cid:19)(cid:22)(cid:19)(cid:4) ) (cid:23)#)(cid:17)(cid:22)(cid:23))(cid:17)#&$(cid:4) (cid:23)#)(cid:17)(cid:22)(cid:23))(cid:17)#&$(cid:4) )(cid:17)%)"(cid:17)(cid:21)&$(cid:4) 6. Contract loans, (including $ premium notes) (cid:21)(cid:4) (cid:21)(cid:4) 7. Other invested assets #(cid:23)(cid:21)(cid:17)(cid:23)&(cid:22)(cid:17)$$)(cid:4) #&(cid:17)(cid:21)(cid:23)"(cid:17)(cid:21)$(cid:23)(cid:4) #(cid:21)(cid:23)(cid:17)##&(cid:17)$(cid:21)$(cid:4) (cid:19)""(cid:17)(cid:19)(cid:22)$(cid:17)(cid:23)#&(cid:4) 8. Receivable for securities %&&(cid:17)%(cid:19)(cid:19)(cid:17)(cid:22)#"(cid:4) %&&(cid:17)%(cid:19)(cid:19)(cid:17)(cid:22)#"(cid:4) "&(cid:17)(cid:19)"(cid:23)(cid:17)(cid:19)(cid:22))(cid:4) 9. Aggregate write-ins for invested assets #"(cid:17))(cid:23)"(cid:17)&"(cid:22)(cid:4) (cid:21)(cid:4) #"(cid:17))(cid:23)"(cid:17)&"(cid:22)(cid:4) "(cid:22)(cid:17)(cid:19)(cid:22))(cid:17)#%"(cid:4) 10. Subtotals, cash and invested assets (Lines 1 to 9) (cid:19)(cid:21)(cid:17)(cid:19)"(cid:19)(cid:17)(cid:22)(cid:22)(cid:22)(cid:17)(cid:21)#$(cid:4) (cid:23)"(cid:17)#)#(cid:17)#)(cid:19)(cid:4) (cid:19)(cid:21)(cid:17)&(cid:22)$(cid:17))#)(cid:17)&(cid:23)(cid:23)(cid:4) &#(cid:17)(cid:23)(cid:21)"(cid:17)$&"(cid:17))#"(cid:4) 11. Investment income due and accrued &(cid:23)#(cid:17)(cid:22)(cid:21)"(cid:17)%(cid:19)(cid:21)(cid:4) "$#(cid:17))(cid:23)(cid:22)(cid:4) &(cid:23)#(cid:17)")#(cid:17)(cid:21)#(cid:22)(cid:4) (cid:19)(cid:23)#(cid:17)"$(cid:19)(cid:17)(cid:19)#)(cid:4) 12. Premiums and considerations: 12.1 Uncollected premiums and agents’ balances in the course of collection )(cid:21)&(cid:17)(cid:19)$&(cid:17)#"%(cid:4) $"(cid:17)$(cid:23)(cid:21)(cid:17)(cid:19))(cid:22)(cid:4) (cid:23)%$(cid:17)"(cid:19)&(cid:17)$(cid:19)(cid:19)(cid:4) )$&(cid:17)(cid:19)(cid:21)(cid:22)(cid:17)""%(cid:4) 12.2 Deferred premiums, agents’ balances and installments booked but deferred and not yet due (including $ earned but unbilled premiums) &(cid:17)$$(cid:23)(cid:17)(cid:19)(cid:22)%(cid:17))(cid:21)"(cid:4) "(cid:17)(cid:21)#(cid:22)(cid:17)(cid:19)(cid:23)$(cid:4) &(cid:17)$$(cid:22)(cid:17)&%(cid:19)(cid:17)&&(cid:21)(cid:4) "(cid:17)(cid:23)%&(cid:17)(cid:19)(cid:19)%(cid:17)(cid:23)"(cid:21)(cid:4) 12.3 Accrued retrospective premiums (cid:19)(cid:17)"(cid:23))(cid:17)#(cid:21)(cid:22)(cid:4) &$(cid:21)(cid:17)(cid:22))%(cid:4) &(cid:17)%#)(cid:17)(cid:21)$#(cid:4) &(cid:17)(cid:22)(cid:22)%(cid:17)(cid:21)(cid:23)(cid:23)(cid:4) 13. Reinsurance: 13.1 Amounts recoverable from reinsurers $(cid:21)$(cid:17)&%#(cid:17)%%(cid:21)(cid:4) $(cid:21)$(cid:17)&%#(cid:17)%%(cid:21)(cid:4) $$(cid:21)(cid:17)&$&(cid:17)&(cid:21)"(cid:4) 13.2 Funds held by or deposited with reinsured companies "(cid:17)&"#(cid:17)&#"(cid:4) (cid:23)(cid:17)"&"(cid:4) "(cid:17)&$%(cid:17)$"%(cid:4) "(cid:17)&%(cid:19)(cid:17)(cid:23)%)(cid:4) 13.3 Other amounts receivable under reinsurance contracts (cid:21)(cid:4) (cid:21)(cid:4) 14. Amounts receivable relating to uninsured plans (cid:21)(cid:4) (cid:21)(cid:4) 15.1Current federal and foreign income tax recoverable and interest thereon (cid:21)(cid:4) (cid:21)(cid:4) 15.2Net deferred tax asset $(cid:17)"$&(cid:17)))(cid:22)(cid:17))(cid:19)(cid:19)(cid:4) $#%(cid:17)$)$(cid:17)(cid:22)&(cid:19)(cid:4) $(cid:17)(cid:21)(cid:19)(cid:19)(cid:17)(cid:23)(cid:21)(cid:19)(cid:17)&$(cid:21)(cid:4) $(cid:17)(cid:21)&(cid:22)(cid:17)#(cid:22)(cid:19)(cid:17))(cid:22)(cid:23)(cid:4) 16. Guaranty funds receivable or on deposit (cid:21)(cid:4) (cid:21)(cid:4) 17. Electronic data processing equipment and software "(cid:21)(cid:21)(cid:17)(cid:22)%(cid:19)(cid:17)$#$(cid:4) $(cid:22)$(cid:17)(cid:21)%$(cid:17)$&(cid:23)(cid:4) (cid:19)%(cid:17)(cid:22)(cid:21)&(cid:17)(cid:21)"(cid:19)(cid:4) (cid:22)$(cid:17)$$%(cid:17)&(cid:21)"(cid:4) 18. Furniture and equipment, including health care delivery assets ($ ) "#(cid:23)(cid:17)%$%(cid:17)##(cid:21)(cid:4) "#(cid:23)(cid:17)%$%(cid:17)##(cid:21)(cid:4) (cid:21)(cid:4) (cid:21)(cid:4) 19. Net adjustment in assets and liabilities due to foreign exchange rates (cid:21)(cid:4) (cid:21)(cid:4) 20. Receivables from parent, subsidiaries and affiliates $&"(cid:17)(cid:21)(cid:23)(cid:23)(cid:17)(cid:22))"(cid:4) "(cid:17)&"$(cid:17)%(cid:21)"(cid:4) $"%(cid:17)(cid:23)(cid:22)(cid:22)(cid:17)#)(cid:21)(cid:4) (cid:19)#)(cid:17)$&(cid:23)(cid:17)))(cid:21)(cid:4) 21. Health care ($ ) and other amounts receivable (cid:21)(cid:4) (cid:21)(cid:4) 22. Other assets nonadmitted (cid:21)(cid:4) (cid:21)(cid:4) 23. Aggregate write-ins for other than invested assets $(cid:17)&"(cid:19)(cid:17)"&(cid:22)(cid:17)(cid:19)"$(cid:4) $(cid:17)$(cid:21)(cid:22)(cid:17)(cid:22)%%(cid:17)(cid:19)(cid:23)#(cid:4) "$)(cid:17)#&(cid:22)(cid:17)%(cid:19)(cid:22)(cid:4) "&(cid:19)(cid:17)"$$(cid:17)#)#(cid:4) 24. Total assets excluding Separate Accounts, Segregated Accounts and Protected Cell Accounts (Lines 10 to 23) (cid:19)(cid:23)(cid:17)%#)(cid:17)#(cid:19)#(cid:17)(cid:21)(cid:22)#(cid:4) $(cid:17)(cid:23))&(cid:17)(cid:22)(cid:23)$(cid:17)(cid:21)(cid:19)(cid:19)(cid:4) (cid:19)#(cid:17)$)(cid:22)(cid:17)(cid:21)(cid:23)(cid:22)(cid:17)(cid:21)$"(cid:4) (cid:19)"(cid:17)#%(cid:21)(cid:17)(cid:22)%&(cid:17)$)$(cid:4) 25. From Separate Accounts, Segregated Accounts and Protected Cell Accounts (cid:21)(cid:4) (cid:21)(cid:4) 26. Total (Lines 24 and 25) (cid:19)(cid:23)(cid:17)%#)(cid:17)#(cid:19)#(cid:17)(cid:21)(cid:22)#(cid:4) $(cid:17)(cid:23))&(cid:17)(cid:22)(cid:23)$(cid:17)(cid:21)(cid:19)(cid:19)(cid:4) (cid:19)#(cid:17)$)(cid:22)(cid:17)(cid:21)(cid:23)(cid:22)(cid:17)(cid:21)$"(cid:4) (cid:19)"(cid:17)#%(cid:21)(cid:17)(cid:22)%&(cid:17)$)$(cid:4) DETAILS OF WRITE-INS 0901. (cid:14)(cid:2)(cid:29)(cid:31)(cid:12)(cid:16)(cid:15)(cid:18)(cid:4)*(cid:2)(cid:26) (cid:16)(cid:26)(cid:28)(cid:4)+(cid:12)(cid:16)(cid:26)(cid:29)(cid:16)+(cid:11)* #"(cid:17))(cid:23)"(cid:17)&"(cid:22)(cid:4) #"(cid:17))(cid:23)"(cid:17)&"(cid:22)(cid:4) "(cid:22)(cid:17)(cid:19)(cid:22))(cid:17)#%"(cid:4) 0902. 0903. 0998. Summary of remaining write-ins for Line 9 from overflow page (cid:21)(cid:4) (cid:21)(cid:4) (cid:21)(cid:4) (cid:21)(cid:4) 0999. Totals (Lines 0901 thru 0903 plus 0998)(Line 9 above) #"(cid:17))(cid:23)"(cid:17)&"(cid:22)(cid:4) (cid:21)(cid:4) #"(cid:17))(cid:23)"(cid:17)&"(cid:22)(cid:4) "(cid:22)(cid:17)(cid:19)(cid:22))(cid:17)#%"(cid:4) 2301. ,(cid:11)(cid:3)(cid:13)(cid:4)(cid:3)(cid:31)(cid:12)(cid:12)(cid:2)(cid:26) (cid:2)(cid:12)(cid:4)(cid:27)(cid:11)*(cid:31)(cid:2)(cid:4),-./ $(cid:21)$(cid:17)#%(cid:22)(cid:17)(cid:22)"(cid:22)(cid:4) $(cid:21)$(cid:17)#%(cid:22)(cid:17)(cid:22)"(cid:22)(cid:4) $(cid:21)(cid:21)(cid:17))(cid:19)"(cid:17)%"#(cid:4) 2302. (cid:25)(cid:2)(cid:26)(cid:3)(cid:16)(cid:9)(cid:26)(cid:4)(cid:16)(cid:26)(cid:15)(cid:11)(cid:26)(cid:28)(cid:16)0*(cid:2)(cid:4)(cid:11)(cid:3)(cid:3)(cid:2)(cid:15) (cid:23)(cid:23)(cid:17)(cid:19)#(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) %(cid:17)(cid:21))(cid:19)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) #)(cid:17)&(cid:23)#(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) #)(cid:17)&(cid:23)#(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 2303. 1(cid:29)(cid:29)(cid:9)(cid:31)(cid:26)(cid:15)(cid:3)(cid:4)(cid:12)(cid:2)(cid:29)(cid:2)(cid:16)(cid:27)(cid:11)0*(cid:2) (cid:19)(cid:23)(cid:17)$"%(cid:17)%)&(cid:4) (cid:23)(cid:23)(cid:17)(cid:23)(cid:19)%(cid:4) (cid:19)(cid:23)(cid:17)(cid:21)(cid:22)"(cid:17)"&(cid:19)(cid:4) (cid:22)$(cid:17)(cid:22)"(cid:19)(cid:17)##&(cid:4) 2398. Summary of remaining write-ins for Line 23 from overflow page $(cid:17)(cid:21)%(cid:23)(cid:17)%(cid:19)%(cid:17)%$(cid:19)(cid:4) $(cid:17)(cid:21)%#(cid:17)(cid:19)&(cid:23)(cid:17)(cid:23)"(cid:23)(cid:4) $(cid:17)(cid:22)$"(cid:17)$)(cid:23)(cid:4) $&(cid:17)(cid:19)#)(cid:17)(cid:21)%(cid:23)(cid:4) 2399. Totals (Lines 2301 thru 2303 plus 2398)(Line 23 above) $(cid:17)&"(cid:19)(cid:17)"&(cid:22)(cid:17)(cid:19)"$(cid:4) $(cid:17)$(cid:21)(cid:22)(cid:17)(cid:22)%%(cid:17)(cid:19)(cid:23)#(cid:4) "$)(cid:17)#&(cid:22)(cid:17)%(cid:19)(cid:22)(cid:4) "&(cid:19)(cid:17)"$$(cid:17)#)#(cid:4) 2 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY LIABILITIES, SURPLUS AND OTHER FUNDS 1 2 Current December 31, Statement Date Prior Year 1. Losses (current accident year $ (cid:19)(cid:17)(cid:21)(cid:23)%(cid:17)(cid:21)(cid:23)$(cid:17)(cid:19)#(cid:22)(cid:4) ) $$(cid:17)$&)(cid:17)%%$(cid:17)$(cid:23))(cid:4) $$(cid:17)(cid:21)&(cid:21)(cid:17)(cid:22)(cid:22)%(cid:17)(cid:23)%"(cid:4) 2. Reinsurance payable on paid losses and loss adjustment expenses &(cid:17)#"#(cid:17)#(cid:21)#(cid:4) (cid:19)(cid:17)&$"(cid:17)(cid:22)$(cid:23)(cid:4) 3. Loss adjustment expenses &(cid:17)""#(cid:17)&)(cid:23)(cid:17)""&(cid:4) "(cid:17)%(cid:22)%(cid:17)(cid:23)"#(cid:17)(cid:23)(cid:19)#(cid:4) 4. Commissions payable, contingent commissions and other similar charges #(cid:21)(cid:17)(cid:21))(cid:23)(cid:17)(cid:21)#)(cid:4) (cid:22)(cid:21)(cid:17)$)$(cid:17)"$#(cid:4) 5. Other expenses (excluding taxes, licenses and fees) $(cid:17)(cid:19)"(cid:23)(cid:17)#"$(cid:17)%(cid:23)(cid:21)(cid:4) $(cid:17)(cid:19)##(cid:17)#%(cid:23)(cid:17))&)(cid:4) 6. Taxes, licenses and fees (excluding federal and foreign income taxes) """(cid:17)$)$(cid:17)%$)(cid:4) "$(cid:22)(cid:17)$(cid:22)"(cid:17)$"&(cid:4) 7.1Current federal and foreign income taxes (including $ on realized capital gains (losses)) $(cid:19)(cid:21)(cid:17)$(cid:19)(cid:22)(cid:17)%(cid:21)$(cid:4) "$)(cid:17)$(cid:23)(cid:22)(cid:17)(cid:23)#%(cid:4) 7.2Net deferred tax liability (cid:21)(cid:4) 8. Borrowed money $ and interest thereon $ #(cid:23)&(cid:17)&(cid:21)(cid:19)(cid:17)#(cid:21))(cid:4) #$)(cid:17))%#(cid:17)(cid:22)(cid:21)#(cid:4) 9. Unearned premiums (after deducting unearned premiums for ceded reinsurance of $ $(cid:21)"(cid:17)#"$(cid:17)(cid:23)%#(cid:4) and including warranty reserves of $ ) )(cid:17)(cid:22)&(cid:22)(cid:17)%"&(cid:17)&)#(cid:4) (cid:23)(cid:17)%&%(cid:17)(cid:21)&(cid:21)(cid:17)%(cid:23)%(cid:4) 10. Advance premium &(cid:19)(cid:22)(cid:17)"(cid:23)#(cid:17)%#&(cid:4) "(cid:22)&(cid:17)#"(cid:23)(cid:17)(cid:23)%(cid:22)(cid:4) 11. Dividends declared and unpaid: 11.1 Stockholders &(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) (cid:21)(cid:4) 11.2 Policyholders (cid:21)(cid:4) 12. Ceded reinsurance premiums payable (net of ceding commissions) $(cid:17)%"(cid:23)(cid:17)#$(cid:19)(cid:4) $(cid:17)(cid:21)$(cid:22)(cid:17)(cid:23)(cid:23)%(cid:4) 13. Funds held by company under reinsurance treaties (cid:19)(cid:17)(cid:21)(cid:22)%(cid:17)&)(cid:21)(cid:4) (cid:19)(cid:17)&"(cid:22)(cid:17)#&%(cid:4) 14. Amounts withheld or retained by company for account of others (cid:19)"(cid:17)&(cid:23)(cid:19)(cid:17)#(cid:21)%(cid:4) &(cid:23)(cid:17)&#(cid:22)(cid:17)%&#(cid:4) 15. Remittances and items not allocated "(cid:22)(cid:17)%&(cid:19)(cid:17)"(cid:23)(cid:23)(cid:4) $(cid:23)(cid:17)&%&(cid:17)"(cid:22)#(cid:4) 16. Provision for reinsurance "&%(cid:17))(cid:19)(cid:22)(cid:17)")"(cid:4) #%(cid:17)(cid:22)(cid:21))(cid:17))#(cid:21)(cid:4) 17. Net adjustments in assets and liabilities due to foreign exchange rates %(cid:22)"(cid:17)"##(cid:4) 18. Drafts outstanding (cid:21)(cid:4) 19. Payable to parent, subsidiaries and affiliates (cid:19)$)(cid:17)(cid:22))(cid:22)(cid:17)$(cid:23)%(cid:4) %$(cid:21)(cid:17)#(cid:21))(cid:4) 20. Payable for securities $(cid:17)(cid:21)(cid:23)(cid:23)(cid:17)(cid:19))(cid:22)(cid:17)(cid:19)(cid:19))(cid:4) %(cid:19)(cid:17)(cid:22)#(cid:19)(cid:17)$(cid:21)"(cid:4) 21. Liability for amounts held under uninsured accident and health plans (cid:21)(cid:4) 22. Capital notes $ and interest thereon $ (cid:21)(cid:4) 23. Aggregate write-ins for liabilities $(cid:17)(cid:23)#(cid:23)(cid:17)#(cid:19)(cid:19)(cid:17)$$#(cid:4) $(cid:17)#(cid:21)(cid:23)(cid:17)#$$(cid:17)%(cid:22))(cid:4) 24. Total liabilities excluding protected cell liabilities (Lines 1 through 23) "%(cid:17)#(cid:22)$(cid:17)(cid:19)(cid:21)"(cid:17)(cid:23)")(cid:4) "#(cid:17)(cid:22)%(cid:21)(cid:17)(cid:21)(cid:21)%(cid:17)#)#(cid:4) 25. Protected cell liabilities (cid:21)(cid:4) 26. Total liabilities (Lines 24 and 25) "%(cid:17)#(cid:22)$(cid:17)(cid:19)(cid:21)"(cid:17)(cid:23)")(cid:4) "#(cid:17)(cid:22)%(cid:21)(cid:17)(cid:21)(cid:21)%(cid:17)#)#(cid:4) 27. Aggregate write-ins for special surplus funds (cid:22)(cid:22)(cid:17)#$(cid:22)(cid:17)#(cid:19)(cid:22)(cid:4) (cid:22)#(cid:17))(cid:23)(cid:22)(cid:17))(cid:21)&(cid:4) 28. Common capital stock (cid:19)(cid:17)"(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) (cid:19)(cid:17)"(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 29. Preferred capital stock (cid:21)(cid:4) 30. Aggregate write-ins for other than special surplus funds (cid:21)(cid:4) (cid:21)(cid:4) 31. Surplus notes (cid:21)(cid:4) 32. Gross paid in and contributed surplus "(cid:17)"$%(cid:17)"(cid:21)%(cid:17)%#"(cid:4) "(cid:17)$#(cid:22)(cid:17)$(cid:22)(cid:22)(cid:17)(cid:23))&(cid:4) 33. Unassigned funds (surplus) $(cid:19)(cid:17)"(cid:22)(cid:19)(cid:17)#(cid:19)#(cid:17)#(cid:23)#(cid:4) $&(cid:17))(cid:23)(cid:19)(cid:17)&(cid:22)$(cid:17)%(cid:21)%(cid:4) 34. Less treasury stock, at cost 34.1 shares common (value included in Line 28 $ ) (cid:21)(cid:4) 34.2 shares preferred (value included in Line 29 $ ) (cid:21)(cid:4) 35. Surplus as regards policyholders (Lines 27 to 33, less 34) $#(cid:17)(cid:22)&&(cid:17)#(cid:23)"(cid:17)")&(cid:4) $#(cid:17)$(cid:21)(cid:21)(cid:17)(cid:22))&(cid:17)(cid:19)%(cid:19)(cid:4) 36. TOTALS (cid:19)#(cid:17)$)(cid:22)(cid:17)(cid:21)(cid:23)(cid:22)(cid:17)(cid:21)$"(cid:4) (cid:19)"(cid:17)#%(cid:21)(cid:17)(cid:22)%&(cid:17)$)(cid:21)(cid:4) DETAILS OF WRITE-INS 2301. (cid:14)(cid:2)(cid:29)(cid:31)(cid:12)(cid:16)(cid:15)(cid:16)(cid:2)(cid:3)(cid:4)*(cid:2)(cid:26) (cid:16)(cid:26)(cid:28) $(cid:17)(cid:19)(cid:21)&(cid:17)(cid:21)(cid:22)(cid:23)(cid:17)$%(cid:21)(cid:4) $(cid:17)"$"(cid:17)(cid:23)(cid:21)"(cid:17)(cid:22)#(cid:22)(cid:4) 2302. 1(cid:29)(cid:29)(cid:9)(cid:31)(cid:26)(cid:15)(cid:3)(cid:4)+(cid:11)(cid:18)(cid:11)0*(cid:2) "(cid:23)(cid:22)(cid:17)(cid:23)#(cid:21)(cid:17)$(cid:23)%(cid:4) &$$(cid:17)#$%(cid:17)$#(cid:23)(cid:4) 2303. 2(cid:2)+(cid:9)(cid:3)(cid:16)(cid:15)(cid:4)(cid:9)(cid:26)(cid:4)(cid:11)(cid:3)(cid:3)(cid:31)3(cid:2) (cid:4)(cid:12)(cid:2)(cid:16)(cid:26)(cid:3)(cid:31)(cid:12)(cid:11)(cid:26)(cid:29)(cid:2) #(cid:19)(cid:17)$$$(cid:17))(cid:19)(cid:21)(cid:4) (cid:23)$(cid:17)(cid:21)%(cid:22)(cid:17)(cid:19)$(cid:22)(cid:4) 2398. Summary of remaining write-ins for Line 23 from overflow page "(cid:19)(cid:17)(cid:23)$(cid:19)(cid:17)%(cid:21)#(cid:4) $"(cid:17)$%(cid:19)(cid:17))$$(cid:4) 2399. Totals (Lines 2301 thru 2303 plus 2398) (Line 23 above) $(cid:17)(cid:23)#(cid:23)(cid:17)#(cid:19)(cid:19)(cid:17)$$#(cid:4) $(cid:17)#(cid:21)(cid:23)(cid:17)#$$(cid:17)%(cid:22))(cid:4) 2701. (cid:14)+(cid:2)(cid:29)(cid:16)(cid:11)*(cid:4)(cid:3)(cid:31)(cid:12)+*(cid:31)(cid:3)(cid:4)(cid:30)(cid:12)(cid:9)3(cid:4)(cid:12)(cid:2)(cid:15)(cid:12)(cid:9)(cid:11)(cid:29)(cid:15)(cid:16)(cid:27)(cid:2)(cid:4)(cid:12)(cid:2)(cid:16)(cid:26)(cid:3)(cid:31)(cid:12)(cid:11)(cid:26)(cid:29)(cid:2)(cid:4)(cid:11)(cid:29)(cid:29)(cid:9)(cid:31)(cid:26)(cid:15) (cid:22)(cid:22)(cid:17)#$(cid:22)(cid:17)#(cid:19)(cid:22)(cid:4) (cid:22)#(cid:17))(cid:23)(cid:22)(cid:17))(cid:21)&(cid:4) 2702. 2703. 2798. Summary of remaining write-ins for Line 27 from overflow page (cid:21)(cid:4) (cid:21)(cid:4) 2799. Totals (Lines 2701 thru 2703 plus 2798) (Line 27 above) (cid:22)(cid:22)(cid:17)#$(cid:22)(cid:17)#(cid:19)(cid:22)(cid:4) (cid:22)#(cid:17))(cid:23)(cid:22)(cid:17))(cid:21)&(cid:4) 3001. 3002. 3003. 3098. Summary of remaining write-ins for Line 30 from overflow page (cid:21)(cid:4) (cid:21)(cid:4) 3099. Totals (Lines 3001 thru 3003 plus 3098) (Line 30 above) (cid:21)(cid:4) (cid:21)(cid:4) 3 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY STATEMENT OF INCOME 1 2 3 Current Year Prior Year Prior Year Ended to Date to Date December 31 UNDERWRITING INCOME 1. Premiums earned: 1.1 Direct (written $ $(cid:21)(cid:17)(cid:22)#(cid:23)(cid:17)(cid:22)"(cid:22)(cid:17))(cid:22)&(cid:4) ) $(cid:21)(cid:17)(cid:19)(cid:23)&(cid:17)(cid:21)(cid:21)"(cid:17)&$(cid:21)(cid:4) $(cid:21)(cid:17)(cid:19))(cid:21)(cid:17)&%(cid:23)(cid:17)%&(cid:19)(cid:4) $&(cid:17)%)"(cid:17))#(cid:19)(cid:17)(cid:21)$#(cid:4) 1.2 Assumed (written $ (cid:23)(cid:17))&"(cid:17)&%#(cid:17)"##(cid:4) ) (cid:23)(cid:17)&$%(cid:17)(cid:21)(cid:23)&(cid:17)(cid:23)$#(cid:4) #(cid:17)(cid:19)(cid:19)%(cid:17))"(cid:21)(cid:17))(cid:23)#(cid:4) )(cid:17)(cid:23)(cid:19)$(cid:17)(cid:23))(cid:19)(cid:17))&(cid:22)(cid:4) 1.3 Ceded (written $ $%"(cid:17)(cid:19))$(cid:17)(cid:21)(cid:19)"(cid:4) ) $)$(cid:17)(cid:21)(cid:21)%(cid:17))%$(cid:4) $(cid:22)&(cid:17)(cid:21)(cid:19)(cid:22)(cid:17)(cid:19)##(cid:4) $%%(cid:17)"(cid:21)(cid:21)(cid:17)#(cid:21)(cid:22)(cid:4) 1.4 Net (written $ $)(cid:17)"(cid:21)(cid:23)(cid:17)(cid:19)(cid:19)$(cid:17)(cid:21)(cid:23)(cid:23)(cid:4) ) $(cid:23)(cid:17)#$$(cid:17)(cid:21)##(cid:17)$&(cid:22)(cid:4) $#(cid:17)(cid:23)(cid:23)(cid:23)(cid:17)$(cid:23)&(cid:17)&(cid:19)(cid:19)(cid:4) ""(cid:17)(cid:22)"(cid:22)(cid:17)(cid:19)(cid:19))(cid:17)"(cid:19)#(cid:4) DEDUCTIONS: 2. Losses incurred (current accident year $ %(cid:17)"(cid:22)(cid:21)(cid:17)(cid:23)(cid:22)(cid:22)(cid:17)(cid:23)(cid:21)%(cid:4)): 2.1 Direct (cid:22)(cid:17))%(cid:19)(cid:17)%"%(cid:17)(cid:21)(cid:19)#(cid:4) #(cid:17)$)%(cid:17)#(cid:23)(cid:22)(cid:17)%$(cid:19)(cid:4) )(cid:17)"(cid:19)&(cid:17)(cid:19)(cid:19)$(cid:17)(cid:22)""(cid:4) 2.2 Assumed &(cid:17))#)(cid:17)&(cid:22)(cid:23)(cid:17)&&(cid:21)(cid:4) (cid:19)(cid:17)(cid:21)"#(cid:17)"(cid:19)%(cid:17)%$(cid:22)(cid:4) (cid:22)(cid:17)""(cid:19)(cid:17)"&)(cid:17))(cid:21)%(cid:4) 2.3 Ceded (cid:23)(cid:19)(cid:23)(cid:17)$#(cid:22)(cid:17)(cid:19)(cid:23)&(cid:4) "#(cid:23)(cid:17)%&"(cid:17)(cid:23)$(cid:21)(cid:4) $(cid:23)(cid:22)(cid:17)$(cid:19)&(cid:17)"&(cid:22)(cid:4) 2.4 Net %(cid:17)(cid:21)$#(cid:17)$"(cid:21)(cid:17)%(cid:21)&(cid:4) %(cid:17)%(cid:19)(cid:23)(cid:17)%%&(cid:17)$$%(cid:4) $&(cid:17)"%"(cid:17)(cid:22)&(cid:23)(cid:17)(cid:21)%#(cid:4) 3. Loss expenses incurred "(cid:17)")(cid:19)(cid:17)""&(cid:17)(cid:23)&(cid:22)(cid:4) "(cid:17)$"(cid:19)(cid:17)%(cid:19)%(cid:17)#(cid:21)%(cid:4) "(cid:17)#(cid:23)(cid:22)(cid:17)$(cid:23)"(cid:17)(cid:22)"(cid:19)(cid:4) 4. Other underwriting expenses incurred (cid:19)(cid:17)(cid:22)#(cid:23)(cid:17)(cid:22)(cid:22))(cid:17)##$(cid:4) (cid:19)(cid:17)"$&(cid:17)))$(cid:17)(cid:19)#"(cid:4) (cid:22)(cid:17)(cid:23)$&(cid:17))(cid:23)(cid:22)(cid:17)#(cid:22)(cid:22)(cid:4) 5. Aggregate write-ins for underwriting deductions (cid:21)(cid:4) "(cid:21)(cid:17))"(cid:22)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) $)(cid:17)%$"(cid:17)&&)(cid:4) 6. Total underwriting deductions (Lines 2.4 thru 5) $(cid:22)(cid:17))#(cid:23)(cid:17)%(cid:21)&(cid:17)&(cid:21)(cid:21)(cid:4) $#(cid:17)&(cid:21)(cid:23)(cid:17)#(cid:19)%(cid:17)$%(cid:21)(cid:4) "$(cid:17)(cid:23)(cid:21)(cid:21)(cid:17)(cid:19)%(cid:23)(cid:17)#$&(cid:4) 7. Net income of protected cells (cid:21)(cid:4) (cid:21)(cid:4) 8. Net underwriting gain or (loss) (Line 1.4 minus Line 6 + Line 7) $(cid:17)(cid:23)(cid:19)&(cid:17)$#"(cid:17))&(cid:22)(cid:4) (cid:19)#%(cid:17)(cid:22)"(cid:19)(cid:17)$(cid:22)(cid:22)(cid:4) )"(cid:19)(cid:17)%(cid:22)(cid:21)(cid:17)#&&(cid:4) INVESTMENT INCOME 9. Net investment income earned $(cid:17)(cid:19)(cid:23)(cid:19)(cid:17)(cid:23)(cid:21)(cid:22)(cid:17)"#%(cid:4) $(cid:17)"""(cid:17)(cid:19)(cid:21)(cid:19)(cid:17)(cid:21)(cid:21)%(cid:4) $(cid:17)(cid:23)(cid:22)(cid:23)(cid:17))(cid:19)&(cid:17)#(cid:21)$(cid:4) 10. Net realized capital gains (losses) &(cid:22)(cid:21)(cid:17)%$%(cid:17)#)"(cid:4) $(cid:23)$(cid:17)%(cid:23)(cid:22)(cid:17)&))(cid:4) "(cid:23)$(cid:17)$(cid:19))(cid:17)))"(cid:4) 11. Net investment gain (loss) (Lines 9 + 10) $(cid:17))"(cid:22)(cid:17)#"(cid:19)(cid:17)%(cid:22)"(cid:4) $(cid:17)&%(cid:19)(cid:17)&(cid:23)%(cid:17)&%(cid:23)(cid:4) "(cid:17)(cid:21)")(cid:17)%%"(cid:17)(cid:19))&(cid:4) OTHER INCOME 12. Net gain or (loss) from agents' or premium balances charged off (amount recovered $ amount charged off $ (cid:19)%(cid:17)"%(cid:23)(cid:17)(cid:22)$"(cid:4)) ’(cid:19)&(cid:17)"%(cid:23)(cid:17)(cid:22)$"( ’(cid:19)#(cid:17)#(cid:23)%(cid:17)#)(cid:19)( ’(cid:22)%(cid:17)&#"(cid:17)"&#( 13. Finance and service charges not included in premiums "&(cid:21)(cid:17)(cid:19)%#(cid:17)(cid:22)#(cid:19)(cid:4) ""(cid:23)(cid:17)#&(cid:21)(cid:17)(cid:23)&#(cid:4) "%$(cid:17)(cid:23)%$(cid:17)(cid:23)(cid:19)(cid:22)(cid:4) 14. Aggregate write-ins for miscellaneous income (cid:22)%(cid:17)(cid:23)%(cid:21)(cid:17)(cid:19)(cid:21)%(cid:4) $$(cid:17)(cid:19)#%(cid:17)$&(cid:23)(cid:4) $(cid:19)(cid:17)%#(cid:21)(cid:17)(cid:23)#%(cid:4) 15. Total other income (Lines 12 through 14) "(cid:19)#(cid:17)%)%(cid:17)(cid:19)#(cid:21)(cid:4) $%"(cid:17)(cid:19)"(cid:21)(cid:17)$)%(cid:4) "(cid:19)(cid:23)(cid:17)&%(cid:21)(cid:17)"(cid:23))(cid:4) 16. Net income before dividends to policyholders and before federal and foreign income taxes (Lines 8 + 11 + 15) &(cid:17))$(cid:22)(cid:17)(cid:23)(cid:23)(cid:23)(cid:17)"(cid:19)#(cid:4) "(cid:17)(cid:21)(cid:22)#(cid:17)&"&(cid:17)(cid:23)(cid:19)(cid:21)(cid:4) &(cid:17)$(cid:21)$(cid:17)&&&(cid:17)&%(cid:19)(cid:4) 17. Dividends to policyholders ’%(cid:22)(cid:23)( ’$"(cid:17)(cid:19)"$( ’$"(cid:17)(cid:19)"$( 18. Net income, after dividends to policyholders but before federal and foreign income taxes (Line 16 minus Line 17) &(cid:17))$(cid:22)(cid:17)(cid:23)(cid:23))(cid:17)"(cid:21)&(cid:4) "(cid:17)(cid:21)(cid:22)#(cid:17)&&#(cid:17)$#"(cid:4) &(cid:17)$(cid:21)$(cid:17)&(cid:19)(cid:22)(cid:17))$#(cid:4) 19. Federal and foreign income taxes incurred $(cid:17)(cid:21)#&(cid:17)(cid:23)$%(cid:17))$"(cid:4) "(cid:19)%(cid:17)(cid:21)(cid:22)"(cid:17)))(cid:23)(cid:4) &))(cid:17))"&(cid:17)$#%(cid:4) 20. Net income (Line 18 minus Line 19)(to Line 22) "(cid:17)(cid:23)(cid:22)"(cid:17)(cid:21)(cid:22))(cid:17)&%"(cid:4) $(cid:17))(cid:21)(cid:23)(cid:17)")&(cid:17)"(cid:23)(cid:19)(cid:4) "(cid:17)(cid:23)$"(cid:17)(cid:22)""(cid:17)#(cid:19)#(cid:4) CAPITAL AND SURPLUS ACCOUNT 21. Surplus as regards policyholders, December 31 prior year $#(cid:17)$(cid:21)(cid:21)(cid:17)(cid:22))&(cid:17)(cid:19)%(cid:19)(cid:4) $&(cid:17)(cid:23)#(cid:21)(cid:17)(cid:22)(cid:19)"(cid:17)%(cid:21)(cid:19)(cid:4) $&(cid:17)(cid:23)#(cid:21)(cid:17)(cid:22)(cid:19)"(cid:17)%(cid:21)(cid:19)(cid:4) GAINS AND (LOSSES) IN SURPLUS 22. Net income (from Line 20) "(cid:17)(cid:23)(cid:22)"(cid:17)(cid:21)(cid:22))(cid:17)&%"(cid:4) $(cid:17))(cid:21)(cid:23)(cid:17)")&(cid:17)"(cid:23)(cid:19)(cid:4) "(cid:17)(cid:23)$"(cid:17)(cid:22)""(cid:17)#(cid:19)#(cid:4) 23. Change in net unrealized capital gains or losses ’#(cid:23)(cid:19)(cid:17)&&(cid:22)(cid:17)")%( (cid:23))#(cid:17)(cid:23)(cid:21)$(cid:17)(cid:21)(cid:21)$(cid:4) $(cid:17)$&#(cid:17))#"(cid:17)(cid:22)(cid:22)(cid:23)(cid:4) 24. Change in net unrealized foreign exchange capital gain (loss) (cid:21)(cid:4) (cid:21)(cid:4) 25. Change in net deferred income tax #(cid:17)(cid:19)")(cid:17)&"(cid:22)(cid:4) ’$(cid:22)$(cid:17)$")(cid:17)%%)( (cid:23)%(cid:17)(cid:19)#(cid:19)(cid:17)")$(cid:4) 26. Change in nonadmitted assets $(cid:22)(cid:17)"$%(cid:17)#(cid:21)(cid:23)(cid:4) $$(cid:21)(cid:17)"#(cid:23)(cid:17)(cid:23)$%(cid:4) ’(cid:23)(cid:22)(cid:19)(cid:17)#$(cid:21)(cid:17)#)#( 27. Change in provision for reinsurance ’$(cid:23)(cid:21)(cid:17)&&#(cid:17)(cid:19)""( ’(cid:19)(cid:23)(cid:17)%(cid:19)%(cid:17)&(cid:19)$( ’$(cid:23)(cid:17)(cid:23))(cid:22)(cid:17)$#"( 28. Change in surplus notes (cid:21)(cid:4) (cid:21)(cid:4) 29. Surplus (contributed to) withdrawn from protected cells (cid:21)(cid:4) (cid:21)(cid:4) 30. Cumulative effect of changes in accounting principles (cid:21)(cid:4) (cid:21)(cid:4) 31. Capital changes: 31.1 Paid in (cid:21)(cid:4) (cid:21)(cid:4) 31.2 Transferred from surplus (Stock Dividend) (cid:21)(cid:4) (cid:21)(cid:4) 31.3 Transferred to surplus (cid:21)(cid:4) (cid:21)(cid:4) 32. Surplus adjustments: 32.1 Paid in (cid:22)(cid:19)(cid:17)(cid:21)(cid:22)(cid:19)(cid:17)$)(cid:21)(cid:4) (cid:22)(cid:17)(cid:22)%#(cid:17)(cid:21)(cid:23))(cid:4) "(cid:23)(cid:17)"&(cid:19)(cid:17)(cid:19)(cid:19)(cid:23)(cid:4) 32.2 Transferred to capital (Stock Dividend) (cid:21)(cid:4) (cid:21)(cid:4) 32.3 Transferred from capital (cid:21)(cid:4) (cid:21)(cid:4) 33. Net remittances from or (to) Home Office (cid:21)(cid:4) (cid:21)(cid:4) 34. Dividends to stockholders ’$(cid:17)(cid:22)(cid:22)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)( ’)(cid:19)&(cid:17)##$(cid:17)%)(cid:19)( ’$(cid:17)"(cid:23)&(cid:17)"$"(cid:17)%%(cid:19)( 35. Change in treasury stock (cid:21)(cid:4) (cid:21)(cid:4) 36. Aggregate write-ins for gains and losses in surplus (cid:21)(cid:4) (cid:21)(cid:4) (cid:19)"%(cid:17)(cid:22)#(cid:22)(cid:17)(cid:22)(cid:21)(cid:21)(cid:4) 37. Change in surplus as regards policyholders (Lines 22 through 36) (cid:19)&&(cid:17)(cid:21)))(cid:17)(cid:23)%"(cid:4) $(cid:17)##(cid:23)(cid:17)$(cid:21)(cid:23)(cid:17)(cid:23)(cid:19))(cid:4) "(cid:17)&(cid:19)(cid:21)(cid:17)(cid:21)(cid:19)(cid:21)(cid:17)(cid:22)%(cid:21)(cid:4) 38. Surplus as regards policyholders, as of statement date (Lines 21 plus 37) $#(cid:17)(cid:22)&&(cid:17)#(cid:23)"(cid:17)")#(cid:4) $(cid:22)(cid:17)(cid:19)"(cid:23)(cid:17)#(cid:22)(cid:21)(cid:17)#(cid:22)$(cid:4) $#(cid:17)$(cid:21)(cid:21)(cid:17)(cid:22))&(cid:17)(cid:19)%(cid:19)(cid:4) DETAILS OF WRITE-INS 0501. "(cid:21)(cid:21)"(cid:4)(cid:8),(cid:4)+(cid:12)(cid:16)(cid:27)(cid:11)(cid:15)(cid:2)(cid:4)+(cid:11)(cid:3)(cid:3)(cid:2)(cid:26)(cid:28)(cid:2)(cid:12)(cid:4)(cid:11)(cid:31)(cid:15)(cid:9)(cid:4)(cid:2)(cid:3)(cid:29)(cid:12)(cid:9)4 "(cid:21)(cid:17))"(cid:22)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) $)(cid:17)%$"(cid:17)&&)(cid:4) 0502. 0503. 0598. Summary of remaining write-ins for Line 5 from overflow page (cid:21)(cid:4) (cid:21)(cid:4) (cid:21)(cid:4) 0599. Totals (Lines 0501 thru 0503 plus 0598) (Line 5 above) (cid:21)(cid:4) "(cid:21)(cid:17))"(cid:22)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) $)(cid:17)%$"(cid:17)&&)(cid:4) 1401. 5(cid:11)(cid:16)(cid:26)(cid:20)’*(cid:9)(cid:3)(cid:3)((cid:4)(cid:9)(cid:26)(cid:4) (cid:2)+(cid:9)(cid:3)(cid:16)(cid:15)(cid:4)(cid:12)(cid:2)(cid:16)(cid:26)(cid:3)(cid:31)(cid:12)(cid:11)(cid:26)(cid:29)(cid:2) (cid:22)(cid:19)(cid:17)#(cid:23)$(cid:17)$(cid:19)%(cid:4) $(cid:17)"%#(cid:17)(cid:19)(cid:21)(cid:21)(cid:4) "(cid:17)(cid:21)(cid:19)(cid:23)(cid:17)(cid:22)(cid:21)(cid:19)(cid:4) 1402. /(cid:26)(cid:15)(cid:2)(cid:12)(cid:2)(cid:3)(cid:15)(cid:4)(cid:16)(cid:26)(cid:29)(cid:9)3(cid:2)(cid:4)(cid:9)(cid:26)(cid:4)6(cid:13)(cid:2)(cid:4)1**(cid:3)(cid:15)(cid:11)(cid:15)(cid:2)(cid:4),(cid:9)(cid:12)+(cid:9)(cid:12)(cid:11)(cid:15)(cid:16)(cid:9)(cid:26)(cid:4)*(cid:9)(cid:11)(cid:26) $(cid:21)(cid:17)(cid:23))(cid:21)(cid:17)%(cid:19))(cid:4) $"(cid:17)%"#(cid:17)#(cid:21)$(cid:4) $(cid:23)(cid:17)""%(cid:17)(cid:23)"(cid:23)(cid:4) 1403. 7(cid:2)(cid:15)(cid:12)(cid:9)(cid:11)(cid:29)(cid:15)(cid:16)(cid:27)(cid:2)(cid:4)(cid:12)(cid:2)(cid:16)(cid:26)(cid:3)(cid:31)(cid:12)(cid:11)(cid:26)(cid:29)(cid:2)(cid:4)(cid:28)(cid:11)(cid:16)(cid:26)(cid:20)’*(cid:9)(cid:3)(cid:3)( $(cid:17)$(cid:19)(cid:22)(cid:17)#)(cid:23)(cid:4) (cid:19)(cid:17)&&(cid:19)(cid:17)"$(cid:21)(cid:4) (cid:19)(cid:17)#&"(cid:17))(cid:23)(cid:19)(cid:4) 1498. Summary of remaining write-ins for Line 14 from overflow page ’#(cid:17))(cid:21)(cid:23)(cid:17)&(cid:23)(cid:22)( ’(cid:23)(cid:17)(cid:21)))(cid:17)(cid:21)(cid:23)(cid:19)( ’)(cid:17)%(cid:19)%(cid:17)&&(cid:22)( 1499. Totals (Lines 1401 thru 1403 plus 1498) (Line 14 above) (cid:22)%(cid:17)(cid:23)%(cid:21)(cid:17)(cid:19)(cid:21)%(cid:4) $$(cid:17)(cid:19)#%(cid:17)$&(cid:23)(cid:4) $(cid:19)(cid:17)%#(cid:21)(cid:17)(cid:23)#%(cid:4) 3601. 1 (cid:16)(cid:15)(cid:16)(cid:9)(cid:26)(cid:11)*(cid:4)3(cid:16)(cid:26)(cid:16)3(cid:31)3(cid:4)+(cid:2)(cid:26)(cid:3)(cid:16)(cid:9)(cid:26)(cid:4)*(cid:16)(cid:11)0(cid:16)*(cid:16)(cid:15)(cid:18) (cid:21)(cid:4) (cid:19)"%(cid:17)(cid:22)#(cid:22)(cid:17)(cid:22)(cid:21)(cid:21)(cid:4) 3602. 3603. 3698. Summary of remaining write-ins for Line 36 from overflow page (cid:21)(cid:4) (cid:21)(cid:4) (cid:21)(cid:4) 3699. Totals (Lines 3601 thru 3603 plus 3698) (Line 36 above) (cid:21)(cid:4) (cid:21)(cid:4) (cid:19)"%(cid:17)(cid:22)#(cid:22)(cid:17)(cid:22)(cid:21)(cid:21)(cid:4) 4 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY CASH FLOW 1 2 Current Year Prior Year Ended To Date December 31 Cash from Operations 1. Premiums collected net of reinsurance $)(cid:17)(cid:21)(cid:21)"(cid:17)&(cid:21))(cid:17)&)#(cid:4) ""(cid:17)(cid:23)%(cid:23)(cid:17)(cid:22)(cid:19)(cid:21)(cid:17)(cid:23)(cid:23)&(cid:4) 2. Net investment income $(cid:17)(cid:19)%)(cid:17)$#(cid:22)(cid:17)%&(cid:22)(cid:4) $(cid:17)(cid:23)(cid:21)(cid:23)(cid:17))(cid:22)$(cid:17)"(cid:22)%(cid:4) 3. Miscellaneous income "(cid:19)(cid:23)(cid:17)(cid:21)#(cid:19)(cid:17)%%&(cid:4) "(cid:19)(cid:23)(cid:17)""%(cid:17)"#(cid:23)(cid:4) 4. Total (Lines 1 to 3) $%(cid:17)(cid:23)(cid:19)(cid:23)(cid:17)(cid:22)&%(cid:17)&$(cid:22)(cid:4) "(cid:19)(cid:17)(cid:23)(cid:22)"(cid:17)#"$(cid:17)"%%(cid:4) 5. Benefits and loss related payments )(cid:17))%)(cid:17)(cid:23)(cid:23)&(cid:17)"(cid:21)#(cid:4) $"(cid:17)#(cid:21)(cid:21)(cid:17)(cid:19)#%(cid:17)&$(cid:23)(cid:4) 6. Net transfers to Separate, Segregated Accounts and Protected Cell Accounts (cid:21)(cid:4) (cid:21)(cid:4) 7. Commissions, expenses paid and aggregate write-ins for deductions #(cid:17)#(cid:21)%(cid:17)%(cid:21)#(cid:17)$%)(cid:4) )(cid:17)(cid:22)(cid:21)"(cid:17)"(cid:21)(cid:22)(cid:17)(cid:22)#(cid:19)(cid:4) 8. Dividends paid to policyholders ’%(cid:22)(cid:23)( ’$"(cid:17)(cid:19)"$( 9. Federal and foreign income taxes paid (recovered) $ %(cid:23)(cid:17)(cid:23)#"(cid:17)#%%(cid:4)net of tax on capital gains (losses) $(cid:17)$(cid:19)$(cid:17)(cid:23)(cid:19)%(cid:17)#)(cid:21)(cid:4) $(cid:22)(cid:21)(cid:17)#"(cid:23)(cid:17)&(cid:23)%(cid:4) 10. Total (Lines 5 through 9) $#(cid:17)#(cid:22)(cid:21)(cid:17)(cid:19)")(cid:17)$"(cid:23)(cid:4) "$(cid:17)"(cid:22)&(cid:17)")%(cid:17))&%(cid:4) 11. Net cash from operations (Line 4 minus Line 10) &(cid:17)(cid:21)%(cid:23)(cid:17)$$$(cid:17)$))(cid:4) &(cid:17)(cid:19)%%(cid:17)&&$(cid:17)(cid:19)#(cid:21)(cid:4) Cash from Investments 12. Proceeds from investments sold, matured or repaid: 12.1 Bonds )(cid:17)(cid:23)""(cid:17)#(cid:22)(cid:21)(cid:17)"%%(cid:4) $(cid:19)(cid:17)(cid:21)(cid:22)#(cid:17)$&(cid:22)(cid:17)))#(cid:4) 12.2 Stocks &(cid:17)(cid:22)"$(cid:17))%(cid:23)(cid:17)#(cid:19)%(cid:4) "(cid:17))#(cid:21)(cid:17)&&"(cid:17))(cid:22)(cid:21)(cid:4) 12.3 Mortgage loans $)(cid:17)%(cid:19)(cid:21)(cid:17)"$(cid:19)(cid:4) "%(cid:17)(cid:19)%"(cid:17)%%(cid:21)(cid:4) 12.4 Real estate (cid:21)(cid:4) $%(cid:17)$%(cid:23)(cid:17))#(cid:21)(cid:4) 12.5 Other invested assets $#)(cid:17)%(cid:22))(cid:17)$"#(cid:4) $(cid:22)#(cid:17))(cid:22)$(cid:17)%(cid:21)%(cid:4) 12.6 Net gains or (losses) on cash, cash equivalents and short-term investments (cid:21)(cid:4) $(cid:19)%(cid:4) 12.7 Miscellaneous proceeds (cid:23)"(cid:17)(cid:19)(cid:21)(cid:19)(cid:17)"(cid:19)"(cid:4) "(cid:17)&$(cid:23)(cid:17)#(cid:19)&(cid:4) 12.8 Total investment proceeds (Lines 12.1 to 12.7) $"(cid:17)(cid:22)(cid:21)(cid:19)(cid:17))(cid:22)(cid:21)(cid:17)(cid:22)&(cid:21)(cid:4) $(cid:23)(cid:17)$"(cid:19)(cid:17)&"%(cid:17)")#(cid:4) 13. Cost of investments acquired (long-term only): 13.1 Bonds $(cid:21)(cid:17)&$%(cid:17)&$(cid:23)(cid:17)(cid:22)(cid:23)(cid:22)(cid:4) $(cid:22)(cid:17)##(cid:21)(cid:17)"$(cid:23)(cid:17)(cid:19)(cid:23)&(cid:4) 13.2 Stocks &(cid:17)(cid:23)(cid:23)(cid:22)(cid:17)(cid:21)%"(cid:17)(cid:21)%$(cid:4) &(cid:17)(cid:22)"(cid:23)(cid:17)#&"(cid:17))(cid:22)&(cid:4) 13.3 Mortgage loans ")(cid:21)(cid:17)&(cid:19)%(cid:17)#(cid:21)(cid:21)(cid:4) $)(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 13.4 Real estate (cid:23)(cid:17)(cid:23)&(cid:23)(cid:17)(cid:21)"(cid:23)(cid:4) $(cid:22)(cid:17)%%(cid:23)(cid:17)(cid:19)))(cid:4) 13.5 Other invested assets "#(cid:21)(cid:17)(cid:22)(cid:21))(cid:17)$")(cid:4) #%(cid:17)(cid:23)$(cid:22)(cid:17)(cid:22)(cid:23)#(cid:4) 13.6 Miscellaneous applications $(cid:21)(cid:21)(cid:17)&(cid:23)$(cid:17)(cid:22)$(cid:21)(cid:4) $)(cid:17)(cid:19)(cid:22)&(cid:17)(cid:21)(cid:23)&(cid:4) 13.7 Total investments acquired (Lines 13.1 to 13.6) $(cid:19)(cid:17)(cid:23)(cid:19)&(cid:17)&(cid:23)(cid:22)(cid:17)%&(cid:21)(cid:4) $%(cid:17)&$(cid:21)(cid:17)(cid:21)$#(cid:17)(cid:19)#"(cid:4) 14. Net increase (or decrease) in policy loans and premium notes (cid:21)(cid:4) (cid:21)(cid:4) 15. Net cash from investments (Line 12.8 minus Line 13.7 and Line 14) ’"(cid:17)"&)(cid:17)(cid:22)"(cid:22)(cid:17)(cid:19)(cid:21)(cid:21)( ’"(cid:17)$)(cid:22)(cid:17)#)(cid:23)(cid:17)$(cid:23)(cid:23)( Cash from Financing and Miscellaneous Sources 16. Cash provided (applied): 16.1 Surplus notes, capital notes (cid:21)(cid:4) (cid:21)(cid:4) 16.2 Capital and paid in surplus, less treasury stock (cid:22)(cid:19)(cid:17)(cid:21)(cid:22)(cid:19)(cid:17)$)(cid:21)(cid:4) "(cid:23)(cid:17)"&(cid:19)(cid:17)(cid:19)(cid:19))(cid:4) 16.3 Borrowed funds (cid:22)(cid:19)(cid:17)(cid:19)(cid:21))(cid:17)$(cid:21)&(cid:4) "#$(cid:17)#$#(cid:17)&#(cid:23)(cid:4) 16.4 Net deposits on deposit-type contracts and other insurance liabilities (cid:21)(cid:4) 16.5 Dividends to stockholders $(cid:17)"(cid:22)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) $(cid:17)"(cid:23)&(cid:17)"$"(cid:17)%%(cid:19)(cid:4) 16.6 Other cash provided (applied) $(cid:17)(cid:21)(cid:19)"(cid:17)(cid:22)(cid:19))(cid:17)(cid:22)"%(cid:4) ’(cid:22)(cid:22)(cid:22)(cid:17)(cid:23)&(cid:21)(cid:17)"$#( 17. Net cash from financing and miscellaneous sources (Line 16.1 through Line 16.4 minus Line 16.5 plus Line 16.6) ’%)(cid:17)%)%(cid:17)$))( ’$(cid:17)(cid:22)(cid:19)(cid:21)(cid:17)(cid:21)%"(cid:17)&%(cid:23)( RECONCILIATION OF CASH AND SHORT-TERM INVESTMENTS 18. Net change in cash and short-term investments (Line 11 plus Lines 15 and 17) (cid:23)(cid:22)%(cid:17)(cid:22)%#(cid:17)#(cid:21)(cid:21)(cid:4) ’""#(cid:17)(cid:19)(cid:19))(cid:17)$$&( 19. Cash and short-term investments: 19.1 Beginning of period )(cid:17)%)"(cid:17)(cid:21)&$(cid:4) "&(cid:22)(cid:17)(cid:19)&(cid:21)(cid:17)$(cid:19)(cid:19)(cid:4) 19.2 End of period (Line 18 plus Line 19.1) (cid:23)#)(cid:17)(cid:22)(cid:23))(cid:17)#&$(cid:4) )(cid:17)%)"(cid:17)(cid:21)&$(cid:4) Note: Supplemental disclosures of cash flow information for non-cash transactions: 20.0001. (cid:25)(cid:12)(cid:9)(cid:29)(cid:2)(cid:2) (cid:3)(cid:4)(cid:30)(cid:12)(cid:9)3(cid:4)0(cid:9)(cid:26) (cid:3)(cid:4)(cid:3)(cid:9)* (cid:17)(cid:4)3(cid:11)(cid:15)(cid:31)(cid:12)(cid:2) (cid:4)(cid:9)(cid:12)(cid:4)(cid:12)(cid:2)+(cid:11)(cid:16) $#%(cid:17)&)(cid:21)(cid:17))$(cid:21)(cid:4) "#(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 20.0002. (cid:25)(cid:12)(cid:9)(cid:29)(cid:2)(cid:2) (cid:3)(cid:4)(cid:30)(cid:12)(cid:9)3(cid:4)(cid:2)8(cid:31)(cid:16)(cid:15)(cid:16)(cid:2)(cid:3)(cid:4)(cid:3)(cid:9)* (cid:17)(cid:4)3(cid:11)(cid:15)(cid:31)(cid:12)(cid:2) (cid:4)(cid:9)(cid:12)(cid:4)(cid:12)(cid:2)+(cid:11)(cid:16) "&(cid:17)"(cid:22)(cid:22)(cid:17)#%%(cid:4) $%(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 20.0003. ,(cid:9)(cid:3)(cid:15)(cid:4)(cid:9)(cid:30)(cid:4)0(cid:9)(cid:26) (cid:3)(cid:4)(cid:11)(cid:29)8(cid:31)(cid:16)(cid:12)(cid:2) $)(cid:19)(cid:17)#""(cid:17)(cid:21)(cid:22)(cid:22)(cid:4) "(cid:22)(cid:23)(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 20.0004. ,(cid:9)(cid:3)(cid:15)(cid:4)(cid:9)(cid:30)(cid:4)(cid:2)8(cid:31)(cid:16)(cid:15)(cid:16)(cid:2)(cid:3)(cid:4)(cid:11)(cid:29)8(cid:31)(cid:16)(cid:12)(cid:2) ""(cid:17)#(cid:22)"(cid:17)(cid:22)(cid:21)$(cid:4) "$(cid:17)(cid:21)(cid:21)(cid:21)(cid:17)(cid:21)(cid:21)(cid:21)(cid:4) 5 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS There have been no material changes to the following December 31, 2003 Annual Statement notes: 1(C), 2-8, 9(B), 9(E-F), 10(F-J), 11-12, 13(1- 8), 13(10-12), 14(B-C), 15-16, 17(A-B), 18-20, 21(A-B), 21(D-F), 22, 23(A-B) 23(C2-3), 23(D-G), 24, 26-32, 34-35. Note 25 disclosures are required to be updated annually per paragraph 14 of Statement of Statutory Accounting Principles No. 55. 1. Summary of Significant Accounting Policies A. Allstate Insurance Company (referred to as the “Company”) prepares its financial statements in conformity with accounting practices prescribed or permitted by the Illinois Department of Insurance (“IL DOI”). Prescribed statutory accounting practices include a variety of publications of the National Association of Insurance Commissioners (“NAIC”), as well as state laws, regulations and general administrative rules. Permitted statutory accounting practices encompass all accounting practices not so prescribed. The state of Illinois requires its domestic insurance companies to prepare financial statements in conformity with the NAIC Accounting Practices and Procedures Manual, subject to any deviations prescribed or permitted by the IL DOI. B. The preparation of financial statements in conformity with accounting practices prescribed or permitted by the IL DOI requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates. 9. Income Taxes A. The components of the net deferred tax asset were as follows: (in millions) September 30, December 31, 2004 2003 Total of gross deferred tax assets $ 1,807 $ 1,800 Total of gross deferred tax liabilities (593) (679) Net deferred tax asset 1,214 1,121 Deferred tax asset nonadmitted 169 85 Net admitted deferred tax asset $ 1,045 $ 1,036 (Increase) decrease in nonadmitted asset $ (84) C. The provision for incurred income taxes for the nine months ended September 30 was: (in millions) 2004 2003 Federal income tax - excluding net capital gains $ 966 $ 195 Federal income tax on net capital gains 98 54 Federal income taxes incurred $ 1,064 $ 249 The provision for income tax incurred did not include any foreign income taxes for the nine months ended September 30, 2004 or 2003. The tax effects of temporary differences that gave rise to significant portions of deferred tax assets and deferred tax liabilities were as follows: (in millions) September 30, December 31, 2004 2003 Deferred tax assets: Revenue offset $ 608 $ 573 Nonadmitted assets 540 574 Reserve discounting 419 422 Additional minimum pension liability 81 81 Other 76 56 Investments 73 65 Uncollectible reinsurance 10 11 Deposit accounting adjustments - 18 Total deferred tax assets 1,807 1,800 Nonadmitted deferred tax assets 169 85 Admitted deferred tax assets 1,638 1,715 Deferred tax liabilities: Net unrealized gains (284) (370) Employee benefits (223) (228) Fixed assets (43) (51) Salvage and subrogation discounting (12) (14) Premium acquisition expense (11) (7) Guaranty fund assessments (10) (9) Deposit accounting adjustments (7) - Other (3) - Total deferred tax liabilities (593) (679) Net admitted deferred tax asset $ 1,045 $ 1,036 The change in net deferred income tax was comprised of the following (this analysis is exclusive of nonadmitted assets, as the change in nonadmitted assets is reported separately from the change in net deferred income tax in the surplus section of the Quarterly Statement): (in millions) September 30, December 31, 2004 2003 Change Total deferred tax assets $ 1,807 $ 1,800 $ 7 Total deferred tax liabilities (593) (679) 86 Net deferred tax asset (liability) $ 1,214 $ 1,121 93 Tax effect of unrealized gains (losses) (87) Change in net deferred income tax 6 Adjustment for prior year tax liabilities - Tax effect of nonadmitted assets 35 Change in net deferred income tax relating to the provision $ 41 6 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS (in millions) September 30, December 31, 2003 2002 Change Total deferred tax assets $ 1,731 $ 1,723 $ 8 Total deferred tax liabilities (512) (220) (292) Net deferred tax asset (liability) $ 1,219 $ 1,503 (284) Tax effect of unrealized gains (losses) 133 Change in net deferred income tax (151) Adjustment for prior year tax liabilities (21) Tax effect of nonadmitted assets (1) Change in net deferred income tax relating to the provision $ (173) D. The provision for federal income taxes incurred was different from that which would have been obtained by applying the statutory federal income tax rate to income before taxes. The significant items causing these differences were as follows at September 30: Effective (in millions) 2004 Tax Rate Provision computed at statutory rate $ 1,335 35.0 % Tax exempt income deduction (209) (5.5) Intercompany dividends (104) (2.7) Dividend received deduction (9) (.3) Adjustment for prior year tax liabilities (3) (.1) Prior year true-up (1) - Change in deferred income taxes 41 1.1 Nondeductibles 23 .6 Other (9) (.2) Total statutory income taxes $ 1,064 27.9 % Effective (in millions) 2003 Tax Rate Provision computed at statutory rate $ 720 35.0 % Tax exempt income deduction (205) (10.0) Intercompany dividends (44) (2.1) Dividend received deduction (8) (.4) Adjustment for prior year tax liabilities (3) (.2) Prior year true-up - - Change in deferred income taxes (173) (8.4) Nondeductibles 13 .6 Other (51) (2.4) Total statutory income taxes $ 249 12.1 % 10. Information Concerning Parent, Subsidiaries and Affiliates A., B.& C. The following transactions were entered into by the Company with related parties during 2004 and 2003 that involved more than ½ of 1% of the Company’s admitted assets. Reinsurance agreements, insurance contracts and cost allocation transactions in accordance with intercompany agreement provisions were excluded. Transactions with The Allstate Corporation (“Corporation”) On August 16, 2004, the Corporation paid in full, with cash, the $405 million Demand Promissory Note, including $2 million of accrued interest held by the Company. The Company paid the following cash dividends to its parent, the Corporation in 2004 and in 2003: (in millions) Date of payment 2004 2003 February 4 $ - $ 150 March 1 200 - April 1 400 300 June 1 200 - July 1 - 175 July 15 350 - September 1 100 - October 15 300 - November 3 - 150 December 5 - 400 Total $ 1,550 $ 1,175 On June 19, 2003 and November 26, 2003, the Company paid dividends with fair values of $69 million and $30 million, respectively, to the Corporation using investment securities. Transactions with Allstate Life Insurance Company (“ALIC”) The Company received cash dividends on common stock from ALIC as follows in 2004 and 2003: (in millions) Date of payment 2004 2003 January 20 $ 75 $ - March 31 25 - June 29 25 - August 31 150 - September 30 - 25 Total $ 275 $ 25 The Company received dividends in the form of securities with a fair value of $98 million from ALIC in 2003: $69 million on June 19 and $29 million on November 26. 6.1 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS Transactions with Allstate Floridian Insurance Company (“AFIC”) and Allstate Holdings, LLC (“Holdings”) On September 30, 2004, AFIC, a subsidiary, issued a $175 million surplus note to the Company in exchange for cash. The surplus note matures on September 30, 2019 and pays interest at a rate of 7.5% annually. Interest payments will be due semi-annually on April 1 and October 1 beginning April 1, 2007 until maturity. The payment of principal and interest is subject to prior written approval from the IL DOI and the Florida Office of Insurance Regulation and can be paid only out of AFIC’s surplus. The Company includes the surplus note in Other Invested Assets on the Asset page of the Quarterly Statement. In addition, the Company entered into other transactions with AFIC, via Holdings, AFIC’s direct parent. On September 29, 2004 the Company contributed cash of $100 million to Holdings, who in turn contributed it to AFIC. On January 20, 2004, AFIC paid a cash dividend of $57 million to Holdings, who, in turn, paid the dividend to the Company. In 2003, Holdings received the following cash dividends from AFIC and then paid them to the Company: $57 million on January 17 and $22 million on July 8. D. The Company reported the following amounts as receivable from its affiliates: (in millions) September 30, December 31, 2004 2003 ALIC $ 56 $ 92 Lincoln Benefit Life Company 16 15 Sterling Collision Centers, Inc. 13 1 American Heritage Life Insurance Company 10 - Allstate Investments, LLC 7 7 Allstate Financial Services, LLC 6 7 Allstate Motor Club, Inc. 4 6 Allstate Indemnity Company 3 3 Allstate Distributors, LLC 3 3 E.R.J. Insurance Group, Inc 2 - Allstate Floridian Indemnity Company 2 2 Glenbrook Life and Annuity Company 2 20 Allstate Life Insurance Company of New York 1 1 Corporation - 281 Allstate New Jersey Insurance Company - 13 Allstate Floridian Insurance Company - 10 AHL Investments Life Insurance Company - 3 Northbrook Services, Inc. - 1 Allstate Insurance Company of Canada - 1 Allstate Bank - 1 Columbia Universal Life Insurance Company - 1 Other 5 - Total $ 130 $ 468 The Company reported the following amounts as payable to affiliates at September 30, 2004: (in millions) Corporation $ 168 Allstate Floridian Insurance Company 138 Allstate Holdings, LLC 100 Other 13 Total $ 419 At December 31, 2003, the total amounts payable to parent, subsidiaries and affiliates were less than $1 million. Intercompany receivables and payables are generally cash settled at least quarterly. E. The Company purchased structured settlement annuities, a type of immediate annuity, at prices determined based on interest rates in effect at the time of purchase, to fund structured settlements from ALIC and two of its subsidiaries, Allstate Life Insurance Company of New York and Lincoln Benefit Life Company. Prior to July 1, 2001, these annuities were issued to Allstate Settlement Corporation (“ASC”), a subsidiary of ALIC. Annuities sold subsequent to July 1, 2001, involving the Company were issued to Allstate Assignment Company (“AAC”), a subsidiary of ALIC. Most of the structured settlements issued by ASC and AAC were under a “qualified assignment”, meaning these entities assumed the Company’s obligation to make future payments. The Company has issued surety bonds to guarantee the payment of structured settlement benefits assumed by ASC (from both the Company and non-related parties) and funded by certain annuity contracts issued by the Company. ASC has entered into general indemnity agreements pursuant to which it indemnified the Company for any liabilities associated with the surety bonds and providing the Company certain collateral security rights with respect to the annuities and certain other rights in the event of default. For contracts written on or after July 1, 2001, the Company no longer issues surety bonds to guarantee the payment of structured settlement benefits. Alternatively, ALIC guarantees the payment of structured settlement benefits on all contracts issued on or after July 1, 2001. Reserves recorded by the Company for annuities related to the surety bonds were $4.97 billion and $5.35 billion at September 30, 2004 and December 31, 2003, respectively. 13. Capital and Surplus, Dividend Restrictions and Quasi-Reorganizations 9. The cumulative amount of the components contributing to the increase or (reduction) of unassigned surplus was as follows: September 30, December 31, 2004 2003 a. Unrealized gains and losses $ 3.19 billion $ 3.87 billion b. Nonadmitted asset values (1.71) billion (1.73) billion c. Separate Account business - - d. Asset valuation reserves - - e. Reinsurance in unauthorized companies (.2) billion (.07) billion 6.2 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS 14. Contingencies A. Contingent Commitments In addition to the item described in Note 10, Part E, the Company made the following contingent commitments and guarantees: North Carolina Rate Refund On June 25, 2004 the North Carolina Supreme Court upheld a lower courts decision in favor of the North Carolina Department of Insurance (“NC DOI”) to reduce 2001 auto rates for certain North Carolina policyholders. In accordance with NC DOI Bulletin 02-B-1 and 02-B-11 (“Bulletins”), which relates to reductions of 2001 and 2002 auto rates for certain North Carolina policyholders, respectively, the Company has accrued for the premium refund, including an interest component. During the third quarter of 2004, the Company began to process refunds related to both Bulletins. At September 30, 2004, the Company had accrued $5 million of interest related to the Bulletins. In addition, the Company has placed on deposit with the Bank of New York, in escrow accounts, bonds to provide for the refund. Please refer to Note 21, Part C for the par value and fair value of bonds on deposit related to these Bulletins. California Earthquake Authority (“CEA”) Exposure to certain potential losses from earthquakes in California is limited by the Company’s participation in the CEA, which provides insurance for California earthquake losses. The CEA is a privately-financed, publicly-managed state agency created to provide insurance coverage for earthquake damage. Insurers selling homeowners insurance in California are required to offer earthquake insurance to their customers either through their company or by participation in the CEA. The Company’s homeowners policies continue to include coverages for losses caused by explosions, theft, glass breakage and fires following an earthquake, which are not underwritten by the CEA. Should losses arising from an earthquake cause a deficit in the CEA, additional funding would be obtained through assessments on participating insurance companies, reinsurance proceeds and bond issuances funded by future policyholder assessments. Participating insurers are required to pay an assessment, currently estimated not to exceed $2.18 billion, if the capital of the CEA falls below $350 million. Participating insurers are required to pay a second assessment, currently estimated not to exceed $1.46 billion, if aggregate CEA earthquake losses exceed $5.55 billion and the capital of the CEA falls below $350 million. At December 31, 2003, the CEA’s capital balance was approximately $1.48 billion. If the CEA assesses its member insurers for any amount, the amount of future assessments on members is reduced by the amounts previously assessed. To date, the only assessment made by the CEA has been its initial assessment paid by participating insurers beginning in 1996. The authority of the CEA to assess participating insurers for the first assessment expires when it has completed twelve years of operation, at year-end 2008. All future assessments on participating CEA insurers are based on their CEA insurance market share as of December 31 of the preceding year. As of December 31, 2003, the Company’s share of the CEA was 23%. The Company does not expect its CEA market share to materially change. At this level, the Company’s maximum possible CEA assessment would be $837 million. However, the Company does not expect its portion of these additional contingent assessments, if any, to exceed $502 million, its share of the first assessment. This is based on the low likelihood of an event exceeding the CEA claims paying capacity of $5.55 billion, and therefore the need for a second assessment is remote. Management believes the Company’s exposure to earthquake losses in California has been significantly reduced as a result of its participation in the CEA. Other Hurricane Exposure The Company has also mitigated its ultimate exposure to hurricanes through policy brokering. Examples include the Company’s brokering of insurance coverage in certain areas of Florida and in Hawaii for hurricane insurance coverage to a non-affiliated company. However, the Company continues to own two subsidiaries, Allstate Floridian Insurance Company and Allstate Floridian Indemnity Company, that write homeowners business in the state of Florida. Shared Markets As a condition of maintaining its licenses to write personal property and casualty insurance in various states, the Company is required to participate in assigned risk plans, reinsurance facilities and joint underwriting associations that provide various types of insurance coverage to individuals or entities that otherwise are unable to purchase such coverage from private insurers. Underwriting results related to these arrangements, which tend to be adverse, were immaterial to the results of operations. PMI Runoff Support Agreement The Company has certain limited rights and obligations under a Capital Support Agreement (“Runoff Support Agreement”) with PMI Mortgage Insurance Company (“PMI”), the primary operating subsidiary of The PMI Group, Inc. Under the Runoff Support Agreement, the Company would be required to pay claims on PMI policies written prior to October 28, 1994 if PMI fails certain financial covenants and fails to pay such claims. In the event any amounts are so paid, the Company would receive a commensurate amount of preferred stock or subordinated debt of The PMI Group, Inc. or PMI. The Runoff Support Agreement also restricts PMI's ability to write new business and pay dividends under certain circumstances. Management does not believe this agreement will have a material adverse effect on results of operations, liquidity or financial position of the Company. Morgan Stanley Guarantee The Company executed a guarantee to Morgan Stanley DW Inc. (“Morgan Stanley”), related to the obligations of Northbrook Holdings, LLC (“Northbrook”), a wholly owned subsidiary of the Company under a certain Note Purchase Agreement between Northbrook and Morgan Stanley and promissory notes issued by Northbrook pursuant thereto. The balance of the notes were $64 million and $77 million at September 30, 2004 and December 31, 2003, respectively. Allstate Real Estate Trust The Company has guaranteed debt issued by Allstate Real Estate Trust, an unconsolidated special purpose entity, from which it leases an office building. The lease contains a residual value guarantee for the properties covered by the lease. The maximum amount of potential future payments for the guarantee of the debt or the residual value guarantee or the combined debt and residual value guarantee was $66 million at both September 30, 2004 and December 31, 2003. The guarantee for the office building expires on December 28, 2006. SunTrust Guarantee The Company provides residual value guarantees on Company leased automobiles. If all outstanding leases were terminated effective September 30, 2004, the Company’s maximum obligation pursuant to these guarantees, assuming the automobiles have no residual value, would be $20 million at September 30, 2004. If all outstanding leases were terminated effective December 31, 2003, the Company’s maximum obligation pursuant to these guarantees, assuming the automobiles had no residual value, would have been $19 million at December 31, 2003. The remaining term of each residual value guarantee is equal to the term of the underlying lease that range from less than one year to three years. Historically, the Company has not made any material payments pursuant to these guarantees. 6.3 STATEMENT AS OF SEPTEMBER 30, 2004 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS D. All Other Contingencies Regulation The Company is subject to changing social, economic and regulatory conditions. Recent state and federal regulatory initiatives and proceedings have included efforts to influence and restrict premium rates in a manner adverse to insurers, restrict the ability of insurers to cancel policies, limit insurers’ ability to impose underwriting standards, remove barriers preventing banks from engaging in the securities and insurance businesses, change tax laws affecting the taxation of insurance companies and the tax treatment of insurance products or competing non-insurance products that may impact the relative desirability of various personal investment products and otherwise expand overall regulation of insurance products and the insurance industry. The ultimate changes and eventual effects of these initiatives on the Company’s business, if any, are uncertain. Regulatory bodies have contacted various subsidiaries of the Company and have requested information relating to variable insurance products, including such areas as market timing and late trading and sales practices. The Company believes that these inquiries are similar to those made to many financial services companies as part of an industry-wide investigation by various regulatory agencies into the practices, policies and procedures relating to variable insurance product sales and subaccount trading practices. The various subsidiaries of the Company have and will continue to respond to these information requests and investigations. The Company at the present time is not aware of any systemic problems with respect to such matters that may have a material adverse effect on the Company’s financial position. Legal proceedings Background The Company and certain of its subsidiaries are named as defendants in a number of lawsuits and other legal proceedings arising out of various aspects of its business. As background to the “Proceedings” sub-section below, please note the following: • These matters raise difficult and complicated factual and legal issues and are subject to many uncertainties and complexities, including but not limited to, the underlying facts of each matter, novel legal issues, variations between jurisdictions in which matters are being litigated, differences in applicable laws and judicial interpretations, the length of time before many of these matters might be resolved by settlement or through litigation and, in some cases, the timing of their resolutions relative to other similar cases brought against other companies, the fact that many of these matters are putative class actions in which a class has not be certified and in which the purported class may not be clearly defined, the fact that many of these matters involve multi-state class actions in which the applicable law(s) for the claims at issue is in dispute and therefore unclear, and the current challenging legal environment faced by large corporations and insurance companies. • In these matters, plaintiffs seek a variety of remedies including equitable relief in the form of injunctive and other remedies and monetary relief in the form of contractual and extra-contractual damages. In some cases, the monetary damages sought include punitive or treble damages or are not specified. Often more specific information beyond the type of relief sought is not available because plaintiffs have not requested more specific relief in their court pleadings. In those cases where plaintiffs have made a specific demand for monetary damages, they often specify damages just below a jurisdictional limit regardless of the facts of the case. This represents the maximum they can seek without risking removal from state court to federal court. In our experience, monetary demands in plaintiffs’ court pleadings bear little relation to the ultimate loss, if any, to the Company. • For the reasons specified above, it is not possible to make meaningful estimates of the amount or range of loss that could result from these matters at this time. The Company reviews these matters on an on-going basis and follows the provisions of Statement of Statutory Accounting Principles No. 5, Liabilities, Contingencies and Impairments of Assets when making accrual and disclosure decisions. When assessing reasonably possible and probable outcomes, the Company bases its decisions on its assessment of the ultimate outcome following all appeals. • In the opinion of the Company’s management, while some of these matters may be material to the Company’s operating results for any particular period if an unfavorable outcome results, none will have a material adverse effect on the financial condition of the Company. Proceedings There are two active nationwide class action lawsuits against the Company regarding its specification of after-market (non-original equipment manufacturer) replacement parts in the repair of insured vehicles. One of these suits alleges that the specification of such parts constitutes breach of contract and fraud, and this suit mirrors to a large degree lawsuits filed against other carriers in the industry. The plaintiffs allege that after-market parts are not "of like kind and quality" as required by the insurance policy, and they are seeking actual and punitive damages. In the second lawsuit, plaintiffs allege that the Company and three co-defendants have violated federal antitrust laws by conspiring to manipulate the price of auto physical damage coverages in such a way that not all savings realized by the use of aftermarket parts are passed on to policyholders. These plaintiffs seek actual and treble damages. In November 2002, a nationwide class was certified in this case. The defendants filed a petition to appeal the certification, and the Eleventh Circuit Court of Appeals recently heard oral arguments. The parties are now awaiting a decision on the appeal. The Company has been vigorously defending both of these lawsuits, and their outcome is uncertain. There are several statewide and nationwide class action lawsuits pending against the Company alleging that its failure to pay “inherent diminished value” to insureds under the collision, comprehensive, uninsured motorist property damage, or auto property damage liability provisions of auto policies constitutes breach of contract and fraud. Plaintiffs define “inherent diminished value” as the difference between the market value of the insured automobile before an accident and the market value after repair. Plaintiffs allege that they are entitled to the payment of inherent diminished value under the terms of the policy. To a large degree, these lawsuits mirror similar lawsuits filed against other carriers in the industry. These lawsuits are pending in various state and federal courts, and they are in various stages of development. Classes have been certified in only two cases. Both are multi-state class actions. A trial in one of these multi-state class action cases involving collision and comprehensive coverage concluded on April 29, 2004, with a jury verdict in favor of the Company. The plaintiffs made a motion for a new trial, which was denied, and have now filed an appeal from the judgment. In the other certified class action lawsuit, which involves uninsured motorist property damage coverage, the appellate court has granted the Company’s petition for review of the order of certification. The Company has been vigorously defending all these lawsuits and, since 1998, has been implementing policy language in more than 40 states reaffirming that its collision and comprehensive coverages do not include diminished value claims. The outcome of these disputes is currently uncertain. There are a number of state and nationwide class action lawsuits pending in various state courts challenging the legal propriety of the Company’s medical bill review processes on a number of grounds, including, among other things, the manner in which the Company determines reasonableness and necessity. One nationwide class action has been certified. These lawsuits, which to a large degree mirror similar lawsuits filed against other carriers in the industry, allege these processes result in a breach of the insurance policy as well as fraud. Plaintiffs seek monetary damages in the form of contractual and extra-contractual damages. The Company denies these allegations and has been vigorously defending these lawsuits. The outcome of these disputes is currently uncertain. A number of nationwide and statewide putative class actions are pending against the Company, which challenge the Company’s use of certain automated database vendors in valuing total loss automobiles. To a large degree, these lawsuits mirror similar lawsuits filed against other carriers in the industry. Plaintiffs allege that flaws in these databases result in valuations to the detriment of insureds. The plaintiffs are seeking actual and punitive damages. The lawsuits are in various stages of development and the Company has been vigorously defending them, but the outcome of these disputes is currently uncertain. 6.4

Description: