Discount to face value PDF

Preview Discount to face value

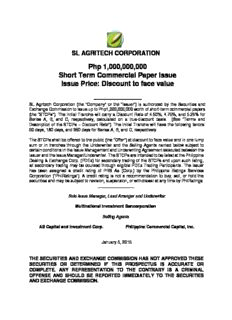

SL AGRITECH CORPORATION Php 1,000,000,000 Short Term Commercial Paper Issue Issue Price: Discount to face value SL Agritech Corporation (the “Company” or the “Issuer”) is authorized by the Securities and Exchange Commission to issue up to Php1,000,000,000 worth of short-term commercial papers (the “STCPs”). The Initial Tranche will carry a Discount Rate of 4.50%, 4.75%, and 5.25% for Series A, B, and C, respectively, calculated on a true-discount basis. (See “Terms and Description of the STCPs – Discount Rate”). The Initial Tranche will have the following tenors: 90 days, 180 days, and 360 days for Series A, B, and C, respectively. The STCPs shall be offered to the public (the “Offer”) at discount to face value and in one lump sum or in tranches through the Underwriter and the Selling Agents named below subject to certain conditions in the Issue Management and Underwriting Agreement executed between the Issuer and the Issue Manager/Underwriter. The STCPs are intended to be listed at the Philippine Dealing & Exchange Corp. (PDEx) for secondary trading of the STCPs and upon such listing, all secondary trading may be coursed through eligible PDEx Trading Participants. The Issuer has been assigned a credit rating of PRS Aa (Corp.) by the Philippine Ratings Services Corporation (“PhilRatings”). A credit rating is not a recommendation to buy, sell, or hold the securities and may be subject to revision, suspension, or withdrawal at any time by PhilRatings. Sole Issue Manager, Lead Arranger and Underwriter Multinational Investment Bancorporation Selling Agents AB Capital and Investment Corp. Philippine Commercial Capital, Inc. January 5, 2015 THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. SL AGRITECH CORPORATION STERLING PLACE 2302 PASONG TAMO EXTENSION MAKATI CITY 1231, PHILIPPINES +632 813 7828 SL AGRITECH CORPORATION (the “Issuer” or the “Company) is offering Short Term Commercial Papers (the “STCPs”) in the aggregate principal amount of P1,000,000,000.00 (the “Offer”). This is the first issuance of STCPs by the Company. The STCPs, which may be issued in lump sum or in tranches, shall have an interest rate fixed prior to issuance. The STCPs will be unsecured obligations of the Company and will rank pari passu without any preference amongst themselves and at least pari passu with other unsecured and unsubordinated obligations of the Company, present and future, other than obligations preferred by law. The STCPs will be effectively subordinated in right of payment to all secured debt of the Company to the extent of the value of the assets securing such debt and all debt that is evidenced by a public instrument under Article 2244(14) of the Civil Code of the Philippines. The Company expects the Net Offer proceeds to amount to approximately Php990,388,375.00. Such proceeds will be used by the Company for general working capital requirements to finance inventory acquisition and refinance existing obligations. See “Use of Proceeds” on page 27. The Underwriter will receive 0.50% on the aggregate value of the STCPs issued. Such amount shall be inclusive of the underwriting and selling agency fees and shall be deductible from the net proceeds of the Offering. The Company was registered with the SEC on September 11, 2000 with an authorized capital stock of Php100,000,000.00 divided into 1,000,000 common shares with a par value of Php100.00. In September 28, 2010, the SEC approved the increase in the Company’s authorized capital stock to Php1,000,000,000.00 divided into 1,000,000,000 common shares with a par value of Php1.00 per share. In July 9, 2012, the SEC approved the increase in the Company’s authorized capital stock to Php2,000,000,000.00 divided into 2,000,000,000 common shares with a par value of Php1.00 per share. The Company is the only Philippine producer of hybrid rice seeds with fully integrated operations. The Company operates two business segments: the production of hybrid rice seeds and premium rice. The majority of the Company’s business is currently derived from hybrid rice seeds, after its first product, SL-8H, was successfully developed and distributed. Another objective of the Company is to develop premium rice from its hybrid rice seed products. The Company currently conducts research and propagates proprietary hybrid rice seed varieties, and distributes premium rice products under the brand names “Doña Maria”, “Cherry Blossom” and “Willy Farms.” The Company was granted by the BOI non-pioneer status for its hybrid rice production in Nueva Ecija in March 2015 and pioneer status for its seeds production in Lupon, Davao Oriental in February 2009. The Company’s main activities are covered under the Investment Priority Plan of the Board of Investments and thereby granted BOI incentives. The hybrid seed production in Lupon, Davao Oriental is registered as a pioneer producer of hybrid rice seed with an annual capacity of 3.2 million tons, while the rice processing plant in Talavera, Nueva Ecija is registered as a new producer of hybrid rice with an annual capacity of 29,225 metric tons. As a registered company, it is entitled to certain benefits including Income Tax Holiday for a period of five (5) years from the date of registration with an extension of two (2) years. The Company further avails of BOI benefits under the law as a result of the additions to and expansion of its production facilities. Page 2 The Company’s Board of Directors (the “Board”) is authorized to declare cash or stock dividends or a combination thereof. A cash dividend declaration requires the approval of the Board and no shareholder approval is necessary. A stock dividend declaration requires the approval of the Board and shareholders representing at least two-thirds of the Company’s outstanding capital stock. Holders of outstanding shares on a dividend record date for such shares will be entitled to the full dividend declared without regard to any subsequent transfer of shares. The Company, intends to declare as a policy at least 5% of its prior year’s net income as dividends whether in stock or in cash, subject to statutory limitations. See “Dividend Policy” on page 72. Unless otherwise stated, all information contained in this Prospectus has been supplied by the Company. The Company, through its Board, having made all reasonable inquiries, accepts full responsibility for the information contained in this Prospectus and confirms that this Prospectus contains all material information with regard to the Company, its business and operations and the STCPs, which as of the date of this Prospectus is material in the context of the Offer; that, to the best of its knowledge and belief as of the date hereof, the information contained in this Prospectus are true and correct and is not misleading in any material respect; that the opinions and intentions expressed herein are honestly held; and, that there are no other facts, the omission of which makes this Prospectus, as a whole or in part, misleading in any material respect. The delivery of this Prospectus shall not, under any circumstances, create any implication that the information contained herein is correct as of any time subsequent to the date hereof. Multinational Investment Bancorporation, the Sole Issue Manager, Arranger and Underwriter, warrants that it has, to the best of its ability, exercised the level of due diligence required under existing regulations in ascertaining that all material information contained in this Prospectus are true and correct, and that to the best of its knowledge no material information was omitted, which was necessary in order to make the statements contained in this Prospectus not misleading. Except for its failure to exercise the required due diligence, the sole Issue Manager, Lead Arranger and Underwriter assumes no responsibility for any breach of the representations of the Company. Market data and certain industry information used throughout this Prospectus were obtained from internal surveys, market research, publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Similarly, internal surveys, industry forecasts and market research, while believed to be reliable, have not been independently verified and neither the Company nor the Sole Issue Manager, Arranger and Underwriter makes any representation as to the accuracy and completeness of such information. In making an investment decision, applicants are advised to carefully consider all the information contained in this Prospectus, including the following key points characterizing potential risks in an investment in the STCPs: Risks relating to the Company and its business Dependency on programs developed or supported by the Department of Agriculture of the Philippines; Risk of non-acceptance of the Company’s hybrid rice seed products; Risk of being affected by changes in the preferences or purchasing power of consumers; Risks of the Company not executing its sales strategy efficiently; Dependence on its proprietary rights on hybrid seeds and rice; Page 3 The Company’s business is affected by seasonality; Revocation of BOI Registration; Dependence on key personnel, the loss of which could adversely affect its business and growth; Dependence on certain key managers of Sterling Paper Enterprise, Inc.; Reliance on third parties; Risk of products not meeting customer’s requirements; Increased amount of debt. General Risks Political or social instability Slowdown in the Philippine economy Natural catastrophe and calamity Risks Relating to the Short Term Commercial Papers Liquidity Risk – the Philippine securities markets are substantially smaller, less liquid and more concentrated than major securities markets Price Risk – the STCPs market value moves (either up or down) depending on the change in interest rates Retention of Ratings Risk – there is no assurance that the rating of the STCPs will be retained throughout the life of the STCPs For a more detailed discussion on the risks in investing, see section on “Risk Factors” beginning on page 19 of this Prospectus, which, while not intended to be an exhaustive enumeration of all risks, must be considered in connection with a purchase of the STCPs. This Prospectus includes forward-looking statements. The Company has based these forward- looking statements largely on its current expectation and projections about future events and financial trends affecting its business and operations. Words including, but not limited to “believe”, “may”, “will”, “estimates”, “continues”, “anticipates”, “intends”, “expects” and similar words are intended to identify forward-looking statements. In light of the risks and uncertainties associated with forward-looking statements, investors should be aware that the forward-looking events and circumstances in this Prospectus may or may not occur. The Company’s actual results could differ significantly from those anticipated in the Company’s forward-looking statements. The contents of this Prospectus are not to be considered as legal, business or tax advice. Each prospective purchaser of the STCPs receiving a copy of this Prospectus acknowledges that he has not relied on the Sole Issue Manager, Arranger and Underwriter or Selling Agents in his investigation of the accuracy of such information or his investment decision. Prospective purchasers should consult their own counsel, accountants or other advisors as to legal, tax, business, financial and related aspects of a purchase of the STCPs. The STCPs are offered solely on the basis of the information contained and the representations made in this Prospectus. No dealer, salesman or other person has been authorized by the Company or by the Sole Issue Manager, Arranger and Underwriter to issue any advertisement or to give any information or make any representation in connection with the Offer other than those contained in this Prospectus and, if issued, given or made, such advertisement information or representation must not be relied upon as having been authorized by the Company or by the Sole Page 4 Issue Manager, Arranger and Underwriter. The laws of certain jurisdictions may restrict the distribution of this Prospectus and the offer and sale of the STCPs. Persons into whose possession this Prospectus or any of the STCPs come must inform themselves about, and observe any such restrictions. Neither the Company, the Issue Manager/Underwriter and the Selling Agents, nor any of its or their respective representatives are making any representation to any prospective purchaser of the STCPs of the legality of any investment in the STCPs by such prospective purchaser under applicable legal investment or similar laws or regulations. ALL REGISTRATION REQUIREMENTS HAVE BEEN MET AND ALL INFORMATION CONTAINED HEREIN IS TRUE AND CURRENT. The Company is organized under the laws of the Republic of the Philippines. Its principal office is located at Sterling Place 2302 Pasong Tamo Extension Makati City 1231, Philippines with telephone number +632 813 7828. Any inquiry regarding this Prospectus should be forwarded to the Company, or to Multinational Investment Bancorporation. SL AGRITECH CORPORATION By: HENRY LIM BON LIONG Chairman SUBSCRIBED AND SWORN to before me this ____th day of ___________ 2015 in __________, Philippines, affiant exhibiting to me his ____________________________________ issued on _____________ in ____________ Doc. No ________; Page No________; Book No ________; Series of 2015. Page 5 TABLE OF CONTENTS DEFINITION OF TERMS ............................................................................................................ 7 EXECUTIVE SUMMARY ............................................................................................................ 9 SUMMARY FINANCIAL INFORMATION ................................................................................. 12 THE OFFER ............................................................................................................................. 14 RISK FACTORS ....................................................................................................................... 20 USE OF PROCEEDS ................................................................................................................ 28 DETERMINATION OF THE OFFER PRICE ............................................................................. 30 PLAN OF DISTRIBUTION ........................................................................................................ 31 DESCRIPTION OF THE SECURITIES TO BE REGISTERED .................................................. 33 INTEREST OF NAMED EXPERTS AND COUNSEL ................................................................ 36 INDUSTRY OVERVIEW AND COMPETITIVE OVERVIEW ...................................................... 37 THE COMPANY ....................................................................................................................... 48 COMPANY OVERVIEW ........................................................................................................48 HISTORY ..............................................................................................................................48 PRODUCTS ..........................................................................................................................50 RESEARCH AND DEVELOPMENT ......................................................................................52 PRODUCTION PROCESS ....................................................................................................55 MARKETING, SALES AND DISTRIBUTION .........................................................................58 COMPETITION .....................................................................................................................60 COMPETITIVE STRENGTHS ...............................................................................................60 BUSINESS STRATEGY ........................................................................................................61 NON-DEPENDENCE ON A SINGLE CUSTOMER ...............................................................62 TRANSACTIONS WITH OR DEPENDENCE ON RELATED PARTIES .................................63 INTELLECTUAL PROPERTIES ............................................................................................63 GOVERNMENT APPROVALS AND PERMITS .....................................................................71 EFFECT OF EXISTING OR PROBABLE GOVERNMENT REGULATIONS ON THE COMPANY’S BUSINESS ......................................................................................................72 EMPLOYEES ........................................................................................................................72 PLANS AND PROGRAMS ....................................................................................................72 PROPERTIES .......................................................................................................................73 INSURANCE .........................................................................................................................73 LEGAL PROCEEDINGS .......................................................................................................74 MARKET INFORMATION .....................................................................................................74 DIVIDEND POLICY ...............................................................................................................74 RECENT ISSUANCE OF EXEMPT OR UNREGISTERED SECURITIES .............................75 DIRECTORS AND SENIOR MANAGEMENT ........................................................................75 INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS ........................................................79 SECURITY OWNERSHIP OF CERTAIN RECORD AND BENEFICIAL OWNERS ................82 MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION .................................................................................................................. 86 MATERIAL CONTRACTS & AGREEMENTS ......................................................................... 111 REGULATORY & ENVIRONMENTAL MATTERS ................................................................. 113 GENERAL CORPORATE INFORMATION ............................................................................. 114 PHILIPPINE TAXATION ......................................................................................................... 115 Page 6 DEFINITION OF TERMS Banking Day……………….. A day (except Saturdays, Sundays and holidays) on which banks in the Philippines are open for business BIR………………..………… Bureau of Internal Revenue BOI………………..………… Board of Investments BPI………………..………… Bureau of Plant and Industry BSP………………..………... Bangko Sentral ng Pilipinas, the central bank of the Philippines Company………………..….. SL Agritech Corporation Corporation Code…………. Batas Pambansa Blg. 68, otherwise known as “The Corporation Code of the Philippines” DA………………..…………. Department of Agriculture DENR………………..……… Philippine Department of Environment and Natural Resources Directors……………………. The members of the Board of Directors of the Company Government………………... The Government of the Republic of the Philippines GRT…………………………. Gross receipts tax Issue Date………………….. A date at which the STCPs or a portion thereof shall be issued by the Issuer, which date shall be set by the Issuer in consultation with the Sole Issue Manager, Arranger and Underwriter. For the avoidance of doubt, an Issue Date shall at any time be a date which is within the validity of the SEC Permit to Sell. Listing Date………………… The date at which the STCP shall be listed with PDEx Lim Family………………….. Mr. Henry Lim Bon Liong, Mr. Joseph Lim Bon Huan, Mr. Gerry Lim Bon Hiong, and Mr. Ruben Lim Bon Siong. MAO………………………… Municipal Agricultural Officers NFA…………………………. National Food Authority Offer………………………… Up to Php1,000,000,000 Short- ‐Term Commercial Papers Offer Price………………….. Discount to face value P or Php or P………………. Philippine Pesos, the lawful currency of the Republic of the Philippines Page 7 PDEx……………………...... Philippine Dealing & Exchange Corp. PDST……………………….. Philippine Dealing System Treasury PDTC……………………...... The Philippine Depository and Trust Corporation PFRS……………………….. Philippine Financial Reporting Standards Philratings………………….. Philippine Ratings Services Corporation Prospectus…………………. This Prospectus together with all its annexes, appendices and amendments, if any SEC…………………………. The Philippine Securities and Exchange Commission SLAC or SL Agritech……… SL Agritech Corporation STCP………………………... The short term commercial papers, an evidence of indebtedness of any person with maturity of three hundred and sixty five (365) days or less STCP Holder………………. A purchaser of the STCPs Sole Issue Manager and Arranger……………………. Multinational Investment Bancorporation SRC…………………………. Republic Act No. 8799, otherwise known as “The Securities Regulation Code” Underwriter………………… Multinational Investment Bancorporation Underwriting Agreement….. The agreement entered into by and between the Company and the Underwriter, indicating the terms and conditions of the Offer and providing that the Offer shall be fully underwritten by the Underwriter USD…………………………. U.S. Dollars, the lawful currency of the United States of America VAT…………………………. Value Added Tax Page 8 EXECUTIVE SUMMARY The following summary does not purport to be complete and is taken from and qualified in its entirety by the more detailed information including the Company’s financial statements and notes relating thereto, appearing elsewhere in this Prospectus. For a discussion of certain matters that should be considered in evaluating any investment in the STCPs, see the section entitled “Risk Factors” beginning on page 19 of this Prospectus. OVERVIEW OF THE COMPANY SL Agritech Corporation, incorporated in 2000, is the only Philippine producer of hybrid rice seeds with fully integrated operations. The Company operates two business segments: the production of hybrid rice seeds and premium rice. The majority of the Company’s business is currently derived from the hybrid rice seeds business, after its first product, SL-8H, was successfully developed and distributed. Another objective of the Company is to develop premium rice from its hybrid rice seed products. The Company currently conducts research and propagates proprietary hybrid rice seed varieties, and distributes premium rice products under the brand names “Doña Maria”, “Cherry Blossom” and “Willy Farms.” The Company’s fully integrated operations, which begins with hybrid rice seed research and ends with the sale of premium rice products, provides an advantage over traditional rice producers. This structure enables the Company to develop its proprietary hybrid rice seed varieties to either sell to local and international markets or to mass produce as premium rice. Having a fully integrated operations allows the Company to utilize its technology while simultaneously maximizing volume production with consistent quality. The Doña Maria brand of rice is positioned as premium quality rice targeting the High and Middle income consumers. The Company’s second brand, Cherry Blossom, aims to attract the lower middle income consumers. All of the Company’s rice products also originate from its proprietary hybrid rice seeds. The premium rice business currently has five (5) Doña Maria variants, one (1) Cherry Blossom variant and three (3) Willy Farms variants. The Doña Maria products currently compete in the market against the Thai Jasmine rice varieties, while Cherry Blossom aims to compete against the local varieties. The Company recently launched a third brand, Willy Farms, targeting the middle income pricing range. The Company was founded by the Lim Family and is affiliated with Sterling Paper Enterprise which is simultaneously headed by Mr. Henry Lim Bon Liong, as Chairman. The Company is positioning itself to be the Philippines’ leading proponent of hybrid rice farming technology and industry model for sound farm management practices. Its objectives are to help the country to achieve rice self- sufficiency and improve the livelihood of local farmers. COMPETITIVE STRENGTHS The Company believes that its strengths lie in the following: Innovation of high yielding rice technology Superior and consistent product quality Fully integrated operations Attractive growth prospects Strong market position Page 9 Additional information on the Company’s Competitive Strengths may be found in the “The Company” beginning page 46. BUSINESS STRATEGY The Company plans to further strengthen its position as the only local producer of high-yielding hybrid rice seeds and increase its market share of its premium rice products. The Company intends to achieve this by pursuing the following strategies: Increase brand awareness Improve operational efficiency Maintain product leadership Improve customer and market knowledge Develop new products Expand market share RISKS OF INVESTING Before making an investment decision, investors should carefully consider the risks associated with an investment in the STCPs. These risks include: Risks relating to the Company and its business Dependency on programs developed or supported by the Department of Agriculture of the Philippines; Risk of non-acceptance of the Company’s hybrid rice seed products; Risk of being affected by changes in the preferences or purchasing power of consumers; Risks of the Company not executing its sales strategy efficiently; Dependence on its proprietary rights on hybrid seeds and rice; The Company’s business is affected by seasonality; Revocation of BOI Registration; Dependence on key personnel, the loss of which could adversely affect its business and growth; Dependence on certain key managers of Sterling Paper Enterprise, Inc.; Reliance on third parties; Risk of products not meeting customer’s requirements; Increased amount of debt. Risks relating to the Short Term Commercial Papers Liquidity Risk Price Risk Retention of Ratings Risk General Risks Political or social instability Slowdown in the Philippine economy Page 10

Description: