A bill to amend the Internal Revenue Code of 1986 to repeal the 1993 Federal income tax rate increases on trusts established for the benefit of individuals with disabilities PDF

Preview A bill to amend the Internal Revenue Code of 1986 to repeal the 1993 Federal income tax rate increases on trusts established for the benefit of individuals with disabilities

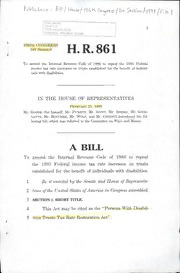

Cf'^SLibrary C2-07-13 7500SecurityBlvd. Baltimore, Marytend21244 106thcongress H.R.861 1stSession To amend the Internal Revenue Codeof1986 to repeal the 1993 Federal incometaxrateincreasesontrustsestablishedforthebenefitofindivid- ualswithdisabilities. IN THE HOUSE OF REPRESENTATIVES February25,1999 Mr.GOODE(forhimself,Mr.PiCKETT,Mr. ScOTT,Mr. SiSlSKY,Mr.GOOD- LATTE,Mr.Boucher,Mr.Wolf,andMr.Condit)introducedthefol- lowingbill;wliichwasreferredtotheCommitteeonWaj-sandMeans A BILL To amend the Internal Revenue Code of 1986 to repeal the 1993 Federal mcome tax rate increases on trusts establishedforthebenefitofindi\idualswithdisabihties. 1 BeitenactedhytheSenateandHouseofRepresenta- 2 tivesofthe UnitedStatesofAmericainCongressassembled, 3 SECTION1.SHORTTITLE. 4 ThisActmaybecitedasthe"PersonsWithDisabil- 5 itiesTrustsTaxRateRestorationAct". — 2 1 SEC.2.REPEALOF1993RATEINCREASESONTRUSTSFOR 2 INDIVroUALS WHO ARE DISABLED OR FOR 3 COLLEGEEDUCATIONS. — 4 (a)InGeneral. Section 1(e) oftheInternalReve- 5 nueCodeof1986 (relatingtotaximposedonestatesand 6 trusts)isamendedtoreadasfollows: — 7 "(e)EstatesandTrusts. — 8 "(1)InGENERAL. Exceptasprovidedinpara- 9 graph (2),thereisherebyimposedonthetaxablein- 10 comeof 11 "(A) everyestate,and 12 "(B)everytrust, 13 taxableunderthissubsectionataxdeterminedinac- 14 cordaneewiththefollowingtable: "Iftaxableincomeis: Thetaxis: Notover$1,500 15%oftaxableincome. Over$1,500butnotover$3,500.. $225, plus 28% ofthe excessover $1,500. Over$3,500butnotover$5,500.. $785, plus 31% ofthe excess over $3,500. Over$5,500butnotover$7,500.. $1,405,plus36% oftheexcessover $5,500. Over$7,500 $2,125,plus39.6%.oftheexcessover $7,500. — 15 "(2) Specialruleforcertaintrusts. — 16 "(A) In GENT:ral. There is hereby im- 17 posedonthetaxableincomeofaneligibletrust 18 taxable under this subsection a tax determined 19 inaccordancewiththefollowingtable: "Iftaxableincomeis: Thetaxis: Notover$3,300 15%oftaxableincome. m >HR861 Ci'lSLibrary C2-07-i3 7500SecurityBlvd. Bsltimors, Maryterci21244 "Iftaxableincomeis: Thetaxis: Over$3,300butnotover$9,900.. $495, plus 28% ofthe excess over $3,300. Over$9,900 $2,343,plus31%oftheexcessover $9,900. — 1 "(B) Eligible trust. For purposes of 2 subparagraph (A), the term 'ehgible trust' 3 means a trust which is estabhshed exclusively 4 for the purpose of providing reasonable 5 amounts forthe support and maintenance of 1 6 or more beneficiaries each ofwhom is an indi- 7 vidual who is mentally iU or has a disability 8 (within the meaning of section 3(2) of the 9 Americans With Disabilities Act of 1990 (42 10 U.S.C. 12102(2)) atthetimethetrustisestab- 11 lished. A trust shall not fail to meet the re- 12 quirements of this subparagraph merely be- 13 causethe corpus ofthetrustmayreverttothe 14 grantor or a member of the grantor's family 15 uponthedeathofthebeneficiar5^" — 16 (b) Effectr^ Date. The amendment made by 17 this section shall apply to taxable years beginning after 18 thedateoftheenactmentofthisAct. O m •HR861 CHSLIBRflRV