2013 Landbook of Taxable Properties in Prince George County in Alphabetical Order PDF

Preview 2013 Landbook of Taxable Properties in Prince George County in Alphabetical Order

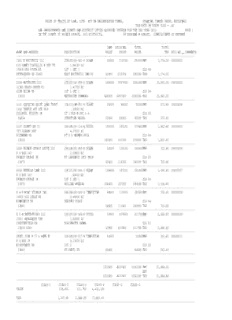

VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 1 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- 1901 E WHITEHILL LLC 22B(02)00-001-0 BLAND 82800 210700 293500FMV 1,174.00 00000002 C/O RAMEY CORVALLIS W REV TR 1.84180 AC 19918 OAK RIVER DR LOT 1 SEC 1 CLS 04 PETERSBURG VA 23803 EAST WHITEHILL IND PK 82800 210700 293500 TAX 1,174.00 ---------------------------------------------------------------------------------------------------------------------------------- 2200 WATERSIDE LLC 220(07)00-006-0 BLAND 568500 2697000 3265500FMV 13,062.00 00000003 12300 KEATS GROVE PL 1.41700 AC GLEN ALLEN VA LOT 6 SEC 1 CLS 04 23059 WATERSIDE COMMONS 568500 2697000 3265500 TAX 13,062.00 ---------------------------------------------------------------------------------------------------------------------------------- 5101 CHESHIRE DRIVE LAND TRUST 12A(12)0M-001-0 BLAND 25000 68200 93200FMV 372.80 00000004 1050 TEMPLE AVE STE 554 .32000 AC COLONIAL HEIGHTS VA LT 1 BLK M SEC 5 A CLS 02 23834 STRATFORD WOODS 25000 68200 93200 TAX 372.80 ---------------------------------------------------------------------------------------------------------------------------------- 5107 COUNTY DR LC 340(0A)00-114-A RIVES 192500 183100 375600FMV 1,502.40 00000005 707 ALBANY AVE 4.37000 AC RICHMOND VA PT S O WEEMPE PROP CLS 04 23224 192500 183100 375600 TAX 1,502.40 ---------------------------------------------------------------------------------------------------------------------------------- 5300 PRINCE GEORGE DRIVE LLC 240(0A)00-068-B BLAND 62500 118100 180600FMV 722.40 00000006 P O BOX 162 2.00800 AC PRINCE GEORGE VA PT LAWRENCE LUCY PROP CLS 02 23875 62500 118100 180600 TAX 722.40 ---------------------------------------------------------------------------------------------------------------------------------- 6650 REDWOOD LAND LLC 23E(01)00-00A-1 BLAND 104400 187200 291600FMV 1,166.40 00000007 P O BOX 162 .95000 AC PRINCE GEORGE VA LOT 2 SEC 1 CLS 04 23875 ROLLING MEADOW 104400 187200 291600 TAX 1,166.40 ---------------------------------------------------------------------------------------------------------------------------------- A & P MINI STORAGE INC 580(0A)00-008-0 TEMPLETON 68600 115300 183900FMV 735.60 00000008 14920 OLD STAGE RD 3.49930 AC DINWIDDIE VA HEATHES PLACE CLS 04 23841 68600 115300 183900 TAX 735.60 ---------------------------------------------------------------------------------------------------------------------------------- A L M ENTERPRISES LLC 230(07)00-00A-0 RIVES 53900 457800 511700FMV 2,046.80 00000009 10911 MERGANSER TER 1.50000 AC CHESTERFIELD VA BLACKWATER SWAMP CLS 03 23838-5269 53900 457800 511700 TAX 2,046.80 ---------------------------------------------------------------------------------------------------------------------------------- ABEEL JOHN R II & ANNE W 530(0A)00-017-B TEMPLETON 65600 65600FMV 262.40 00000012 P O BOX 29 9.17470 AC DISPUTANTA VA LOT 2 CLS 02 23842 PT ABEEL PR 65600 65600 TAX 262.40 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 1223800 4037400 5261200 FMV 21,044.80 DEF 1223800 4037400 5261200 TAX 21,044.80 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 339,400 511,700 4,410,100 TAX 1,357.60 2,046.80 17,640.40 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 2 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ABEEL JOHN R II & ANNE W 600(0A)00-025-A TEMPLETON 84300 84300FMV 337.20 00000010 P O BOX 29 46.49000 AC 63800 63800 DEF 255.20 DISPUTANTA VA PT JOHN ABEEL PR CLS 05 23842 20500 20500 TAX 82.00 ---------------------------------------------------------------------------------------------------------------------------------- ABEEL JOHN R II & ANNE W 600(0A)00-026-0 TEMPLETON 32500 32500FMV 130.00 00000013 P O BOX 29 10.00000 AC 28100 28100 DEF 112.40 DISPUTANTA VA JOSEPH SWAMP CLS 02 23842 4400 4400 TAX 17.60 ---------------------------------------------------------------------------------------------------------------------------------- ABEEL JOHN R II & ANNE W 600(0A)00-035-0 TEMPLETON 87300 87300FMV 349.20 00000011 P O BOX 29 26.50000 AC 75600 75600 DEF 302.40 DISPUTANTA VA TEMPLE TRACT CLS 05 23842 11700 11700 TAX 46.80 ---------------------------------------------------------------------------------------------------------------------------------- ABEEL PAIGE S 500(0A)00-008-A RIVES 53000 180200 233200FMV 932.80 00000014 13818 FAIRWOOD RD 3.30100 AC PETERSBURG VA PT GLENN F PERKINS CLS 02 23805 53000 180200 233200 TAX 932.80 ---------------------------------------------------------------------------------------------------------------------------------- ABELE CHARLES W JR & VERA F 250(11)00-011-0 BLAND 64500 128500 193000FMV 772.00 00009100 9753 HIDDEN HILLS DR 5.12450 AC PRINCE GEORGE VA LT 11 SEC B CLS 02 23875 HIDDEN HILLS 64500 128500 193000 TAX 772.00 ---------------------------------------------------------------------------------------------------------------------------------- ABERDEEN FARM PROPERTIES LLC 270(0A)00-039-0 BLACKWATER 443900 113900 557800FMV 2,231.20 00000015 C/O CAROL M BOWMAN 378.00000 AC 239000 239000 DEF 956.00 15301 JAMES RIVER DR ABERDEEN CLS 06 DISPUTANTA VA 23842 204900 113900 318800 TAX 1,275.20 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY CLYDE W & JEANETTE K 420(12)00-002-0 RIVES 62700 179600 242300FMV 969.20 00000016 13350 FAIRWOOD RD 5.00000 AC PETERSBURG VA LOT 2 CLS 02 23805 WILFLO FARMS 62700 179600 242300 TAX 969.20 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY ELIZABETH M & LARRY S 11B(02)0D-002-0 BLAND 23000 64800 87800FMV 351.20 00009101 12378 POLE RUN RD .25000 AC DISPUTANTA VA LT 2 BLK D SEC 1 CLS 02 23842 ATHOL GARDENS 23000 64800 87800 TAX 351.20 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY ELIZABETH M ET ALS 12A(02)02-051-0 BLAND 25000 64300 89300FMV 357.20 00000017 701 W BROADWAY .30000 AC HOPEWELL VA LOT 51 BLK 2 CLS 02 23860 JEFFERSON PARK 25000 64300 89300 TAX 357.20 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 876200 731300 1607500 FMV 6,430.00 406500 406500 DEF 1,626.00 469700 731300 1201000 TAX 4,804.00 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 850,000 32,200 318,800 TAX 3,400.00 128.80 1,275.20 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 3 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY GEORGE A & PEGGY G 430(05)00-003-E RIVES 43000 107100 150100FMV 600.40 00009804 2301 CLARY RD 1.17800 AC PETERSBURG VA YOUNGBLOODS STORE CLS 02 23805 43000 107100 150100 TAX 600.40 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY LARRY S & ELIZABETH M 12A(09)0C-007-0 BLAND 25000 66700 91700FMV 366.80 00008321 12378 POLE RUN RD .00000 AC DISPUTANTA VA LT 7 BLK C SEC 2 CLS 02 23842 STRATFORD WOODS 25000 66700 91700 TAX 366.80 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY LARRY S & ELIZABETH M 370(03)00-005-0 BLACKWATER 97300 228300 325600FMV 1,302.40 00009805 12378 POLE RUN RD 16.57000 AC 52700 52700 DEF 210.80 DISPUTANTA VA PT DON SOWERS PROP P CLS 02 23842 44600 228300 272900 TAX 1,091.60 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY LARRY S ET ALS 230(04)00-001-A BLAND 41000 41000FMV 164.00 00000019 12378 POLE RUN RD 8.44000 AC DISPUTANTA VA NEAR COURTHOUSE ALSO INC CLS 02 23842 41000 41000 TAX 164.00 ---------------------------------------------------------------------------------------------------------------------------------- ABERNATHY LARRY S ET ALS 230(04)00-001-B BLAND 40400 148900 189300FMV 757.20 00000018 12378 POLE RUN RD 1.22000 AC DISPUTANTA VA LOT 1 CLS 02 23842 PT LARRY ABERNATHY ALS P 40400 148900 189300 TAX 757.20 ---------------------------------------------------------------------------------------------------------------------------------- ABERNETHY ALAN B & ELAINE S 250(14)00-001-B BLAND 56400 309600 366000FMV 1,464.00 00000020 10132 BRIGHTON DR 5.00000 AC HOPEWELL VA PT DALLAS WESTON PR CLS 02 23860 56400 309600 366000 TAX 1,464.00 ---------------------------------------------------------------------------------------------------------------------------------- ABKEN RICHARD L & HOE S 13A(02)0E-004-0 BLAND 45400 105800 151200FMV 604.80 00000021 3500 ONTARIO DR .00000 AC PRINCE GEORGE VA LT 4 BLK E SEC 4 CLS 02 23875 BIRCHETT EST 45400 105800 151200 TAX 604.80 ---------------------------------------------------------------------------------------------------------------------------------- ABLE JOE C & CONNIE F 600(07)00-004-0 TEMPLETON 39800 116100 155900FMV 623.60 00009806 17400 LOVING UNION RD 1.53800 AC DISPUTANTA VA LOT 4 SEC A CLS 02 23842 MELVINS ACRES 39800 116100 155900 TAX 623.60 ---------------------------------------------------------------------------------------------------------------------------------- ABRAHAM LOUIS L & JANET J 43C(03)0B-005-0 RIVES 43000 110700 153700FMV 614.80 00000022 3300 BROOKS PARK DR .00000 AC PETERSBURG VA LT 5 BLK B CLS 02 23805 BROOKS PARK VIEW 43000 110700 153700 TAX 614.80 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 431300 1193200 1624500 FMV 6,498.00 52700 52700 DEF 210.80 378600 1193200 1571800 TAX 6,287.20 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,571,800 TAX 6,287.20 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 4 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ABRAMS VINCENT 360(03)00-00E-0 BLACKWATER 41600 41600FMV 166.40 00000023 11140 LAWYERS RD 5.00000 AC PRINCE GEORGE VA CLAUDE C DUNN CLS 02 23875 PARCEL E 41600 41600 TAX 166.40 ---------------------------------------------------------------------------------------------------------------------------------- ACE HARDWARE CORP 350(01)00-003-0 RIVES 2113200 24653800 26767000FMV 107,068.00 00000024 ATTN TAX DEPT 155.40000 AC 2200 KENSINGTON CT M P GERHART 112 136 CLS 04 OAK BROOK IL 60523 2113200 24653800 26767000 TAX 107,068.00 ---------------------------------------------------------------------------------------------------------------------------------- ACKERMAN FANNIE TUCKER 530(02)00-00C-1 TEMPLETON 60800 123800 184600FMV 738.40 00011908 831 20TH ST 5.00170 AC WASHINGTON DC TUCKER PROP TRACT C1 CLS 02 20002 60800 123800 184600 TAX 738.40 ---------------------------------------------------------------------------------------------------------------------------------- ACREE GENEVA C 250(0A)00-083-B BLACKWATER 66200 66200FMV 264.80 00000025 3941 GREEN PASTURES EAST 22.40000 AC BATTLEBORO NC LOT C CLS 05 27809 PT TRACY CHRISTIAN PR 66200 66200 TAX 264.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAINGER FAMILY TRUST VIII THE 12B(01)0N-006-0 BLAND 25000 82300 107300FMV 429.20 00000026 P O BOX 682 .72000 AC COLONIAL HEIGHTS VA LT 6 BLK N SEC 5B CLS 02 23834 STRATFORD WOODS 25000 82300 107300 TAX 429.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAIR ALAN L & RAMONA W 130(16)00-024-0 BLAND 71000 218900 289900FMV 1,159.60 00008322 7682 HUNTERS RIDGE DR 5.02000 AC PRINCE GEORGE VA LOT 24 CLS 02 23875 FOX HILL 71000 218900 289900 TAX 1,159.60 ---------------------------------------------------------------------------------------------------------------------------------- ADAIR MARK A & CANDACE M 380(0A)00-005-A BLACKWATER 71800 255500 327300FMV 1,309.20 00009807 14410 SHANNONS LN 11.70000 AC DISPUTANTA VA LOT 10 CLS 02 23842 PT MICHAEL SULLIVAN PR 71800 255500 327300 TAX 1,309.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS A W III 350(0A)00-032-0 BLACKWATER 292900 142500 435400FMV 1,741.60 00000027 7713 PRINCE GEORGE DR 54.61000 AC 229500 229500 DEF 918.00 PRINCE GEORGE VA BLACKWATER SWAMP CLS 05 23875 63400 142500 205900 TAX 823.60 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS BOBBI & WILLIE 130(03)00-003-T BLAND 63800 68100 131900FMV 527.60 00000028 5050 SALEM CT 2.08900 AC COLONIAL HEIGHTS VA LOT 3T CLS 02 23834 PT ERNEST A STORY PR 63800 68100 131900 TAX 527.60 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 2806300 25544900 28351200 FMV 113,404.80 229500 229500 DEF 918.00 2576800 25544900 28121700 TAX 112,486.80 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,082,600 26,767,000 272,100 TAX 4,330.40 107,068.00 1,088.40 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 5 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ADAMS CLARENCE A JR 24G(02)00-003-0 BLAND 54600 179100 233700FMV 934.80 00000029 3111 TINSLEY TER .33000 AC PRINCE GEORGE VA LOT 3 SEC 2 CLS 02 23875 TINSLEY CHARTER 54600 179100 233700 TAX 934.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS DAVID J & MARTHA W 45A(01)E1-022-0 TEMPLETON 42400 108900 151300FMV 605.20 00009808 12809 CHESTER DR .00000 AC DISPUTANTA VA LT 22 BLK E1 SEC 1 CLS 02 23842 PR GEO CTRY CLUB EST 42400 108900 151300 TAX 605.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS DENNIS P & ROSE MARIE 24F(09)0J-042-0 BLAND 39000 150600 189600FMV 758.40 00011909 4817 LACE WING LN .57000 AC PRINCE GEORGE VA LT 42 BLK J SEC 17 CLS 02 23875 BRANCHESTER LAKES 39000 150600 189600 TAX 758.40 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS DIANE R 510(0A)00-071-0 RIVES 98800 66000 164800FMV 659.20 00000030 1212 BRIARCLIFF DR 14.38000 AC COLONIAL HEIGHTS VA JOS THWEATT CLS 02 23834 98800 66000 164800 TAX 659.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS DONALD T & WILLIAM H CHAPMAN 610(0A)00-002-0 TEMPLETON 58400 58400FMV 233.60 00000031 19585 FULLERS MILL RD 36.75000 AC 45900 45900 DEF 183.60 BOYKINS VA WARWICK SWAMP CLS 05 23827 12500 12500 TAX 50.00 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS ERNEST & MELINDA 400(0A)00-004-A BRANDON 33200 64600 97800FMV 391.20 00012956 18401 LEBANON RD 1.00000 AC SPRING GROVE VA PT MILTON L WOODEN PROP CLS 02 23881 33200 64600 97800 TAX 391.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS EUGENE R & BERTHA S 500(0A)00-027-0 TEMPLETON 17500 17500FMV 70.00 00000032 27010 PERKINS RD 7.00000 AC 12800 12800 DEF 51.20 PETERSBURG VA NEAR DINWIDDIE LINE CLS 02 23805 4700 4700 TAX 18.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS EUGENE R & BERTHA S 570(0A)00-001-0 TEMPLETON 16300 16300FMV 65.20 00000033 27010 PERKINS RD 7.00000 AC 12200 12200 DEF 48.80 PETERSBURG VA NEAR DINWIDDIE LINE CLS 02 23805 4100 4100 TAX 16.40 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS GERALD D SR & LOIS F 270(12)00-021-0 BRANDON 61100 235800 296900FMV 1,187.60 00008958 15844 WOODCLIFF LN 5.49200 AC DISPUTANTA VA LOT 21 SEC 2 CLS 02 23842 GREENBRIAR 61100 235800 296900 TAX 1,187.60 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 421300 805000 1226300 FMV 4,905.20 70900 70900 DEF 283.60 350400 805000 1155400 TAX 4,621.60 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,142,900 12,500 TAX 4,571.60 50.00 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 6 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ADAMS HAZEL J 600(0A)00-032-A TEMPLETON 59300 59300FMV 237.20 00000034 12715 VINGS CREEK DR #814 11.36000 AC MATTHEWS NC LOT B CLS 02 28105-3211 PT EARL JACKSON ALS PROP 59300 59300 TAX 237.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS JAMES G & AUDREY D 440(0A)00-057-B RIVES 50200 152200 202400FMV 809.60 00009068 5505 RED GATE DR 4.20000 AC DISPUTANTA VA PT BRUCE O GREEN PROP CLS 02 23842 50200 152200 202400 TAX 809.60 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS JASON W & AMANDA N FULLER 12A(11)0D-005-0 BLAND 25000 77300 102300FMV 409.20 00011910 3517 WESTBROOK RD .00000 AC HOPEWELL VA LT 5 BLK D SEC 4 CLS 02 23860 STRATFORD WOODS 25000 77300 102300 TAX 409.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS JEFFREY G & KIMBERLY D 260(08)00-004-0 BLACKWATER 68700 163000 231700FMV 926.80 00000035 5800 BARBARA LN 7.14400 AC PRINCE GEORGE VA LOT 4 CLS 02 23875 ALLRYN ACRES 68700 163000 231700 TAX 926.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS JESSE L JR & IVORY C 43C(03)0B-008-0 RIVES 43000 103600 146600FMV 586.40 00000036 3312 BROOKS PARK DR .00000 AC PETERSBURG VA LT 8 BLK B CLS 02 23805 BROOKS PARK VIEW 43000 103600 146600 TAX 586.40 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS NITA M 570(0A)00-025-0 TEMPLETON 48500 144800 193300FMV 773.20 00000037 18610 INDIAN RD 2.62100 AC PETERSBURG VA NEAR OLD CARSON CLS 02 23805 48500 144800 193300 TAX 773.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS RICHARD D 440(06)00-012-0 RIVES 57900 180800 238700FMV 954.80 00009102 5900 LARCHWOOD DR 5.32000 AC DISPUTANTA VA L H M CO PROP CLS 02 23842 57900 180800 238700 TAX 954.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS RICHARD E & AMY G 23B(01)00-033-A BLAND 51500 151200 202700FMV 810.80 00008323 6611 BULL HILL RD 1.36700 AC PRINCE GEORGE VA SCOTT PROP PARCEL 1 CLS 02 23875 51500 151200 202700 TAX 810.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS RICHARD E & AMY G 23B(01)00-033-B BLAND 32400 32400FMV 129.60 00000038 6611 BULL HILL RD 1.00600 AC PRINCE GEORGE VA SCOTT PROP PARCEL 2 CLS 02 23875 32400 32400 TAX 129.60 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 436500 972900 1409400 FMV 5,637.60 DEF 436500 972900 1409400 TAX 5,637.60 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,409,400 TAX 5,637.60 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 7 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ADAMS RICHARD E & AMY G 23B(01)00-033-C BLAND 29200 29200FMV 116.80 00000039 6611 BULL HILL RD 1.00500 AC PRINCE GEORGE VA SCOTT PROP PARCEL 3 CLS 02 23875 29200 29200 TAX 116.80 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS ROBERT L & REBECCA 140(0A)00-078-0 BLAND 25600 31700 57300FMV 229.20 00000040 10021 SANDY RIDGE RD .38100 AC HOPEWELL VA JONES LODGE CLS 02 23860 25600 31700 57300 TAX 229.20 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS SHERRI M 22A(01)0E-018-0 RIVES 43000 84100 127100FMV 508.40 00009809 2928 LAKESIDE DR .00000 AC PRINCE GEORGE VA LT 18 BLK E SEC 1 CLS 02 23875 COMMONWEALTH ACRES 43000 84100 127100 TAX 508.40 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS THOMAS C 380(0A)00-051-0 BRANDON 227800 227800FMV 911.20 00000041 15200 POLE RUN RD 105.12000 AC 176800 176800 DEF 707.20 DISPUTANTA VA POLE RUN RD CLS 06 23842 51000 51000 TAX 204.00 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS THOMAS C 380(0A)00-051-A BRANDON 53600 61900 115500FMV 462.00 00000042 15200 POLE RUN ROAD 5.01000 AC DISPUTANTA VA PT THOMAS ADAMS PR CLS 02 23842 53600 61900 115500 TAX 462.00 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS WALTER A & PHOEBE D 13H(02)0C-051-0 BLAND 32000 32000FMV 128.00 00000043 316 LYNCHBURG AVE .00000 AC COLONIAL HEIGHTS VA LOT 51 BLK C SEC 3 CLS 02 23834 BRANCHESTER LAKES 32000 32000 TAX 128.00 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS WILLIAM M JR 270(0A)00-022-0 BRANDON 106400 106400FMV 425.60 00000044 4030 MONZA DR 54.39000 AC 79300 79300 DEF 317.20 RICHMOND VA POWELLS CREEK CLS 05 23234 27100 27100 TAX 108.40 ---------------------------------------------------------------------------------------------------------------------------------- ADAMS WILLIAM MILTON JR & BARBARA 270(0A)00-022-A BRANDON 38900 153400 192300FMV 769.20 00000045 4030 MONZA DR 1.61000 AC RICHMOND VA PT WILLIAM M ADAMS P CLS 02 23234 38900 153400 192300 TAX 769.20 ---------------------------------------------------------------------------------------------------------------------------------- ADATO BEVERLEY Z 32A(02)00-023-A RIVES 44000 154300 198300FMV 793.20 00000046 1120 FT HAYES DR .00000 AC PETERSBURG VA LOT 23 UNIT 23A CLS 02 23805 FORT HAYES 44000 154300 198300 TAX 793.20 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 600500 485400 1085900 FMV 4,343.60 256100 256100 DEF 1,024.40 344400 485400 829800 TAX 3,319.20 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 751,700 27,100 51,000 TAX 3,006.80 108.40 204.00 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 8 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ADENAUER BARRY J 23E(01)00-00A-0 BLAND 95400 95400FMV 381.60 00000047 14100 JEFFERSON DAVIS HWY 1.58700 AC CHESTER VA ROLLING MEADOW RES CLS 04 23831 95400 95400 TAX 381.60 ---------------------------------------------------------------------------------------------------------------------------------- ADENAUER BARRY J 580(0A)00-005-0 TEMPLETON 330900 4200 335100FMV 1,340.40 00000048 14100 JEFFERSON DAVIS HWY 27.24000 AC CHESTER VA HEATHES PLACE CLS 04 23831 330900 4200 335100 TAX 1,340.40 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS ANN M 12A(02)06-030-0 BLAND 25000 90000 115000FMV 460.00 00008324 3708 HAMILTON AVE .00000 AC HOPEWELL VA LTS 30 31 BLK 6 CLS 02 23860 JEFFERSON PARK 25000 90000 115000 TAX 460.00 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS EDNA EARL 340(0A)00-005-0 RIVES 94600 181600 276200FMV 1,104.80 00000049 4400 COURTHOUSE RD 6.30400 AC PRINCE GEORGE VA BLACKWATER SWAMP CLS 02 23875 94600 181600 276200 TAX 1,104.80 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES E & KAREN L 350(0A)00-003-E RIVES 93400 348500 441900FMV 1,767.60 00000050 6800 W QUAKER RD 12.66000 AC DISPUTANTA VA LOT 2 CLS 02 23842 BLACKWATER SWAMP 93400 348500 441900 TAX 1,767.60 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES E & KAREN L 350(0A)00-003-F RIVES 80000 80000FMV 320.00 00000051 6800 W QUAKER RD 12.73000 AC DISPUTANTA VA PT JAMES ADKINS PROP CLS 02 23842 80000 80000 TAX 320.00 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES E BUILDER INC 23B(01)00-002-B BLAND 18300 18300FMV 73.20 00000053 6800 W QUAKER RD .41000 AC DISPUTANTA VA LOT 2B2 CLS 02 23842 SCOTT PROPERTY 18300 18300 TAX 73.20 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES E BUILDER INC 23B(01)00-002-C BLAND 21000 21000FMV 84.00 00000054 6800 W QUAKER RD .51000 AC DISPUTANTA VA LOT 2B3 CLS 02 23842 SCOTT PROPERTY 21000 21000 TAX 84.00 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES E BUILDER INC 270(12)00-036-0 BRANDON 48300 48300FMV 193.20 00000052 6800 W QUAKER RD 5.19700 AC DISPUTANTA VA LOT 36 SEC 2 CLS 02 23842 GREENBRIAR 48300 48300 TAX 193.20 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 806900 624300 1431200 FMV 5,724.80 DEF 806900 624300 1431200 TAX 5,724.80 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,000,700 430,500 TAX 4,002.80 1,722.00 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 9 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES M 230(0A)00-074-A RIVES 19600 19600FMV 78.40 00000055 4400 COURTHOUSE RD 49.55000 AC PRINCE GEORGE VA PT ROPER-DOHNALLEK (112- CLS 05 23875 19600 19600 TAX 78.40 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JAMES M 230(0A)00-074-B RIVES 8200 8200FMV 32.80 00000056 4400 COURTHOUSE RD 12.76100 AC PRINCE GEORGE VA PT FIRST COLONIAL FINANC CLS 02 23875 8200 8200 TAX 32.80 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS JENNIFER S 24F(02)0C-075-0 BLAND 39000 113100 152100FMV 608.40 00009810 7376 TRAILING ROCK RD .00000 AC PRINCE GEORGE VA LOT 75 BLK C SEC 1A CLS 02 23875 BRANCHESTER LAKES 39000 113100 152100 TAX 608.40 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS LORI M 140(01)00-004-C BLAND 52500 156800 209300FMV 837.20 00012957 3614 RUFFIN RD 3.22400 AC HOPEWELL VA TRACT 4 CLS 02 23860 SANDY RIDGE 52500 156800 209300 TAX 837.20 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS NANNIE & TIMOTHY (LIFE EST) 540(0A)00-045-0 TEMPLETON 25900 65300 91200FMV 364.80 00000057 14525 ARWOOD RD 1.54000 AC DISPUTANTA VA NEAR DISPUTANTA CLS 02 23842 25900 65300 91200 TAX 364.80 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS RICKY D & JEANNE H EASTWOOD 500(09)00-006-0 RIVES 77900 266200 344100FMV 1,376.40 00000058 C/O EASTWOOD JEANNE H 8.38000 AC 1101 DRAYTON CT LT 6 CLS 02 PETERSBURG VA 23805 WEDGEWOOD FARMS 77900 266200 344100 TAX 1,376.40 ---------------------------------------------------------------------------------------------------------------------------------- ADKINS VIRGIL J & JEAN C 530(13)00-001-0 TEMPLETON 62300 238800 301100FMV 1,204.40 00008325 15700 GRAHAM LN 5.05500 AC DISPUTANTA VA LOT 1 CLS 02 23842 WARWICK ACRES NORTH 62300 238800 301100 TAX 1,204.40 ---------------------------------------------------------------------------------------------------------------------------------- ADKT LLC 240(0A)00-069-A BLAND 77100 151600 228700FMV 914.80 00000061 P O BOX 3870 1.10400 AC CHESTER VA BLANDS SWAMP CLS 04 23831 77100 151600 228700 TAX 914.80 ---------------------------------------------------------------------------------------------------------------------------------- ADKT LLC 240(0A)00-069-G BLAND 78700 259000 337700FMV 1,350.80 00000062 P O BOX 3870 1.35050 AC CHESTER VA PT AL FORBES PROP CLS 04 23831 78700 259000 337700 TAX 1,350.80 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 441200 1250800 1692000 FMV 6,768.00 DEF 441200 1250800 1692000 TAX 6,768.00 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,106,000 566,400 19,600 TAX 4,424.00 2,265.60 78.40 ---------------------------------------------------------------------------------------------------------------------------------- VALUE OF TRACTS OF LAND, LOTS NOT IN INCORPORATED TOWNS, STANDING TIMBER TREES, BUILDINGS TAX RATE ON EVERY $100 = .40 AND IMPROVEMENTS AND COUNTY AND DISTRICT LEVIES ASSESSED THEREON FOR THE TAX YEAR 2013 PAGE 10 IN THE COUNTY OF PRINCE GEORGE, ALL DISTRICTS, BY DARLENE M ROWSEY, COMMISSIONER OF REVENUE ---------------------------------------------------------------------------------------------------------------------------------- LAND BUILDING TOTAL TOTAL NAME AND ADDRESS DESCRIPTION VALUE VALUE VALUE TAX BILL NO _ COMMENTS ---------------------------------------------------------------------------------------------------------------------------------- ADKT LLC 240(0A)00-069-K BLAND 8900 8900FMV 35.60 00000063 P O BOX 3870 .18500 AC CHESTER VA PT AL FORBES PROP CLS 04 23831 8900 8900 TAX 35.60 ---------------------------------------------------------------------------------------------------------------------------------- ADKT LLC 240(0A)00-069-L BLAND 73500 284900 358400FMV 1,433.60 00000059 P O BOX 3870 .98100 AC CHESTER VA PT ALFRED FORBES PROP CLS 04 23831 73500 284900 358400 TAX 1,433.60 ---------------------------------------------------------------------------------------------------------------------------------- ADKT LLC 240(0A)00-069-M BLAND 69100 69100FMV 276.40 00000060 P O BOX 3870 1.77200 AC CHESTER VA LOT 3 CLS 04 23831 PT ALFRED FORBES PR 69100 69100 TAX 276.40 ---------------------------------------------------------------------------------------------------------------------------------- AGEE THOMAS W & TRACEY A 12C(01)0A-043-0 BLAND 50700 223500 274200FMV 1,096.80 00009103 5805 JAY BIRD CT 3.48000 AC PRINCE GEORGE VA LOT 43 BLK A SEC 1 CLS 02 23875 CEDAR CREEK 50700 223500 274200 TAX 1,096.80 ---------------------------------------------------------------------------------------------------------------------------------- AGNOR HENRY H & SHARON R 380(05)00-004-0 BRANDON 43300 122400 165700FMV 662.80 00000064 7833 HINES RD 2.01200 AC DISPUTANTA VA LOT 4 CLS 02 23842 BRANDON ACRES 43300 122400 165700 TAX 662.80 ---------------------------------------------------------------------------------------------------------------------------------- AGUILAR LUIS A & GLADIS S 23G(02)00-028-0 RIVES 51000 145200 196200FMV 784.80 00008326 4704 BARREL POINT RD .27000 AC PRINCE GEORGE VA LOT 28 SEC 2 CLS 02 23875 BAXTER RIDGE 51000 145200 196200 TAX 784.80 ---------------------------------------------------------------------------------------------------------------------------------- AHERN DOROTHY K 24G(01)00-020-0 BLAND 41000 131000 172000FMV 688.00 00000065 1633 TINSLEY BLVD .13000 AC PRINCE GEORGE VA LOT 20 SEC 1 CLS 02 23875 TINSLEY CHARTER 41000 131000 172000 TAX 688.00 ---------------------------------------------------------------------------------------------------------------------------------- AIRD JOHN A & POLINA N YORDANOVA 12B(06)0W-002-0 BLAND 25000 74400 99400FMV 397.60 00000066 4106 ROBERT E LEE DR .00000 AC HOPEWELL VA LT 2 BLK W SEC 6B CLS 02 23860 STRATFORD WOODS 25000 74400 99400 TAX 397.60 ---------------------------------------------------------------------------------------------------------------------------------- AIRD THOMAS D & ANNIE M 13F(02)00-028-0 BLAND 34600 144700 179300FMV 717.20 00000067 4429 MARTINSON LN 1.59500 AC PRINCE GEORGE VA LT 28 CLS 02 23875 MANCHESTER MILL 34600 144700 179300 TAX 717.20 ---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- 397100 1126100 1523200 FMV 6,092.80 DEF 397100 1126100 1523200 TAX 6,092.80 ---------------------------------------------------------------------------------------------------------------------------------- CLASS-1 CLASS-2 CLASS-3 CLASS-4 CLASS-5 CLASS-6 VALUE 1,086,800 436,400 TAX 4,347.20 1,745.60 ----------------------------------------------------------------------------------------------------------------------------------

Description: