Kingdom of Saudi Arabia GMTN Programme PDF

Preview Kingdom of Saudi Arabia GMTN Programme

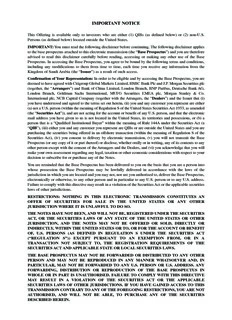

IMPORTANT NOTICE This Offering is available only to investors who are either (1) QIBs (as defined below) or (2) non-U.S. Persons(asdefinedbelow)locatedoutsidetheUnitedStates. IMPORTANT:Youmustreadthefollowingdisclaimerbeforecontinuing.Thefollowingdisclaimerapplies tothebaseprospectusattachedtothiselectronictransmission(the“BaseProspectus”)andyouaretherefore advised to read this disclaimer carefully before reading, accessing or making any other use of the Base Prospectus.InaccessingtheBaseProspectus,youagreetobeboundbythefollowingtermsandconditions, including any modifications to them from time to time, each time you receive any information from the KingdomofSaudiArabia(the“Issuer”)asaresultofsuchaccess. ConfirmationofYourRepresentation:InordertobeeligibleandbyaccessingtheBaseProspectus,youare deemedtohaveagreedwithCitigroupGlobalMarketsLimited,HSBCBankPlcandJ.P.MorganSecuritiesplc (together, the “Arrangers”) and Bank of China Limited, London Branch, BNP Paribas, Deutsche BankAG, London Branch, Goldman Sachs International, MUFG Securities EMEA plc, Morgan Stanley & Co. International plc, NCB Capital Company (together with theArrangers, the “Dealers”) and the Issuer that (i) youhaveunderstoodandagreedtothetermssetoutherein,(ii)youandanycustomeryourepresentareeither (a)notaU.S.person(withinthemeaningofRegulationSoftheUnitedStatesSecuritiesAct1933,asamended (the“SecuritiesAct”)),andarenotactingfortheaccountorbenefitofanyU.S.person,andthattheelectronic mail address you have given to us is not located in the United States, its territories and possessions, or (b) a person that is a “Qualified Institutional Buyer” within the meaning of Rule 144A under the SecuritiesAct (a “QIB”),(iii)eitheryouandanycustomeryourepresentareQIBsorareoutsidetheUnitedStatesandyouare purchasing the securities being offered in an offshore transaction (within the meaning of Regulation S of the Securities Act), (iv) you consent to delivery by electronic transmission, (v) you will not transmit the Base Prospectus(oranycopyofitorpartthereof)ordisclose,whetherorallyorinwriting,anyofitscontentstoany otherpersonexceptwiththeconsentoftheArrangersandtheDealers,and(vi)youacknowledgethatyouwill makeyourownassessmentregardinganylegal,taxationorothereconomicconsiderationswithrespecttoyour decisiontosubscribefororpurchaseanyoftheNotes. YouareremindedthattheBaseProspectushasbeendeliveredtoyouonthebasisthatyouareapersoninto whose possession the Base Prospectus may be lawfully delivered in accordance with the laws of the jurisdictioninwhichyouarelocatedandyoumaynot,norareyouauthorisedto,delivertheBaseProspectus, electronicallyorotherwise,toanyotherpersonandinparticulartoanyU.S.personortoanyU.S.address. FailuretocomplywiththisdirectivemayresultinaviolationoftheSecuritiesActortheapplicablesecurities lawsofotherjurisdictions. RESTRICTIONS: NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY OTHER JURISDICTIONWHEREITISUNLAWFULTODOSO. THENOTESHAVENOTBEEN,ANDWILLNOTBE,REGISTEREDUNDERTHESECURITIES ACT, OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR OTHER JURISDICTION, AND THE NOTES MAY NOT BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY,WITHINTHE UNITED STATES ORTO, OR FORTHEACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT (“REGULATION S”)) EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIESACTANDAPPLICABLESTATEORLOCALSECURITIESLAWS. THE BASE PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER AND, IN PARTICULAR, MAY NOT BE FORWARDED TO ANY U.S. PERSON OR U.S. ADDRESS. ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THE BASE PROSPECTUS IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE SECURITIES LAWS OF OTHER JURISDICTIONS. IF YOU HAVE GAINED ACCESS TO THIS TRANSMISSIONCONTRARYTOANYOFTHEFOREGOINGRESTRICTIONS,YOUARENOT AUTHORISED, AND WILL NOT BE ABLE, TO PURCHASE ANY OF THE SECURITIES DESCRIBEDHEREIN. UndernocircumstancesshalltheBaseProspectusconstituteanoffertosellorthesolicitationofanofferto buynorshalltherebeanysaleoftheNotesinanyjurisdictioninwhichsuchoffer,solicitationorsalewould beunlawful. The Base Prospectus is not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of the Base Prospectus is only being made to those persons falling within Article 19(5) or Article 49(2)(a) to (e) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, or to other persons to whom the Base Prospectus may otherwise be distributed without contravention of the Financial Services and Markets Act 2000, or any person to whom it may otherwise lawfully be made. This communication is being directed only at persons having professional experience in matters relating to investments and any investment or investment activity to which this communicationrelateswillbeengagedinonlywithsuchpersons.Nootherpersonshouldrelyonit. The Base Prospectus has been sent to you in an electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic transmission and consequently none of the Arrangers or the Dealers, any person who controls any of the Arrangers or the Dealers,theIssuer,anydirector,officer,employeeoragentoforpublicofficialrepresentinganyofthem,or anyaffiliateofanysuchpersonacceptsanyliabilityorresponsibilitywhatsoeverinrespectofanydifference between the Base Prospectus distributed to you in electronic format and the hard copy version available to youonrequestfromanyoftheArrangersortheDealers. If you received the Base Prospectus by e-mail, you should not reply by e-mail to this communication.Any reply e-mail communications, including those you generate by using the “Reply” function on your email software, will be ignored or rejected. If you receive the Base Prospectus by e-mail, your use of this e-mail isatyourownriskanditisyourresponsibilitytotakeprecautionstoensurethatitisfreefromvirusesand otheritemsofadestructivenature. Thematerialsrelatingtotheofferingdonotconstitute,andmaynotbeusedinconnectionwith,anofferor solicitationinanyplacewheresuchoffersorsolicitationsarenotpermittedbylaw.Ifajurisdictionrequires that the offering be made by a licensed broker or dealer and the Arrangers, the Dealers or any of their respectiveaffiliatesisalicensedbrokerordealerinthatjurisdiction,theofferingshallbedeemedtobemade bytheArrangers,theDealersorsuchrespectiveaffiliate(s)onbehalfoftheIssuerinsuchjurisdiction. RecipientsoftheBaseProspectuswhointendtosubscribefororpurchasetheNotesareremindedthatany subscriptionorpurchasemayonlybemadeonthebasisoftheinformationcontainedintheBaseProspectus. ThedistributionoftheBaseProspectusincertainjurisdictionsmayberestrictedbylaw.Personsintowhose possession the Base Prospectus comes are required by theArrangers, the Dealers and the Issuer to inform themselvesabout,andtoobserve,anysuchrestrictions. THE KINGDOM OF SAUDI ARABIA acting through the Ministry of Finance Global Medium Term Note Programme UnderthisGlobalMediumTermNoteProgramme(the“Programme”),theKingdomofSaudiArabia(the“Issuer”,the“Kingdom”or“Saudi Arabia”),actingthroughtheMinistryofFinance,mayelect,subjecttocompliancewithallrelevantlaws,regulationsanddirectives,fromtime totimetoissuenotes(the“Notes”)denominatedinanycurrencyagreedbetweentheIssuerandtherelevantDealer(s)(asdefinedbelow). Notesmaybeissuedinbearerorregisteredform(respectively,“BearerNotes”and“RegisteredNotes”).TheNotesmaybeissuedona continuingbasistooneormoreoftheDealersspecifiedunder“OverviewoftheProgramme”andanyadditionalDealer(s)appointedunder theProgrammefromtimetotimebytheIssuer(eacha“Dealer”andtogether,the“Dealers”),whichappointmentmaybeforaspecificissue oronanongoingbasis.ReferencesinthisBaseProspectustothe“relevantDealer(s)”shall,inthecaseofanissueofNotesbeing(orintended tobe)subscribedbymorethanoneDealer,betoallDealersagreeingtosubscribeforsuchNotes. ANINVESTMENTINNOTESISSUEDUNDERTHEPROGRAMME INVOLVESCERTAINRISKS.SEE“RISKFACTORS”. ThisBaseProspectushasbeenapprovedbytheCentralBankofIreland,ascompetentauthorityunderDirective2003/71/EC,asamended(the “ProspectusDirective”).TheCentralBankofIrelandonlyapprovesthisBaseProspectusasmeetingtherequirementsimposedunderIrish andEUlawpursuanttotheProspectusDirective.Suchapprovalhasbeensoughtforthepurposeofgivinginformationwithregardtotheissue ofNotesdescribedinthisBaseProspectusfortheperiodof12monthsfromthedateofthisBaseProspectus.Suchapprovalrelatesonlyto theNoteswhicharetobeadmittedtotradingonaregulatedmarketforthepurposesofDirective2004/39/ECand/orwhicharetobeoffered tothepublicinanyMemberStateoftheEuropeanEconomicArea.ApplicationhasbeenmadetotheIrishStockExchangeplc(the“Irish StockExchange”)fortheNotesissuedundertheProgrammetobeadmittedtotheofficiallist(the“OfficialList”)andtotradingonits regulatedmarket. ReferencesinthisBaseProspectustoNotesbeing“listed”(andallrelatedreferences)shallmeanthatsuchNoteshavebeenadmittedtothe OfficialListandhavebeenadmittedtotradingontheIrishStockExchange. TheProgrammealsopermitsNotestobeissuedonthebasisthattheywillnotbeadmittedtolisting,tradingand/orquotationbyanycompetent authority,stockexchangeand/orquotationsystemortobeadmittedtolisting,tradingand/orquotationbysuchotherorfurthercompetent authorities,stockexchangesand/orquotationsystemsasmaybeagreedwiththeIssuer. TheaggregatenominalamountofNotes,interest(ifany)payableinrespectofNotes,theissuepriceofNotesandcertainotherinformation whichisapplicabletoeachTranche(asdefinedherein)ofNoteswillbesetoutinthefinaltermsspecifictoeachTranche(the“FinalTerms”). Payments of interest on Notes issued under the Programme will be made without deduction for, or on account of, taxes imposed by the KingdomtotheextentdescribedinCondition13(Taxation)under“TermsandConditionsoftheNotes”. TheIssuerhasbeenassignedasovereigncreditratingofAA-(negativeoutlook)byFitchRatingsLimited(“Fitch”)andA1(stableoutlook) by Moody’s Investors Service Limited (“Moody’s”). Each of Fitch and Moody’s is established in the European Union (the “EU”) and registeredunderRegulation(EC)No.1060/2009(asamended)(the“CRARegulation”).Assuch,eachofFitchandMoody’sisincludedin thelistofcreditratingagenciespublishedbytheEuropeanSecuritiesandMarketsAuthorityonitswebsiteinaccordancewiththeCRA Regulation.CertaintranchesofNotes(each,a“Tranche”)tobeissuedundertheProgrammemayberatedorunratedand,ifrated,thecredit ratingagencyissuingsuchratingwillbespecifiedintheFinalTerms.WhereaTrancheisrated,suchratingwillnotnecessarilybeequivalent totheratingsassignedtotheIssuer.WhetherornoteachcreditratingappliedforinrelationtoaTranchewillbe(a)issuedbyacreditrating agencyestablishedintheEEAandregisteredundertheCRARegulation,or(b)issuedbyacreditratingagencywhichisnotestablishedin theEEAbutwillbeendorsedbyacreditratingagencywhichisestablishedintheEEAandregisteredundertheCRARegulation,or(c)issued byacreditratingagencywhichisnotestablishedintheEEAbutwhichiscertifiedundertheCRARegulationwillalsobedisclosedinthe FinalTerms.Aratingisnotarecommendationtobuy,sellorholdtheNotes,doesnotaddressthelikelihoodortimingofrepaymentandmay besubjecttorevision,suspensionorwithdrawalatanytimebytheassigningratingorganisations. TheNoteshavenotbeen,andwillnotbe,registeredundertheU.S.SecuritiesActof1933,asamended(the“SecuritiesAct”)orwithany securitiesregulatoryauthorityofanystateorotherjurisdictionoftheUnitedStates,andNotesinbearerformmaybesubjecttoU.S.taxlaw requirementsandmaynotbeoffered,soldordeliveredwithintheUnitedStatesoritspossessionsortoaUnitedStatespersonexceptincertain transactionspermittedbyU.S.taxregulations.TheNotesmaynotbeoffered,soldor(inthecaseofNotesinbearerform)deliveredwithin theUnitedStatesorto,orfortheaccountorbenefitof,U.S.persons(asdefinedinRegulationSundertheSecuritiesAct(“RegulationS”)) exceptincertaintransactionsexemptfromtheregistrationrequirementsoftheSecuritiesAct.TheNotesmaybeofferedandsold(A)inbearer formorregisteredformoutsidetheUnitedStatestoNon-U.S.personsinrelianceonRegulationSand(B)inregisteredformwithintheUnited States to persons who are “qualified institutional buyers” (“QIBs”) in reliance on Rule 144A under the SecuritiesAct (“Rule 144A”). ProspectivepurchaserswhoareQIBsareherebynotifiedthatsellersoftheNotesmayberelyingontheexemptionfromtheprovisionsof Section5oftheSecuritiesActprovidedbyRule144A.Foradescriptionoftheseandcertainfurtherrestrictionsonoffers,salesandtransfers ofNotesanddistributionofthisBaseProspectus,see“SubscriptionandSale”and“TransferRestrictions”. ThisBaseProspectusshouldbereadandconstruedtogetherwithanyamendmentorsupplementhereto.InrelationtoaTrancheofNotes,this BaseProspectusshouldbereadandconstruedtogetherwiththeFinalTerms. ArrangersandDealers Citigroup HSBC J.P. Morgan Dealers Bank of China BNP PARIBAS Deutsche Bank Goldman Sachs MUFG Morgan Stanley NCB Capital ThedateofthisBaseProspectusis10October2016. RESPONSIBILITYSTATEMENT ThisBaseProspectuscomprisesabaseprospectusforthepurposesofArticle5.4oftheProspectusDirective to the extent that such amendments have been implemented in a relevant member state of the EU (an “EU Member State”) and for the purpose of giving information with regard to the Issuer and the Notes which, according to the particular nature of the Issuer and the Notes, is necessary to enable investors to make an informedassessmentoftheassetsandliabilities,financialpositionandprospectsoftheIssuer. The Issuer accepts responsibility for the information contained in this Base Prospectus. To the best of the knowledge and belief of the Issuer (having taken all reasonable care to ensure that such is the case), the information contained in this Base Prospectus is in accordance with the facts and does not omit anything likely to affect the import of such information. The opinions, assumptions, intentions, projections and forecasts expressed in this Base Prospectus with regard to the Issuer are honestly held by the Issuer, not misleading in any material respect, have been reached after considering all relevant circumstances and are basedonreasonableassumptions. Where information has been sourced from a third party (other than a state agency or Government department,inrespectofwhichtheIssueracceptsresponsibility),theIssuerconfirmsthatsuchinformation has been accurately reproduced and that, so far as it is aware and is able to ascertain from information published by such third party, no facts have been omitted which would render the reproduced information inaccurate or misleading. The source of any third party information contained in this Base Prospectus is statedwheresuchinformationappearsinthisBaseProspectus. Each Tranche (as defined herein) of Notes will be issued on the terms set out herein under “Terms and Conditions of the Notes” (the “Conditions”), as completed by the FinalTerms.This Base Prospectus must be read and construed together with any supplements hereto and with any information incorporated by reference herein and, in relation to anyTranche of Notes which is the subject of FinalTerms, must be read andconstruedtogetherwiththeFinalTerms. Nopersonhasbeenauthorisedtogiveanyinformationortomakeanyrepresentationnotcontainedinornot consistentwiththisBaseProspectusoranyotherdocumententeredintoinrelationtotheProgrammeorany informationsuppliedbytheIssuerorsuchotherinformationasisinthepublicdomainand,ifgivenormade, such information or representation should not be relied upon as having been authorised by the Issuer, any Arranger(asdefinedherein)oranyDealer. TheArrangers,theDealersandtheAgentshavenotindependentlyverifiedtheinformationcontainedherein. Accordingly, none of theArrangers, the Dealers, theAgents or any of their respective affiliates makes any representation or warranty or accepts any responsibility as to the accuracy or completeness of the informationcontainedinthisBaseProspectus. Neither this Base Prospectus nor any Final Terms are intended to provide the basis of any credit or other evaluation and should not be considered as a recommendation by any of the Issuer, the Arrangers or the Dealers that any recipient of this Base Prospectus or any Final Terms should purchase the Notes. Each potential purchaser of Notes should determine for itself the relevance of the information contained in this BaseProspectusandanyFinalTermsanditspurchaseofNotesshouldbebaseduponsuchinvestigationas itdeemsnecessary.NoneoftheArrangersortheDealersundertakestoreviewthefiscalconditionoraffairs oftheIssuerduringthelifeofthearrangementscontemplatedbythisBaseProspectusandanyFinalTerms nortoadviseanyinvestororpotentialinvestorintheNotesofanyinformationcomingtotheattentionofany oftheArrangersortheDealers. ii IMPORTANTNOTICES NeitherthedeliveryofthisBaseProspectusoranyFinalTermsnortheoffering,saleordeliveryofanyNote shall,inanycircumstances,createanyimplicationthattheinformationcontainedinthisBaseProspectusis truesubsequenttothedatehereofor,ifapplicable,thedateuponwhichthisBaseProspectushasbeenmost recentlyamendedorsupplementedorthattherehasbeennoadversechange,oranyeventreasonablylikely to involve any adverse change, in the condition (fiscal, economic, political or otherwise), general affairs or prospectsoftheIssuersincethedatehereofor,ifapplicable,thedateuponwhichthisBaseProspectushas beenmostrecentlyamendedorsupplementedorthatanyotherinformationsuppliedinconnectionwiththe Programme is correct at any time subsequent to the date on which it is supplied or, if different, the date indicatedinthedocumentcontainingthesame. ThedistributionofthisBaseProspectusandanyFinalTermsandtheoffering,saleanddeliveryoftheNotes in certain jurisdictions may be restricted by law.Accordingly, no Notes may be offered or sold, directly or indirectly, and neither this Base Prospectus nor any advertisement or other offering materials may be distributed or published in any jurisdiction, except in circumstances that will result in compliance with any applicable laws and regulations. Persons into whose possession this Base Prospectus or any Final Terms comes are required by the Issuer, theArrangers and the Dealers to inform themselves about and to observe anysuchrestrictions.Foradescriptionofcertainrestrictionsonoffers,salesanddeliveriesofNotesandon thedistributionofthisBaseProspectusoranyFinalTermsandotherofferingmaterialrelatingtotheNotes, see “Subscription and Sale”. In particular, the Notes have not been and will not be registered under the SecuritiesActandmaybesubjecttoU.S.taxlawrequirements. Neither this Base Prospectus nor any other information supplied in connection with the Programme or any Notesisintendedtoprovidethebasisofanycreditorotherevaluation.NeitherthisBaseProspectusnorany Final Terms constitutes an offer or an invitation to subscribe for or purchase any Notes and should not be consideredasarecommendationbytheIssuer,theArrangers,theDealersoranyofthemthatanyrecipient ofthisBaseProspectusoranyFinalTermsshouldsubscribefororpurchaseanyNotes.Eachrecipientofthis Base Prospectus or any Final Terms shall be taken to have made its own investigation and appraisal of the condition(financialorotherwise)oftheIssuer. The Notes may not be a suitable investment for all investors. Each potential investor in the Notes must determine the suitability of that investment in light of its own circumstances. In particular, each potential investorshould: (a) have sufficient knowledge and experience to make a meaningful evaluation of the Notes, the merits andrisksofinvestingintheNotesandtheinformationcontainedorincorporatedbyreferenceinthis BaseProspectusoranyapplicablesupplement; (b) have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of its particular financial situation, an investment in the Notes and the impact the Notes will have on its overallinvestmentportfolio; (c) havesufficientfinancialresourcesandliquiditytobearalloftherisksofaninvestmentintheNotes, including Notes with principal or interest payable in one or more currencies, or where the currency forprincipalorinterestpaymentsisdifferentfromthepotentialinvestor’scurrency; (d) understand thoroughly the terms of the Notes and be familiar with the behaviour of any relevant indicesandfinancialmarkets;and (e) be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic, interest rate and other factors that may affect its investment and its ability to bear the applicablerisks. Theinvestmentactivitiesofcertaininvestorsaresubjecttolegalinvestmentlawsandregulations,orreview or regulation by certain authorities. Each potential investor should consult its legal and tax advisers to determinewhetherandtowhatextent:(i)theNotesarelegalinvestmentsforit;(ii)theNotescanbeusedas collateral for various types of borrowing; and (iii) other restrictions apply to its purchase or pledge of any Notes.Financialinstitutionsshouldconsulttheirlegaladvisersortheappropriateregulatorstodeterminethe appropriatetreatmentoftheNotesunderanyapplicablerisk-basedcapitalorsimilarrules. iii SUPPLEMENTSTOTHISBASEPROSPECTUS The Issuer has agreed to comply with any undertakings given by it from time to time to the Irish Stock ExchangeinconnectionwithNotesinaSeries(asdefinedherein)tobelistedontheOfficialListoftheIrish StockExchangeand,withoutprejudicetothegeneralityoftheforegoing,shallinconnectionwiththelisting oftheNotesontheOfficialListoftheIrishStockExchangeoronanyotherrelevantstockexchange,solong as any Note remains outstanding, prepare a supplement to this Base Prospectus, or, as the case may be, publishinanewBaseProspectus,wheneverrequiredbytherulesoftheIrishStockExchangeoranyother relevantstockexchange.IntheeventthatasupplementtothisBaseProspectusisproducedpursuanttosuch undertakings,acopyofsuchsupplementwillaccompanythisBaseProspectus.Anysuchsupplementtothis Base Prospectus will also be available from the specified office of the Fiscal Agent. See “General Information—DocumentsonDisplay”. NOTICETOU.S.INVESTORS This Base Prospectus may be submitted on a confidential basis in the United States to a limited number of QIBs for informational use solely in connection with the consideration of the purchase of certain Notes which may be issued under the Programme. Its use for any other purpose in the United States is not authorised. It may not be copied or reproduced in whole or in part nor may it be distributed or any of its contentsdisclosedtoanyoneotherthantheprospectiveinvestorstowhomitisoriginallysubmitted. AnyNotesinbearerformaresubjecttoU.S.taxlawrequirementsandmaynotbeoffered,soldordelivered withintheUnitedStatesoritspossessionsortoorfortheaccountofUnitedStatespersons,exceptincertain transactions permitted by U.S.Treasury regulations.Terms used in this paragraph have the meanings given tothembytheU.S.InternalRevenueCodeof1986andtheTreasuryregulationspromulgatedthereunder. RegisteredNotesmaybeofferedorsoldwithintheUnitedStatesonlytoQIBsintransactionsexemptfrom registration under the Securities Act in reliance on Rule 144A under the Securities Act or any other applicable exemption.Any U.S. purchaser of Registered Notes is hereby notified that the offer and sale of any Registered Notes to it may be being made in reliance upon the exemption from the registration requirementsofSection5oftheSecuritiesActprovidedbyRule144A. Each purchaser or holder of Notes represented by a Restricted Global Certificate or any Notes issued in registered form in exchange or substitution therefor (together “Legended Notes”) will be deemed, by its acceptance or purchase of any such Legended Notes, to have made certain representations and agreements intended to restrict the resale or other transfer of such Notes as set out in “Subscription and Sale” and “TransferRestrictions”. NEITHER THE PROGRAMME NOR THE NOTES HAVE BEENAPPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), ANY STATE SECURITIES COMMISSION IN THE UNITED STATES ORANY OTHER U.S. REGULATORYAUTHORITY, NOR HASANY OF THE FOREGOINGAUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF ANY OFFERING OF NOTES OR THE ACCURACY OR ADEQUACY OF THIS INFORMATION MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE IN THEUNITEDSTATES. NOTICETOINVESTORSINTHEEUROPEANECONOMICAREA This Base Prospectus has been prepared on the basis that any offer of Notes in any Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”) will be made pursuant to an exemption under the Prospectus Directive, as implemented in that Relevant Member State, from the requirement to publish a prospectus for offers of Notes.Accordingly any personmakingorintendingtomakeanofferinthatRelevantMemberStateofNoteswhicharethesubject ofanofferingcontemplatedinthisBaseProspectusascompletedbytheFinalTermsinrelationtotheoffer ofthoseNotesmayonlydosoincircumstancesinwhichnoobligationarisesfortheIssueroranyDealerto publish a prospectus pursuant toArticle 3 of the Prospectus Directive or supplement a prospectus pursuant toArticle16oftheProspectusDirective,ineachcase,inrelationtosuchoffer. iv NOTICETOUNITEDKINGDOMRESIDENTS The distribution in the United Kingdom of this Base Prospectus, any FinalTerms and any other marketing materials relating to the Notes if effected by a person who is not an authorised person under the Financial ServicesandMarketsAct2000isbeingaddressedto,ordirectedat,onlythefollowingpersons:(i)persons whoareInvestmentProfessionalsasdefinedinArticle19(5)oftheFinancialServicesandMarketsAct2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”); (ii) persons falling withinanyofthecategoriesofpersonsdescribedinArticle49(1)oftheFinancialPromotionOrder(allsuch persons together being referred to as “relevant persons”; and (iii) any other person to whom it may otherwise lawfully be made in accordance with the Financial Promotion Order. Any person who is not a relevantpersonshouldnotactorrelyonthisdocumentoranyofitscontents.Personsintowhosepossession this Base Prospectus may come are required by the Issuer, the Arrangers and the Dealers to inform themselvesaboutandtoobservesuchrestrictions. NOTICETORESIDENTSOFTHEKINGDOMOFSAUDIARABIA ThisBaseProspectusmaynotbedistributedinSaudiArabiaexcepttosuchpersonsasarepermittedunder theOffersofSecuritiesRegulationsissuedbytheCapitalMarketAuthorityoftheKingdomofSaudiArabia (the“CapitalMarketAuthority”). TheCapitalMarketAuthoritydoesnotmakeanyrepresentationsastotheaccuracyorcompletenessofthis Base Prospectus and expressly disclaims any liability whatsoever for any loss arising from, or incurred in relianceupon,anypartofthisBaseProspectus.ProspectivepurchasersofNotesissuedundertheProgramme should conduct their own due diligence on the accuracy of the information relating to the Notes. If a prospectivepurchaserdoesnotunderstandthecontentsofthisBaseProspectus,heorsheshouldconsultan authorisedfinancialadviser. NOTICETORESIDENTSOFTHEKINGDOMOFBAHRAIN ThisBaseProspectusdoesnotconstituteanofferofsecuritiesintheKingdomofBahrainintermsofArticle (81) of the Central Bank and Financial Institutions Law 2006 (decree Law No. 64 of 2006). This Base Prospectusandanyrelatedofferingdocumentshavenotbeenandwillnotberegisteredasaprospectuswith the Central Bank of Bahrain. Accordingly, no securities may be offered, sold or made the subject of an invitation for subscription or purchase nor will this Base Prospectus or any other related document or materialbeusedinconnectionwithanyoffer,saleorinvitationtosubscribeorpurchasesecurities,whether directlyorindirectly,topersonsintheKingdomofBahrain,otherthanto‘accreditedinvestors’,assuchterm isdefinedbytheCentralBankofBahrain. The Central Bank of Bahrain has not reviewed, approved or registered this Base Prospectus or any related offeringdocumentsandithasnotinanywayconsideredthemeritsoftheNotestobeofferedforinvestment, whether in or outside the Kingdom of Bahrain. Therefore, the Central Bank of Bahrain assumes no responsibility for the accuracy and completeness of the statements and information contained in this Base Prospectus and expressly disclaims any liability whatsoever for any loss howsoever arising from reliance uponthewholeoranypartofthecontentofthisBaseProspectus.Noofferofsecuritieswillbemadetothe publicintheKingdomofBahrainandthisBaseProspectusmustbereadbytheaddresseeonlyandmustnot beissued,passedto,ormadeavailabletothepublicgenerally. NOTICETORESIDENTSOFTHESTATEOFQATAR This Base Prospectus does not and is not intended to constitute an offer, sale or delivery of notes or other debtfinancinginstrumentsunderthelawsoftheStateofQatarandhasnotbeenandwillnotbereviewedor approvedbyorregisteredwiththeQatarFinancialMarketsAuthorityortheQatarCentralBank.TheNotes arenotandwillnotbetradedontheQatarExchange. v PRESENTATIONOFSTATISTICALANDOTHERINFORMATION PresentationofStatisticalInformation Statistical data appearing in this Base Prospectus has, unless otherwise stated, been obtained from, among others,theGeneralAuthorityforStatistics (“GASTAT”), theSaudiArabian MonetaryAgency(“SAMA”), the Ministry of Finance, the Ministry of Economy and Planning, Saudi Aramco, the Ministry of Energy, Industry and Mineral Resources, the CMA, the Saudi Commission for Tourism and National Heritage (“SCTH”), the Communications and Information Technology Commission (the “CITC”), the General Railway Organisation, the Saudi PortsAuthority, the Ministry of Transport, the GeneralAuthority of Civil Aviation(“GACA”),thePublicPensionAgency(the“PPA”),theGeneralOrganizationforSocialInsurance (the“GOSI”)andtheSaudiFundforDevelopment(the“SFD”).Somestatisticalinformationhasalsobeen derivedfrominformationpubliclymadeavailablebythirdparties,includingtheUnitedNations(the“UN”), theWorld Bank, theWorldTrade Organisation (the “WTO”), the Organization of the Petroleum Exporting Countries(“OPEC”),theInternationalMonetaryFund(the“IMF”)andotherthirdparties.Wheresuchthird party information has been so sourced the source is stated where it appears in this Base Prospectus. The Issuer confirms that such information has been accurately reproduced. Similar statistics may be obtainable fromothersources,buttheunderlyingassumptions,methodologyand,consequently,theresultingdatamay varyfromsourcetosource. Although every effort has been made to include in this Base Prospectus the most reliable and the most consistently presented data, no assurance can be given that such data was compiled or prepared on a basis consistentwithinternationalstandards. Annual information presented in this Base Prospectus is based upon 1 January to 31 December periods, unlessotherwiseindicated.Notwithstandingtheforegoing,forthepurposesoftheGovernment’sbudget(the details of which are set forth in “Public Finance”), the Government’s fiscal year commences on 31 December and ends on 30 December in the following year. References in this Base Prospectus to a specific “fiscal year” are to the 12-month period commencing on 31 December of the preceding calendar yearandendingon30Decemberofthespecifiedyear. CertainDefinedTermsandConventions CapitalisedtermswhichareusedbutnotdefinedinanyparticularsectionofthisBaseProspectuswillhave the meaning attributed thereto in “Terms and Conditions of the Notes” or any other section of this Base Prospectus.Inaddition,allreferencesinthisBaseProspectusto: • “SaudiArabia”ortothe“Kingdom”aretotheKingdomofSaudiArabia; • the“Government”aretothegovernmentofSaudiArabia; • “bpd”aretobarrelsperday; • “GW”aretogigawatts; • “GWh”aretogigawatthours; • “kg”aretokilograms; • “km”aretokilometres; • “MW”aretomegawatts; • “mtpy”aretomilliontonnesperyear; • “scfd”aretosquarecubicfeetperday; • “TEUs”aretotwenty-footequivalentunits; • “tonnes”aretometrictonnes;and • “TWh”aretoterawatthours. vi CertainfiguresandpercentagesincludedinthisBaseProspectushavebeensubjecttoroundingadjustments; accordingly figures shown in the same category presented in different tables may vary slightly and figures shownastotalsincertaintablesmaynotbeanarithmeticaggregationofthefigureswhichprecedethem. CurrenciesandExchangeRates AllreferencesinthisBaseProspectusto: • “Saudi riyals”, “riyals” and “SAR” refer to Saudi riyals, the legal currency of SaudiArabia for the timebeing; • “U.S. dollars”, “dollars”, “U.S.$” and “$” refer to United States dollars, the legal currency of the UnitedStatesforthetimebeing; • “pounds sterling”, “pounds”, “GBP” and “£” refer to pounds sterling, the legal currency of the UnitedKingdomforthetimebeing;and • “euro”, “EUR” and “€” refer to the currency introduced at the start of the third stage of European economic and monetary union pursuant to the Treaty establishing the European Community, as amended. The Saudi riyal has been pegged to the U.S. dollar at a fixed exchange rate of SAR 3.75 = U.S.$1.00 and, unlessotherwiseindicated,U.S.dollaramountsinthisBaseProspectushavebeenconvertedfromSaudiriyal atthisexchangerate. WebsitesandWebLinks Thewebsitesand/orweblinksreferredtointhisBaseProspectusareincludedforinformationpurposesonly andthecontentofsuchwebsitesorweblinksisnotincorporatedinto,anddoesnotformpartof,thisBase Prospectus. FORWARD-LOOKINGSTATEMENTS CertainstatementsincludedinthisBaseProspectusmayconstitute“forwardlookingstatements”withinthe meaning of Section 27A of the SecuritiesAct and Section 21E of the United States ExchangeAct of 1934, as amended (the “ExchangeAct”). However, this Base Prospectus is not entitled to the benefit of the safe harbour created thereby.These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes”, “estimates”, “anticipates”, “projects”, “expects”, “intends”, “may”, “will”, “seeks” or “should” or, in each case, their negative or other variations or comparable terminology, or in relation to discussions of strategy, plans, objectives, goals, future events or intentions. Forward-looking statements are statements that are not historical facts, including statements about the Issuer’sbeliefsandexpectations.Thesestatementsarebasedoncurrentplans,estimatesandprojectionsand, therefore, undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made. Although the Government believes that beliefs and expectations reflected in such forward-lookingstatementsarereasonable,noassurancecanbegiventhatsuchbeliefsandexpectationswill provetohavebeencorrect.Forwardlookingstatementsinclude,butarenotlimitedto:(i)planswithrespect to the implementation of economic policy; (ii) expectations about the behaviour of the economy if certain economic policies are implemented; (iii) the outlook for gross domestic product (“GDP”), inflation, exchange rates, interest rates, commodity prices, foreign investment, balance of payments, trade and fiscal balances;and(iv)estimatesofexternaldebtrepaymentanddebtservice. Forward-looking statements involve inherent risks and uncertainties.A number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. The informationcontainedinthisBaseProspectusidentifiesimportantfactorsthatcouldcausesuchdifferences, including,butnotlimitedto: vii Externalfactors,suchas: • theimpactofchangesinthepriceofoil; • ongoingpoliticalandsecurityconcernsintheMiddleEast; • globalfinancialconditions; • presentandfutureexchangerates;and • economicconditionsintheeconomiesofkeytradingpartnersofSaudiArabia; Domesticfactors,suchas: • revenuesfromcrudeoilexports; • theimpactoftheGovernment’sfiscalconsolidationmeasures; • thediversificationoftheSaudieconomy; • thesovereigncreditratingassignedtoSaudiArabia; • changestoestimatesofhydrocarbonreserves; • levelsofunemployment; • foreigncurrencyreserves;and • themaintenanceoftheSaudiriyal-U.S.dollarcurrencypeg. Any forward-looking statements contained in this Base Prospectus speak only as at the date of this Base Prospectus. Without prejudice to any requirements under applicable laws and regulations, the Issuer expressly disclaims any obligation or undertaking to disseminate after the date of this Base Prospectus any updatesorrevisionstoanyforward-lookingstatementscontainedhereintoreflectanychangeinexpectations thereoforanychangeinevents,conditionsorcircumstancesonwhichanysuchforward-lookingstatement isbased. SERVICEOFPROCESSANDENFORCEMENTOFCIVILLIABILITIES The Issuer is a sovereign state and a substantial portion of the assets of the Issuer are therefore located outsidetheUnitedStatesandtheUnitedKingdom.Asaresult,itmaynotbepossibleforinvestorstoeffect serviceofprocesswithintheUnitedStatesand/ortheUnitedKingdomupontheIssuerortoenforceagainst it in the United States courts or courts located in the United Kingdom judgments obtained in United States courtsorcourtslocatedintheUnitedKingdom,respectively,includingjudgmentspredicateduponthecivil liability provisions of the securities laws of the United States or the securities laws of any state or territory withintheUnitedStates. A substantial part of the Issuer’s assets are located in Saudi Arabia. In the absence of a treaty for the reciprocal enforcement of foreign judgments, the courts of Saudi Arabia are unlikely to enforce a United StatesorEnglishjudgmentwithoutre-examiningthemeritsoftheclaimandmaynotconsequentlyobserve the choice by the parties of English law as the governing law of the Notes. In addition, the courts of Saudi Arabia may decline to enforce a foreign judgment if certain criteria are not met, including, but not limited to, compliance with public policy of SaudiArabia. Investors may have difficulties in enforcing any United StatesorEnglishjudgmentsorarbitralawardsagainsttheIssuerinthecourtsofSaudiArabia. The Notes are governed by English law and disputes in respect of the Notes may be settled under the Arbitration Rules of the London Court of InternationalArbitration in London, England. SaudiArabia is a signatory to the NewYork Convention on Recognition and Enforcement ofArbitralAwards (1958) and as such, any arbitral award could be enforceable in Saudi Arabia but subject to filing a legal action for recognition and enforcement of foreign arbitral awards with the Enforcement Departments of the General Courts which can take considerable time. Enforcement in Saudi Arabia of a foreign arbitral award is not viii

Description: