Trusts & Estates 1992: Vol 131 Index PDF

Preview Trusts & Estates 1992: Vol 131 Index

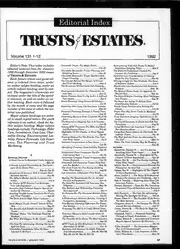

|D re bune) meet mbea lel=>. TRUSTS; ESTATES. Volume 131 1-12 Editor’s Note: This index includes Charitable Trusts: The Magic Builet.... Restructuring Wills And Trusts To Reduce editorial material from the January Feb 45 Generation-Skipping Taxe8.........00. s+ Mer 8 1992 through December 1992 issues Charitable Remainder Trusts: Planning And The Rules Of Professional Conduct For Designing Issues Lawyers Are Confusing of TRusTs & ESTATES. Charitable Remainder Trusts: Realities And Securities Law Considerations In Valuing Each feature article and guest col- Proper Planning Stock For Tax Purposes umn is indexed three ways: under The Concept Behind The Merger Of Private Shining A Light On New Products: The Annu- And Trust Banking al Software Update an author subject heading, under an Should Attorneys Recommend Life Insurance article subject heading, and by sub- ject. The magazine’s columnists are The Spousal Estate Swap: An Approach To Acid Test Bracket Run indexed under the title of the specif- Estate Planners Need To Dig In For A Difficult ic columns, as well as under an au- Year Ahead thor heading. Each entry is followed The States Are Acting To Reform Their Guardianship Statutes by the month of issue and the page Trends Shape Products And Services For number of the issue in which the ma- terial was published. Major subject headings are print- Trust Document Imaging: Opportunity or Ne- ed in small capital letters. For quick cessity reference to an author, check the Au- The Use Of Discounts In Estate And Gift Tax thor subject heading. Major subject Valuations headings include: Technology, Elder Care, Investments, Case Law, Char- itable Giving, Environmental Lia- Housing Options For The Elderly: Tax, Care bility, Future Forecasts, Life Insur- And Other Issues ance, Tax Planning and Trust Marketing. Abendroth, Thomas W. — Are You Saving Independent Trust Companies Tap En- Anything Other Than Paper’............. Aug 39 A treprenerual Zeal Abendroth, Thomas W. — Highlights Of The ARTICLES, FEATURE Investment Company Trusts Companies: Risk Chapter 14 Final Regulations A Short Course In Municipal Credit Analysis. Versus Reqward Adams, Roy M. — Are You Saving Anything Irrevocable Life Insurance Trusts: Good Busi- Cina Tit PG aasccccescessscsssscecsnnvete Aug 39 A Family Limited Partnership As The Center- OR TOF I oiiiscenintcaninssosectessconnen May 24 Adams, Roy M. — Environmental Hazards For piece Of An Estate Plan The Joint Trust: Are You Saving Anything Fiduciaries: An Acid Test Sep 45, Oct 52 Other Than Paper? ...........ssssseeeseeseees Aug 39 Acceptance Of Accounts With A Closely-Held 14 Final Regulations Business Interest Avery, Luther J. — The Rules Of Professional The Affluent Market And Its Investment Po- Conduct For Lawyers Are Confusing....Apr 8 tential Ball, S. Timothy — Exploring Joint Lives Life An Unwise QTIP Election Can Endanger Insurance Policies Your Life Expectancy Barnett, Barnard — Plans For The Vanishing Suspended PALs Of Decedents And Executors tention By Planners Gain Approval Avoiding Taxable Lapse Treatment For Crum- No Panacea For The Financial Services Indus- mey Trust Transfers Shining The Spotlight On Trust Brown, Peter O. — The Punctilio Of An Honor Competitive Advantage The Most Sensitive Post-Mortem Planning Differences For Trusts And Estates Litigations Through A Family Foundation The Punctilio Of An Honor The Most Sensitive Coplan, Robert B. — Annuities And Unitrusts QTIP Trusts As IRA Beneficiary: Is There An light On Trust Alternative To 89-89? ........cc.ssssseeeseees Nov 16 Culm, Gerald P. — The Generation-Skippin- Charitable Foundations: What We Have Questions And Answers On Estate Planning Tax: Is It Constitutional?................00+ Mar 28 Learned In 20 Years And Administration Jan 49, Mar 59, Davis, William B. — Life Insurance: A Fidu- May 49, Jul 48, Sep 53, Nov 54 ciary Time Bomb TRUSTS & ESTATES / JANUARY 1993 DeMarco, John J. — The Affluent Market And The Concept Behind The Merger Of Private Its Investment Potential And Trust Banking Edie, John A. — Meeting The Requirements Independent Trust Companies Tap En- For An Advised Fund IN A Foundation McCroskey, Elizabeth W. — Housing Options trepreneurial Zeal For The Elderly: Tax, Care And Other Issues The Staie Of Estate Planning: Meet Challenges Errett, Amy J. — The Concept Behind The And Prosper Merger Of Private And Trust Banking McCue, Howard M. — Charitable Founda- Where The Trust Industry May Be Heading.... tions: What We Have Learned In 20 Years. .... Esperti, Robert A. — Post-Mortem Planning Differences For Trust And Estates McCue, Judith — The States Are Acting To Re- CHARITABLE GIVING form Their Guardianship Statutes A Philanthropic Advisory Service: Creating A Competitive Advantage try May Be Heading Charitable Trusts: The Magic Bullet Fox, Charles D. — The State Of Estate Plan- ning: Meet Challenges And Prosper ....Oct 20 Using Reai Estate Options In Charitable Re- Fisher, Robert W. — Charitable Remainder SIRI BIMNI 5is ceicnscatccicenmamacas Dec 49 Challenge Posed By Blockage Murray, John V. — Securities Law Considera- COMMENTARY Franklin, Richard S. — QTIP Trusts As IRA tions In Valuing Stock Attention To Homework Helps Avoid Day In Beneficiary: Is There An Alternative To 89- Ometer, Gary — A Short Course In Municipal ath iach dskntinka tenia ainibsaceipabiuien Nov 16 Credit Analysis Freeman, Douglas K. — The Economics Of Painter, Andrew D. — Annuities And Uni- Charitable Gift Planning trusts Require Special Attention By Planners Gallanis, Thomas P. — Charitable Founda- tions: What We Have Learned In 20 Years.... Parker, James O. — The Spousal Estate Swap: An Approach To Bracket Run Gibbs, Larry W. — A Family Limited Partner- ship As The Centerpiece Of An Estate Plan... Peterson, Renno L. — Post-Mortem Planning Sep 45, Oct 52 Differences For Trusts And Estates Gilfix, Michael — Housing Options For The Powell, Agnes C. — The Need For Increased Early Effort To Understand Helps Ease Tran- Goudeseune, Robert A. — But What Will Hap- Life Insurance Due Diligence... sition SOOTE TO BCG osnsnesancecreccscesczsnasacesed Jun 55 Facing The Age Wave Head On With Planning Harris, Richard W. — Avoiding Taxable Lapse Treatment For Crummey Trust Transfers Magic Bullet Prince, Russ A. — A Philanthropic Advisory Service: Creating A Competitive Advantage... Final Regulations Hirschfeld, Alan H. — Restructuring Wills And Trusts To Reduce Generation-Skipping Hitchner, James R. — The Use Of Discounts In Estate And Gift Tax Valuations ....Aug 49 Scheiner, Barbara J. — Estate Planning Using Holding Jr, Graham D. — Getting QTIP Treat- Powers Of Attorney ment For IRAs And Qualified Retirement ELDER CARE ing Powers Of Attorney Schlesinger, Sanford J. — Exploring Joint Lives Life Insurance Policies Schneider, Gail A. — Trends Shape Products The States Are Acting To Reform Their And Services For Clients Guardianship Statutes Sellinger, Philip R. — No Panacea For The Fi- Trusts That May Prove Useful In Medicaid nancial Services Industry Planning Katz, Marsha R. — But What Will Happen To Sennett, David — An Unwise QTIP Election MII. i sdichinineieinsatininsuaninssinhsnisintenit’ Jun 55 Can Endanger Your Life Expectancy ENVIRONMENTAL LIABILITY Kemp, George — Acceptance Of Accounts With A Closely-Held Business Interest Sennett, David — Protecting The IRA In A Klein, Stanley L. — The Economics Of Chari- Credit Shelter Trust table Gift Planning Kochman, Ronald S. — Protective Measures And Considerations In Litigation ESTATE PLANNING TECHNIQUES Kopelman, Ian S. — New Rollover And With- Smith, Daniel A. — Identifying Crummey Charitable Remainder Trusts: Planning And holding Provisions Gain Approval Trust Liability Problems Designing Issues Sperling, Peter R. — Using Off-Shore Life In- Getting QTIP Treatment For IRAs And Quali- Krause, Andrew J. — QTIP Trusts As IRA surance Trusts For Non-Resident Aliens fied Retirement Plans ...............0.0000000 Feb 26 Beneficiary: Is There An Alternative To 89- Plan For The Vanishing Suspended PALs Of Mee eit ahinicsscictsseiseteaktegiceacasegn Nov 16 Decedents And Executors Kruse, Clifton B. —Trusts That May Prove Opportunity or Necessity Useful In Medicaid Planning Waldron, Gary L. — Should Attorneys Recom- Landreth, Charles B. — Bank Mutual Funds: mend Life Insurance Products?..............:.+++++ Growth Vehicle Of The ’90s Lepman, Carol S. — New Rollover And With- Welber, Joel S. — But What Will Happen To holding Provisions Gain Approval... cis atia sii cercsntasnbinenaceksbaaeidcreeel Jun 55 Waltuch, Robert — Investment Company FUTURE FORECASTS Lochray, Paul J. — Using Real Estate Options Trust Companies A Sobering Economic Forecast In Charitable Remainder Trusts Williams, Richard A. — The Benefits And Pit- Beware The Loss Of The Minimum Tax Credit Lyman, Curtis L. — Investment Company falls Of Joint Revocable Trusts Trust Companies Zeena, William — Protective Measures And MacDonagh, Niall — Independent Trust Com- Considerations In Litigation panies Tap Entrepreneurial Zeal The Malpractice Predicament.. Maurer, David V. — Irrevocable Life Insur- Cc Multi-Generational Representation ance Trust: Good Business For Banks CHANGEs IN THE INDUSTRY Maurer, David V. — Irrevocable Life Insur- Bank Mutual Funds: Growth Vehicle Of The ance Trust: Good Business For Banks ‘90s The Trust Business In Transition 58 TRUSTS & ESTATES / JANUARY 1993 Reason For Concern: Boomers Are Unpre- Meeting The Requirements For An Advised Fund In A Foundation G GENERATION-SKIPPING TAX The Generation-Skipping Tax: Is It Constitu- EREee e e Mar 28 Restructuring Wills And Trusts To Reduce Generation-Skipping TaxeS.........0s.+ Mar 8 Trust LIABILITY I Annuitites And Unitrusts Require Special At- INVESTMENTS Questions Surround Prepayment Clauses Of tention By Planners ............0000000ee0ee0ee0 Dec 15 Acceptance Of Accounts With A Closely-Held CRTANIIS TON isssccesssssccrnennateonsonenicd Jul 56 Identifying Crummey Trust Liability Problems RCCL Jun 46 The Significance Of Discretionary Beneficia- OUND ccivnisnsasientionsiueiseliapapstanceanieedinasinaiaaal Jan 55 Investment Company Trust Companies: Risk L Will Fixed Gifts To All Religions Become Versus Reward : Law & Lire INSURANCE UII sisenienscccitcnnctavnbibannGeesn tM ar 63 Protective Measures And Considerations In Litigation R Can Interest On A Policy Loan Be Taken As A RETIREMENT BENEFIT PLANNING Trust MARKETING I aiicsisssiisnetsincnitestioasinaal Jul 54 New Rollover And Withholding Provisions Digging Deeper Into Irrevocable Life Insurance Gain Approval BT ities veistthastonigeedsntensannssuicveneieadl Jun 65 Protecting The IRA In A Credit Shelter Trust . Dispute Continues Over Life Insurance Com- mission Rebating Qi? Trusts As IRA Beneficiary: Is There An The Case For Advertising: Shining The Spot- Alternative To 89-89? ..........ccccccseeeeeeeee Nov 16 I BE ivr cecneccsnssistllatiinmanitaa Oct 44 Generating Business From Corporate Bank Of- Lawsuits Can Erupt Over The Validity Of Pre- Ss NI aia bis csankasScieangcnsssiastlacialighaieiiabeatmana nJ un 62 I I si siecesssksnclesesvncensearavinnl Oct 64 SPECIAL INTEREST TRUSTS Incentive Compensation: A New Arena Policies On Children May Be The Ultimate Ap- But What Will Happen To My Child. preciating Asset Trends Shape Products And Services For Private Letter Ruling 9110016: A Flawed Charitable Remainder Trusts: Realities And CII icinccrvinsecnninitsisiainjeeiebasigenticandae’ Oct 28 Judgment Proper Planning Reinstatement Period Presents Issues And Eth- Using Off-Shore Life Insurance Trusts For Vv POE IE So nakicinisiemsionewcted Dec 57 Non-Resident Aliens ...............:s0000000004 Jun 49 VALUATIONS Sales Illustrations Are Poor Predictors Of Fu- ‘Blockage’ Redux: The Challenge Posed By T TAX PLANNING An Unwise QTIP Election Can Endanger Your Life Expectancy The Use Of Discounts In Estte And Gift Tax Avoiding Taxable Lapse Treatment For Crum- PED wnciciisnnniratiinbsipmsdinscialisiusseinal Aug 49 mey Trust Transfers .............0000sese000es Apr 45 LiFE INSURANCE Highlights Of The Chapter 14 Final Regula- Exploring Joint Lives Life Insurance Policies . CeO N a ES Apr 28 Irrevocable Life Insurance Trusts: Good Busi- TECHNOLOGY 0008 FOF Baa? on.ss...i0sserssoseescossnsscociel May 24 ShiningA Light On New Products: Annual REPRINTS Life Insurance: A Fiduciary Time Bomb Software Update Trust Document Imaging: Opportuntiy Or Ne- The Need For Increased Life Insurance Due cessity AVAILABLE Diligence Should Attorneys Recommend Life Insurance TRENDS & DEVELOPMENTS ieee LOE Mar 38 Bank Trust Department Shine As Advisors.... The Wait-And-See Trust: An Alternative To IE sina cahctlibisesp aisstrncipribenausiibessand May 10 Banks See Future In Non-Traditional Prod- MIDID :c cssnscincssepnnaignenhésnneiasiepiainamanan Dec 6 M Babyboomers Expected To Inheret $8Trillion. You can order reprints of MISCELLANEOUS Nov 6 A Short Course In Municipal Credit Analysis. anya rticiln tehi s The Benefits And Pitfalls Of Joint Revocable nileleler4lal—) Tameltlarsielatelelce I iciha 5s -ticnsecinsnisndcasanaasitieinsenndias Nov 41 A Family Limited Partnership As The Center- Consumers Holding On To Life Insurance olgulelmel mall snip 4=10 me piece Of An Estate Plan PD sis cincintntbintnicnseicciiniaaaecieaiaila Sep 6 your specifications Sep 45, Oct 52 Court Ruling Could Prompt Wave Of Suits .... The Joint Trust: Are You Saving Anything Car Fiat FOG oiaessiesesesesinrossnscceeet Aug 39 The Punctilio Of An Honor The Most Sensitive WVtiatianltlaamelae(= eamn ee The Rules Of Professional Conduct For Lawyers Are Confusing Inheritance, A Double-Edged Sword Interest Grows In Group Financial Planning . Q QUESTIONS AND ANSWERS ON ESTATE PLAN- NING AND ADMINISTRATION melmuulelecmialielauleliveln Answers to readers’ questions feretst (elem ialee mello) Mar 59, May 49, Jul 48, Sep 53, Nov 54 (404) 955-2500 P PHILANTHROPY Charitable Foundations: What We Have Learned In 20 Year ............0ssseseeeseeee Aug 12 The Economics Of Charitable Gift Planning .. Financial Parenting Through A Family Foun- TRUSTS & ESTATES / JANUARY 1993