08-450 - Lynch, et al. v. State of Alabama, The, et al. [PDF 3329 KB] PDF

Preview 08-450 - Lynch, et al. v. State of Alabama, The, et al. [PDF 3329 KB]

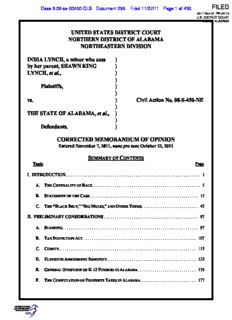

FILED Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 1 of 450 2011 Nov-07 PM 04:10 U.S. DISTRICT COURT N.D. OF ALABAMA UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ALABAMA NORTHEASTERN DIVISION INDIA LYNCH, a minor who sues ) by her parent, SHAWN KING ) LYNCH, et al., ) ) Plaintiffs, ) ) vs. ) Civil Action No. 08-S-450-NE ) THE STATE OF ALABAMA, et al., ) ) Defendants. ) CORRECTED MEMORANDUM OF OPINION Entered November 7, 2011, nunc pro tunc October 21, 2011 SUMMARY OF CONTENTS Topic Page I. INTRODUCTION................................................................. 1 A. THE CENTRALITY OF RACE.................................................... 5 B. STATEMENT OF THE CASE. ................................................... 15 C. THE “BLACK BELT,” “BIG MULES,” AND OTHER TERMS. .......................... 45 II. PRELIMINARY CONSIDERATIONS . ............................................ 97 A. STANDING. ................................................................ 97 B. TAX INJUNCTION ACT. ..................................................... 107 C. COMITY.................................................................. 115 D. ELEVENTH AMENDMENT IMMUNITY........................................... 123 E. GENERAL OVERVIEW OF K-12 FUNDING IN ALABAMA. ........................... 139 F. THE COMPUTATION OF PROPERTY TAXES IN ALABAMA........................... 177 Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 2 of 450 G. SUMMARY OF PREDECESSOR LITIGATION. ..................................... 203 H. CONTROLLING PRINCIPLES OF LAW........................................... 397 III. FINDINGS OF FACT. ......................................................... 453 A. FINDINGS OF HISTORICAL FACT. ............................................. 453 B. FINDINGS OF FACT RELEVANT TO AN ASSESSMENT OF DISPARATE IMPACT ON THE BASIS OF RACE...................................................... 689 IV. CONCLUSIONS OF LAW. ..................................................... 757 A. DISCRIMINATORY INTENT. .................................................. 757 B. DISPARATE IMPACT ON THE BASIS OF RACE..................................... 777 C. RATIONAL BASIS REVIEW. .................................................. 787 D. TITLE VI OF THE CIVIL RIGHTS ACT OF 1964. .................................. 793 V. CONCLUSIONS. .............................................................. 795 VI. APPENDICES................................................................. 805 ACKNOWLEDGMENTS (Page 843) ILLUSTRATIONS Alabama Counties (Showing Dates of Creation)........................................... xxx Traditional Counties of the Alabama Black Belt. ........................................ 44 Georgia in 1825 (Depicting the Confluence of the Broad and Savannah Rivers). ................. 56 Plan of the Town of Petersburg, Georgia (in the Fork of the Broad and Savannah Rivers)......... 60 Route of the Federal Road Through the Alabama Territory. .............................. 66 Map of Alabama’s Public School Systems.............................................. 138 ii Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 3 of 450 EXPANDED TABLE OF CONTENTS I. INTRODUCTION A. The Centrality of Race. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 1. The Slave Experience. ....................................................... 6 2. The Post-Emancipation Experience. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 B. Statement of the Case. ....................................................... 15 1. The Plaintiffs and Their Contentions. ......................................... 15 a. The state constitutional provisions challenged by plaintiffs.................... 18 i. Article XI, Section 214 — limiting the State tax rate....................... 19 ii. Article XI, Section 215 — limiting county tax rates........................ 20 iii. Article XI, Section 216 — limiting municipal tax rates. .................... 21 iv. Article XI, Section 217, as twice amended. .............................. 21 (A) Amendment 325, ratified in 1972. ................................. 22 (B) Amendment 373, ratified in 1978. ................................. 23 v. Article XIV, Section 269, as amended. ................................. 31 b. The injuries alleged by plaintiffs.......................................... 32 c. The relief sought by plaintiffs. ........................................... 41 2. The Defendants and Their Contentions. ....................................... 41 C. The “Black Belt,” “Big Mules,” and Other Terms. ............................ 45 1. The Defining Characteristics of the “Black Belt”. ............................... 47 a. The geology of the Black Belt............................................. 47 b. The social history of the Black Belt........................................ 48 i. The origins of those persons who settled the region, and their society, education, and wealth................................ 50 iii Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 4 of 450 ii. From the Virginia Piedmont to the Broad River Valley of Georgia................................................... 57 (A) The Virginians of the Broad River Valley. ......................... 58 (B) The Pope, Watkins, Thompson, Bibb, and Walker families of Petersburg, Georgia, and Huntsville, Madison County, Alabama....... 61 iii. From the Broad River Valley to the “Great Bend of the Tennessee River” in the Alabama Territory............................. 65 iv. The Federal Road. ................................................. 65 v. The War of 1812, the Battle of Horseshoe Bend, and the Opening of East-Central Alabama. ............................................. 67 vi. From the Broad River Valley of Georgia to the Alabama Black Belt ........ 68 vii. “The Georgia Machine”. ............................................ 72 c. The demographic make-up of the Black Belt................................ 75 d. The enduring political influence of the Black Belt............................ 78 2. “Big Mules”. .............................................................. 82 3. “Carpetbaggers”. .......................................................... 86 4. “Scalawags”. .............................................................. 87 5. “Radical Republicans”. ..................................................... 88 6. “Conservative Democrats” and “Bourbons”..................................... 89 7. “Black Codes”. ............................................................ 91 8. “Redeemers”............................................................... 91 9. “Jim Crow laws”. .......................................................... 93 II. PRELIMINARY CONSIDERATIONS A. Standing. .................................................................... 97 B. Tax Injunction Act.......................................................... 107 C. Comity...................................................................... 115 iv Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 5 of 450 D. Eleventh Amendment Immunity............................................. 123 E. General Overview of K-12 Funding in Alabama. ............................. 139 1. Federal Funding Sources. .................................................. 139 a. Elementary and Secondary Education Act of 1965. ......................... 140 b. Individuals with Disabilities Education Act of 1975. ........................ 142 2. State Funding Sources...................................................... 143 a. The Education Trust Fund.............................................. 144 i. Current sources of revenue. ........................................ 146 b. The Public School Fund. ............................................... 147 c. Special trust funds..................................................... 151 d. The Foundation Program............................................... 153 3. Local Funding Sources. .................................................... 159 a. 1.0 mill county tax — Section 269......................................... 161 b. 3.0 mill county tax — Section 269.01. ..................................... 162 c. 3.0 mill school district tax — Section 269.02................................ 164 d. 5.0 mill special county tax — Section 269.04................................ 165 e. 3.0 mill school district tax — Section 269.05................................ 166 f. Municipal levies....................................................... 166 4. Exceeding Generally Authorized Millage Rates................................. 167 a. General constitutional amendment with statewide application. ............... 168 b. So-called “general constitutional amendments with local application”. ......... 169 c. Local constitutional amendment — Amendments 425 & 555................... 170 d. Increasing the millage rate of an existing tax............................... 172 v Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 6 of 450 F. The Computation of Property Taxes in Alabama............................. 177 1. First Step — Identifying the property subject to taxation........................... 179 2. Second Step — Appraisal.................................................... 180 a. The usual methods of determining fair market value........................ 182 b. The “current use” method of valuation.................................... 183 i. Residential property and historic buildings and sites.................... 185 ii. Agricultural and timber properties................................... 186 (A) Agricultural land.............................................. 187 (B) Timber property. ............................................. 189 (C) 2008 current use standard values for agricultural and timber properties.......................................... 191 3. Third Step — Determining the assessed value. .................................. 192 4. Fourth Step — Deduction of exemptions........................................ 193 5. Fifth Step — Applying the tax millage rate...................................... 195 a. Computation of the State ad valorem tax on Class III agricultural and timber properties.................................................. 196 6. The “Lid Bill’s” Impact Upon the Aggregate Amount of Ad Valorem Property Taxes Owed the State, Counties, Municipalities, and School Districts. ............. 198 G. Summary of Predecessor Litigation........................................... 203 1. Brown v. Board of Education and its Progeny................................... 204 a. Plessy v. Ferguson. .................................................... 204 b. Brown v. Board of Education............................................. 211 c. Overcoming the South’s campaign of “massive resistance”. .................. 217 d. Milliken v. Bradley and the issue of interdistrict desegregation remedies. ............................................................ 225 2. School Finance Litigation................................................... 231 vi Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 7 of 450 a. Serrano v. Priest....................................................... 233 b. San Antonio Independent School District v. Rodriguez........................ 235 i. The underlying facts............................................... 235 ii. Socioeconomic status as a “suspect classification”....................... 242 iii. Public education as a “fundamental right”............................. 244 iv. “Rational basis review” of the Texas system. .......................... 247 c. The Alabama Equity Funding litigation................................... 250 3. The Weissinger Line of Cases................................................ 259 a. The requirement of uniformity and equality. .............................. 260 b. The requirement of uniform assessment ratios. ............................ 262 c. State v. Alabama Power Co. — Ala. Sup. Ct. (Oct. 19, 1950).................... 266 d. The interregnum — 1950-1959. ......................................... 270 e. The Haden Regulation — 1959. ......................................... 271 f. Louisville and Nashville Railroad Co. v. State — Montgomery County, Ala. Circuit Court (Apr. 5, 1967). .................................. 281 g. Hornbeak v. Hamm — M.D. Ala. Civil Action No. 2608-N..................... 282 h. Hornbeak v. Rabren — M.D. Ala. Civil Action No. 2877-N. ................... 291 i. M.D. Ala. Civil Action No. 2877-N redux — the evolution of Hornbeak v. Rabren into Weissinger v. Boswell (June 29, 1971). ................ 296 j. Amendment 325: the initial Legislative response to the Weissinger mandate. .............................................. 300 k. McCarthy v. Jones — S.D. Ala. Civil Action No. 77-242-H and the second invalidation of variable assessment ratios........................... 302 l. Thorn v. Jefferson County — Ala. Sup. Ct. (Sept. 28, 1979) .................... 307 m. Amendment 373 — the second Legislative attempt to deflect the substantial increases in ad valorem taxes portended by the Weissinger mandate. ................................................... 308 vii Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 8 of 450 n. Weissinger v. Eagerton — M.D. Ala. Civil Action No. 2877-N continued (March 26, 1979)....................................................... 310 o. Weissinger v. White — M.D. Ala. Civil Action No.2877-N continued (October 5, 1983). ..................................................... 315 p. Weissinger v. White — Eleventh Circuit appeal (June 1, 1984). ................. 322 q. Summary of the Weissinger line of cases and plaintiffs’ claims................ 325 4. The Knight Line of Cases. .................................................. 331 a. The original, Middle District action. ..................................... 331 b. The Northern District action. ........................................... 333 c. Merger of the Middle and Northern District actions......................... 335 d. Motions to disqualify Judge U.W. Clemon................................. 336 e. The first trial — conducted by Judge Clemon................................ 337 f. Eleventh Circuit reversal and disqualification of Judge Clemon......................................................... 338 g. Reassignment of Northern District action to Judge Harold Murphy....................................................... 338 h. Designation of the Knight Class as lead plaintiffs. .......................... 339 i. The second trial — but the first conducted by Judge Murphy. .................. 340 j. Judge Murphy’s first opinion — “Knight I”. ............................... 340 i. Relevant findings of fact............................................ 341 k. The Supreme Court’s intervening opinion in Fordice........................ 364 l. Eleventh Circuit reversal and remand of Judge Murphy’s first opinion — “Knight I-A”............................................. 371 m. Proceedings on remand and Judge Murphy’s second opinion — “Knight II”. ................................................. 372 n. Third and final opinion by Judge Murphy, addressing plaintiffs’ “motion for additional relief” — “Knight III”............................... 374 viii Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 9 of 450 o. Eleventh Circuit affirmance — “Knight III-A”.............................. 379 H. Controlling Principles of Law................................................ 397 1. Express Racial Classifications. .............................................. 399 2. Facially Neutral Racial Classifications. ....................................... 401 a. “Ordinary equal protection standards”. .................................. 406 i. Disproportionate effects along racial lines............................. 412 ii. Racially-discriminatory purpose..................................... 417 iii. Causation........................................................ 425 iv. The defendant’s burden under Mt. Healthy. ........................... 428 3. The alleged impact of San Antonio Independent School District v. Rodriguez upon the analysis. ......................................................... 432 4. The alleged impact of Personnel Administrator of Massachusetts v. Feeney upon the analysis. ......................................................... 434 5. The alleged impact of United States v. Fordice upon the analysis................... 445 III. FINDINGS OF FACT A. Findings of Historical Fact................................................... 453 1. Antebellum Alabama....................................................... 458 a. The Alabama Constitution of 1819. ...................................... 458 b. The rapid accumulation of wealth in the “Black Belt”. ...................... 461 c. Taxation in Antebellum Alabama. ....................................... 466 d. Education Funding. ................................................... 470 i. “Sixteenth Section Lands”. ......................................... 470 ii. Public Schools Act of 1854. ......................................... 475 2. Secession and the 1861 Constitution. ......................................... 478 ix Case 5:08-cv-00450-CLS Document 296 Filed 11/07/11 Page 10 of 450 a. The politics of secession. ............................................... 478 b. Secession and Alabama’s 1861 Constitution................................ 481 3. The End of the Civil War and “Presidential” Reconstruction. .................... 482 4. Congressional, or “Radical,” Reconstruction................................... 488 a. The movement toward the 1868 Constitution............................... 492 b. The 1868 “Radical Reconstruction” Constitution. .......................... 496 i. The State Board of Education. ...................................... 500 ii. Increased taxation for public schools. ................................ 501 c. The ratification campaign. ............................................. 503 d. Alabama under the 1868 “Radical Reconstruction” Constitution. ............. 508 i. Public schools and taxation. ........................................ 509 ii. White hostility to education of the former slaves and the taxation that supported it........................................... 511 5. “Redemption”............................................................. 515 6. The 1875 “Redeemer” Constitution........................................... 519 7. Democratic Rule Under the 1875 Constitution — 1875-1901...................... 534 a. Extra-legal means of subverting black rights............................... 534 b. The “convict leasing system”. ........................................... 540 c. Education............................................................ 542 i. White motives to subvert black education. ............................ 542 ii. Diversion of funding for black schools to white schools. ................. 545 iii. Failed attempts to improve public education........................... 550 d. Division within the Democratic Party and the movement for a new constitution. .................................................... 554 i. Class differences resurface.......................................... 563 x

Description: