The Austrian Theory of the Trade Cycle - Ludwig von Mises Institute PDF

Preview The Austrian Theory of the Trade Cycle - Ludwig von Mises Institute

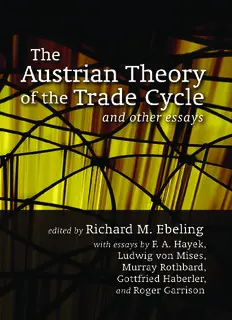

ThE AUSTRiAN ThEORy of ThE TRAdE CyclE ANd OThER ESSAYS ludwiG VON MisES GOTTFRiEd HAbERlER MURRAy N. ROT~bARd FRiEdRic~ A. HAyEk CoMpilEd by RichARd M. EbEliNG WiT~ AN INTRoduCTioN ANd SUMMARy by RoqER W. GARRisON ~ LudwiG VON MisES INSTiTUTE INSTITUTE AubuRN, AlAbAMA }6849...BOl Ludwi8vonMises GotifriedHaberler FriedrichA. Hayek MurrayN. Rothbard Dedicated to thememoryofo. :eAlford, III, championoflibertyand theAustrian School Copyright © 1996 by the Ludwigvon Mises Institute. Originallypublished bythe Center for Libertarian Studies (1978). All rights reserved. Written permission mustbe secured from the publisher to use or reproduce any partofthis book, exceptfor briefquotations in critical reviews or articles. Publishedby the Ludwigvon Mises Institute, Auburn, Alabama 36849-5301. LibraryofCongress CatalogCard Number: 96-075695 ISBN: 0-945466-21-8 Contents Introduction: TheAustrianTheoryin Perspective Roger W" Garrison. ... .. .... ... ... ... .. . ... ... .. . . 7 The '~ustrian"Theory ofthe Trade Cycle Ludwig von Mises . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 25 Money and the Business Cycle Gotifried Haberler. . . . . . . . . . . . . . . . . . . . . . . . .. . . . .. 37 Economic Depressions: Their Cause and Cure Murray N. Rothbard. . . . . . . . . . . . . . . . . . . . . . . . . . . .. 65 CanWe StillAvoid Inflation? Friedrich A. Hayek. . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 93 TheAustrianTheory: A Summary Roger W" Garrison. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 111 Index 123 About the Authors. ..... ......... ... ... ...... .... 127 TheLudwigvonMisesInstitute • 5 Introduction: The Austrian Theory in Perspective Roger W Garrison T hefouressaysinthisvolume, eachwrittenbyamajor figure in the Austrian school ofeconomics, set out and apply a distinctive theory ofthe business cycle. Thespanofyears(1932-1970) overwhichtheyappearedsaw adramaticwaxingandthenwaningoftheprominence-both insideandoutsidetheeconomicsprofession-oftheAustrian theorJ Gottfried Haberler wrote in his 1932 essay that the theory "is notsowellknown inthis countryas itdeserves to be" (pp. 44). Although Ludwigvon Mises offered no assess ment in this regard in his essa~ he remarked in 1943 about the effect of the theory's general acceptance on the actual course ofthe cycle. Anticipating akeyinsight in the modern literature on "rational expectations," Mises wrote,"The teachings ofthe monetarytheoryofthe trade cycle are today so well known even outside the circle ofeconomists thatthe naiveoptimismwhichinspiredtheentrepreneursintheboom TheLudwigvonMisesInstitute • 7 THEAUSTRIANTHEORYOFTHETRADECYCLEANDornERESSAYS periodshasgivenwaytogreaterskepticism.,,1 Then,in 1969, MurrayN. Rothbardcouldwrite-withoutseriousoverstate ment-that "a correct theory of depressions and of the businesscycledoesexist,eventhoughitisuniversallyneglected inpresent-dayeconomics" (p. 74). What happened over the span of nearly forty years to accountfor the rise and fall ofthis theoryofboomandbust? The simple answer, of course, is: the Keynesian revolution. of John Maynard Keynes's General Theory Employment, Interest, and Money, which made its appearance in 1936, produced a major change in the way that economists deal with macro economic issues. A close look at some pre-Keynesian ideas can show why the Austrian theory was so easily lost in the aftermath ofthe Keynesian revolution; a briefsurvey ofthe alternatives offered by modern macroeconomics will show whythere is anew-found interestinthis oldAustriantheor~ of FirstintroducedbyMisesinhis Theory MoneyandCredit (1912),. the theory was originally billed as the circulation credittheoryratherthanasauniquelyAustriantheor~ Mises wasverymuchawareofitsmultinationalroots.Thenotionthat themarketprocesscanbesystematicallyaffectedbyadivergence between the bank rate ofinterest and the natural rate came from Swedish economist Knut Wicksell; the understanding 1Ludwigvon Mises, "Elastic Expectations andtheAustrianTheoryofthe TradeCycle,"Economica,os. 10(August 1943):251. 8 • TheLudwigvonMisesInstitute ROGER W. GARRISON thattheprocesssoaffectedwouldhaveaself-reversingquality to it (Mises used the term "counter-movements" in his earliest exposition) came from the British currency school, whoseanalysisfeaturedinternationalgoldflows. Theuniquely AustrianelementinMises's formulation is the capitaltheory introduced by Carl Menger and developed by Eugen von Bohm-Bawerk. Mises showed that an artificially low rate\of interest, maintainedbycreditexpansion,misallocatescapital, making the production process too time-consuming in rela tion to the temporal pattern ofconsumer demand. As time eventually reveals the discrepan~markets for both capital goods and consumergoods react to undo the misallocation. The initial misallocation and eventual reallocation constitute the microeconomic foundations that underlie the observed macroeconomic phenomenon of boom and bust. Mises's theorywassuperiortoitsSwedishforerunnerinthatWicksell was concerned almost exclusively with the effect of credit expansiononthegenerallevelofprices. Itwas superiorto its British forerunner in that the currency school's theory ap pliedonlywhenmonetaryexpansioninonecountryoutpaced thatofitstradingpartners.Mises'stheorywasapplicableeven to a closed economy and to a world economy in which all countries are experiencinga creditexpansion. The theory took on a more predominantly Austrian character in the hands ofF. A. Hayek. In the late 1920s and early 1930s, Hayek gave emphasis to the Austrian vision of TheLudwigvonMisesInstitute • 9