DON PB15 Press Brief PDF

Preview DON PB15 Press Brief

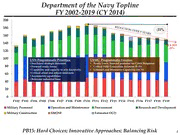

DEPARTMENT OF THE NAVY FY 2015 PRESIDENT’S BUDGET Rear Admiral William K. Lescher, USN Deputy Assistant Secretary of the Navy for Budget March 2014 Strategic Foundation CNO National CNO DoD CMC SECNAV Guidance CMC Guidance Guidance Guidance Guidance Defense Planning and Programming Guidance Tenets Warfighting First Operate Forward Be Ready 10 Primary Department of the Missions Navy Priorities Rebalance to Protect Five Pillars Asia-Pacific Homeland People Region High Quality Engage Joint Force of Globally Platforms People 2020 Unit Readiness Infrastructure Project power Power and win Capability to Sustainment decisively Partnerships meet strategic Equipment guidance 2 Modernization 1 Where it Matters, When it Matters Global Engagement Navy MMaarriinnee CCoorrppss 323,561 active strength on a Daily Basis 119935,, 870910 aaccttiivvee ssttrreennggtthh 3,881 mobilized reservists 22,,222451 aaccttiivvee rreesseerrvveess Battle Force Ships: 289 21,,241162 aaccttiivvaatteedd rreesseerrvviissttss 42,514 Sailors deployed afloat 44,,665500 MMaarriinneess ddeeppllooyyeedd aaffllooaatt Deployed: FY2014/ 19/ 23 Avg TToottaall ddeeppllooyyeedd:: 3379,,440000 Total: 289/ 309/ 316 TToottaall AAffgghhaanniissttaann:: 66,,230000 Deployed: 113/ 127/ 124 48 Ships NNOORRTTHHCCOOMM:: 110000 EEUUCCOOMM:: 13,,010000 OOtthheerr CCEENNTTCCOOMM:: 33,,675000 1CSG 1 ARG/MEU SSOOUUTTHHCCOOMM:: 115000 2 BMD 31 Ships 187 Ships AAFFRRIICCOOMM:: 11,,000000 PPAACCOOMM:: 2255,,330000 1 Amphib 1 SSGN 1 Amphib 1 CVN 20 Ships 1 SSGN 1 ARG/MEU 1 CSG 1 BMD 1 ARG/MEU 2 SSGN 2 BMD 1 Ships 2 Ships Total: 291 Total: 289 Deployed: 106 Ships Operations Deployed: 104 Ships Amphib Operations Exercise/TSC 3 2 Department of the Navy Topline FY 2002-2019 (CY 2014) 200 180 -21% 160 140 BCA 2023 -25% 120 100 USN Programmatic Priorities: USMC Programmatic Priorities: • Sea-based strategic deterrent • Ready Force, forward postured for Crisis Response 80 • Forward ready forces • Critical Fifth Generation Aviation (F-35) • Capability and capacity to win decisively • Littoral/Land Maneuver Capability (ACV) 60 • Critical afloat and ashore readiness • Asymmetric capabilities • Relevant industrial base 40 20 0 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Military Personnel Operation and Maintenance Procurement Research and Development Military Construction SMOSF Estimated OCO PB15: Hard Choices; Innovative Approaches; Balancing Risk 4 3 Department of the Navy Topline FY 2002-2019 (TY) FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Total Funding (TY) $101.7 $126.3 $123.5 $133.6 $144.3 $151.6 $164.9 $166.8 $177.1 $176.8 $174.6 $163.1 $163.7 Baseline $101.7 $116.8 $118.4 $120.9 $127.9 $127.2 $139.2 $148.1 $156.1 $156.1 $158.3 $151.6 $149.8 $148.0 $159.5 $161.2 $163.7 $165.9 Funding (TY) FY15-19 -$38.1B (to PB14) 180 1 21 21 16 0 2 -6.2 -7.7 -5.1 160 -4.0 17 12 14 -15.1 26 BCA 140 25 17 sra 5 13 65 65 64 65 66 66 llo 120 10 64 70 60 59 56 D f 59 o s 100 47 54 52 n 44 48 o i l l iB 80 39 46 47 48 43 47 50 51 51 52 42 42 60 40 38 43 35 36 37 33 40 20 35 36 37 37 38 40 42 44 45 46 44 45 45 45 46 47 48 30 0 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 MilPers O&M Investment OCO ARRA SMOSF 5 (FY 2009 $1B TY) (FY 2013 $0.4B TY) 4 Numbers may not add due to rounding (FY 2104 $2.2B TY) Summary by Appropriation Group FY 2015 Base Budget O&M: $46.8B FY15: Procurement: $38.4B Ship Ops & Maint $11.2 Ships $14.4 Aviation Ops & Maint $8.3 $148.0B Aircraft $13.1 Base Ops & Support $6.8 Marine Corps O&M $5.9 Weapons $3.2 Combat/Weapons Support $4.8 Marine Corps $1.0 Service Wide Support $4.7 Ammunition $0.8 Training and Education $1.7 32% Reserve O&M $1.3 Other Navy Procurement $6.0 Environmental Restoration $0.3 25% Mobilization $1.7 R&D: $16.3B Basic Research $0.6 MilPers: $45.0B Applied Research $0.8 31% 11% Basic Pays $18.8 Advance Tech Dev $0.6 Housing Allowance $7.4 Adv Component Dev $4.6 Retired Pay Accrual $5.9 1% System Dev & Demo $5.4 Health Accrual $2.0 Management Support $1.0 Reserve Personnel $2.5 Subsistence $2.2 Infrastructure: $1.5B Ops Systems Dev $3.3 Allowances $1.1 MILCON $1.1 Special Pays $1.6 BRAC $0.1 Other $3.5 Family Housing $0.4 6 5 Numbers may not add due to rounding Military Personnel Navy Personnel Strength Marine Corps Personnel Strength Aligning the Force Focusing on forward presence and crisis response - FY15 Active end strength 323,600 - FY15 Active end strength 182,700 o Reduce manning gaps at sea, improve sea/shore flow o Includes Marine Corps Embassy Security Guard plus-up o Investing in Career Sea Pay, Career Sea Pay – Premium o Remaining agile and ready for a full range of contingencies - FY15 Reserve end strength 57,300 - FY15 Reserve end strength 39,200 200,000 330,000 325,000 190,000 320,000 315,000 310,000 180,000 305,000 300,000 170,000 295,000 290,000 160,000 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Actual PB 14 PB 15 Actual PB 14 PB 15 Base + OCO 7 6 Civilian Personnel *FY13 FY14 FY15 FTE FY13 FY14 FY15 207,869 212,798 215,014 Total — Department of the Navy 207,869 212,798 215,014 250,000 200,000 22,216 23,055 By Type Of Hire 22,942 Direct 196,710 201,339 203,462 Indirect Hire, Foreign National 11,159 11,459 11,552 150,000 100,000 By Appropriation/Fund 184,927 190,582 191,959 Operation and Maintenance 127,656 130,436 133,643 50,000 Other (FHOPS/RDTEN) 1,748 2,010 1,936 Working Capital Funds 78,465 80,352 79,435 - 207,869 212,798 215,014 FY13 FY14 FY15 Marine Corps Navy *NOTE: FTE total for FY 2013 does not include approximately 3,200 FTEs due to 6 days of furlough. FY15 FY16 FY17 FY18 FY19 FYDP FTE Profile: 215,014 214,121 212,326 210,252 208,668 Management Headquarters: 20% reduction over the FYDP begins with the elimination of 328 HQ FTEs in FY15. Ship Maintenance: Continued focus on ship maintenance (including nuclear manning). Shipyard Firefighting Capability: Increase to strengthen fire emergency response capability. 8 7 FY15 Baseline Readiness Metrics Ship Operations Flying Hour Operation Marine Corps Ground Equip 45 days/qtr deployed Navy T-Rating 2.5 83% of projected Marine Corps T-Rating 2.0 maintenance funded in FY15 ($B) 20 days/qtr non-deployed ($B) ($B) 6.0 10.0 0.8 5.0 0.6 8.0 0.8 4.0 1.6 1.9 0.6 6.0 3.0 0.6 4.7 4.0 0.4 0.4 2.0 3.3 3.9 7.0 6.3 7.2 1.0 2.0 0.2 0.2 0.2 0.2 0.0 0.0 0.0 4.7 5.1 5.2 FY13 FY14 FY15 FY13 FY14 FY15 FY13 FY14 FY15 Ship Depot Maintenance Aircraft Depot Maint/Logistics Base Support 80% of projected ADM Navy 70%/USMC 75% 80% of projected maintenance requirement funded of facility sustainment model ($B) funded in baseline ($B) ($B) 8.0 1.6 10.0 0.2 7.0 1.4 0.2 9.0 0.7 0.2 1.3 8.0 6.0 1.2 7.0 2.7 5.0 1.0 6.0 6.2 4.0 0.8 6.4 6.0 5.0 3.0 0.6 1.2 1.3 1.3 5.7 5.3 4.0 2.0 4.1 0.4 3.0 1.0 0.2 2.0 3.2 0.0 0.0 1.0 2.5 2.7 FY13 FY14 FY15 FY13 FY14 FY15 0.0 FY13 FY14 F9Y 15 NAVY BASE USMC BASE OCO 8 Shipbuilding Procurement Plan SSN 783 FY14 FY15 FY16 FY17 FY18 FY19 FYDP CVN-21 0 0 0 0 1 0 1 SSN-774 2 2 2 2 2 2 10 DDG 51 1 2 2 2 2 2 10 LCS 4 3 3 3 3 2 14 LHA(R) 0 0 0 1 0 0 1 T-ATF 0 0 0 2 1 1 4 MLP/AFSB 1 0 0 1 0 0 1 T-AO(X) 0 0 1 0 1 1 3 New Construction Total QTY 8 7 8 11 10 8 44 DDG 51 LCAC SLEP 4 2 4 4 4 0 14 Ship-to-Shore Connector 0 2 5 5 8 11 31 SC(X) (R) (LCU Replacement) 0 0 0 0 1 2 3 Moored Training Ships 0 1 0 1 0 0 2 CVN RCOH* 0 0 0 0 0 0 0 Total Shipbuilding QTY 12 12 17 21 23 21 94 Total Shipbuilding includes all new construction, RCOH, SLEP or conversion in SCN, R&D and FY14 NDSF, as well as other related line items including Service Craft, Outfitting and Post Delivery. *Pending FY16 Decision 10 LCS – (Independence) LCS – (Freedom) CVN 78 9