WC024 Stellenbosch AFS 2009-10 audited PDF

Preview WC024 Stellenbosch AFS 2009-10 audited

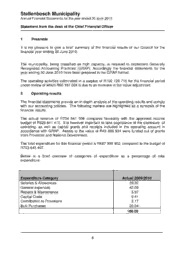

Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 General Information Mayoral committee Executive Mayor C Jooste J van der Poel (Speaker) P Biscombe L De Villiers M Linders J Serdyn K Shubani P Winsnes Councillors E Williams J Anthony D Botha A Crombie F Christiaans L Conradie M Doro V Fernandez A Fortuin A Frazenburg J Gagiano J Giliomee S Gordon S Jooste C Langeveldt L Maree C Mcako A Mgijima J Morgan S Mxesibe M Ngofe M Oliphant W Ortell G Pojie L Siwakamisa M Smith J Van Zyl Grading of local authority Councillors Grade 4 Personnel Grade 10 Accounting Officer MP du Plessis (Acting) Tel: (021) 808 8025 Fax: (021) 808 8200 Chief Finance Officer (CFO) MAC Bolton Tel: (021) 808 8528 Fax: (021) 808 8574 1 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 General Information Registered office Plein Street Stellenbosch 7600 Business address Plein Street Stellenbosch 7600 Postal address P O Box 17 Stellenbosch 7599 Bankers ABSA Bank Auditors Auditor General 2 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 Index The reports and statements set out below comprise the annual financial statements presented to the Auditor General: Index Page Accounting Officer's Responsibilities and Approval 5 Statement from the desk of the Chief Financial Officer 6 - 10 Statement of Financial Position 11 Statement of Financial Performance 12 Statement of Changes in Net Assets 13 Cash flow statement 14 Accounting Policies 15 - 35 Notes to the Annual Financial Statements 36 - 85 Appendixes: Appendix A: Schedule of External loans 86 Appendix B: Analysis of Property, Plant and Equipment 89 Appendix C: Segmental analysis of Property, Plant and Equipment 94 Appendix D: Segmental Statement of Financial Performance 97 Appendix E(1): Actual versus Budget (Revenue and Expenditure) 102 Appendix E(2): Actual versus Budget (Acquisition of Property, Plant and 104 Equipment) Appendix F: Disclosure of Grants and Subsidies in terms of the Municipal 107 Finance Management Act Appendix G: Supply Chain Management Deviations 109 Abbreviations COID Compensation for Occupational Injuries and Diseases CRR Capital Replacement Reserve DBSA Development Bank of South Africa SA GAAP South African Statements of Generally Accepted Accounting Practice GRAP Generally Recognised Accounting Practice GAMAP Generally Accepted Municipal Accounting Practice HDF Housing Development Fund IAS International Accounting Standards 3 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 Index IMFO Institute of Municipal Finance Officers IPSAS International Public Sector Accounting Standards ME's Municipal Entities MEC Member of the Executive Council MFMA Municipal Finance Management Act MIG Municipal Infrastructure Grant (Previously CMIP) 4 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 Statement from the desk of the Chief Financial Officer 1 Preamble It is my pleasure to give a brief summary of the financial results of our Council for the financial year ending 30 June 2010. The municipality, being classified as high capacity, is required to implement Generally Recognised Accounting Practices (GRAP). Accordingly the financial statements for the year ending 30 June 2010 have been prepared in the GRAP format. The operating activities culminated in a surplus of R106 729 715 for the financial period under review of which R60 197 024 is due to an increase in fair value adjustment. 2 Operating results The financial statements provide an in-depth analysis of the operating results and comply with our accounting policies. The following matters are highlighted as a synopsis of the financial results. The actual revenue of R734 641 908 compares favorably with the approved income budget of R626 841 410. It is however important to take cognizance of the disclosure of operating, as well as capital grants and receipts included in the operating account in accordance with GRAP. Assets to the value of R40 886 934 were funded out of grants from Provincial and National Government. The total expenditure for this financial period is R687 995 902, compared to the budget of R703 645 407. Below is a brief overview of categories of expenditure as a percentage of total expenditure. Expenditure Category Actual 2009/2010 Salaries & Allowances 29.32 General expenses 42.09 Repairs & Maintenance 5.97 Capital Costs 0.41 Contribution to Provisions 2.17 Bulk Purchases 20.04 100.00 6 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 Statement from the desk of the Chief Financial Officer 3 CAPITAL EXPENDITURE Budget Actual Percentage Percentage 2009/2010 2008/2009 Capital 223,303,417 147,932,661 66.25% 84.00% 4 INDICATORS AND RATIOS The following ratios are used as a guide to analyse year on year performance over the previous MTREF: Current assets (i) Current Ratio = Current liabilitie s Restated Restated 30/06/2008 30/06/2009 30/06/2010 302,079,888 300,726,816 336,199,280 146,098,540 173,184,281 156,401,049 2.1:1 1.7:1 2:1 The generally accepted norm in this regard is a ratio of 2:1. The ratio for 2009/2010 is still within acceptable norms. Total operating revenue received - operating grants (ii) Debt coverage = Debt service payments (I & R) due within fin year Restated Restated 30/06/2008 30/06/2009 30/06/2010 493,668,106 -19,801,656 574,721,502 - 25,825,067 734,641,908 –43,717,764 6,428,702 4,301,471 2,985,917 74 : 1 128 :1 231 : 1 As the generally accepted norm for this ratio is unknown, the only measurement is year on year comparisons which shows a positive trend. 7 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 Statement from the desk of the Chief Financial Officer Outstanding service debtors (iii) Outstanding service debtors to revenue = Actual revenue received for services Restated Restated 30/06/2008 30/06/2009 30/06/2010 44,730,989 56,284,452 78,819,638 445,135,892 524,439,114 650,037,210 0.10 : 1 0.11 : 1 0.12 : 1 As the generally accepted norm for this ratio is unknown, the only measurement is year on year comparisons of which the result is indicative of Council debt not growing out of proportion to actual revenue. Management is continuously improving credit control processes with a view of exhausting all internal remedies as allowed for the Credit Control and Debt Collection Policy before handing over recoverable debt to Council’s external service providers. Long term liabilitie s (iv) Long-term debt/income = Total income Restated Restated 30/06/2008 30/06/2009 30/06/2010 27,506,716 25,606,816 35,480,824 493,668,106 574,721,502 734,641,908 5.57% 4.46% 4.83% As the generally accepted norm in this regard is 35%, the ratio of Stellenbosch Municipality is very good. Gross Debtors (v) Debtors/Income = Total income Restated Restated 30/06/2008 30/06/2009 30/06/2010 92,709,146.00 122,480,912 112,817,363 493,668,106 574,721,502 734,641,908 18. 78% 21.31% 15.36% The generally accepted norm in this regard is a ratio of 16.7%. 8 Stellenbosch Municipality Annual Financial Statements for the year ended 30 June 2010 Statement from the desk of the Chief Financial Officer Gross debtors - working capital reserve (vi) Net Debtors/income = Total income Restated Restated 30/06/2008 30/06/2009 30/06/2010 92,709,146-22,654,217 122,480,912-41,722,513 112,817,363 – 34,455,674 493,668,106 574,721,502 734,641,908 14.19% 14.54 % 10.67 % The generally accepted norm in this regard is 12.5%. Interest and redemption (vii) Debt servicing cost to total expenditure = Total expenditure Restated Restated 30/06/2008 30/06/2009 30/06/2010 3,214,351 3,218,116 2,824,714 467,893,606 551,088,542 687,995,902 0.69% 0.58% 0.41% The generally accepted norm in this regard is 15.0%. The ability to fund our capital programmes from own sources, and not external finance, is the main reason that Stellenbosch Municipality is exemplary in the performance of this ratio. 5 CLASSIFICATION OF SERVICES The various services rendered by Council are arranged per function (directorate) or purpose of expenditure in the various statements and appendixes of the financial statements, in order to comply with the GAMAP/GRAP format of financial year-end reporting. 9