Corporate Governance Statement 2014 - Bendigo and Adelaide Bank PDF

Preview Corporate Governance Statement 2014 - Bendigo and Adelaide Bank

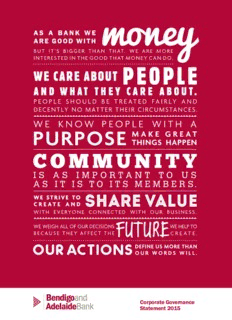

Corporate Governance Statement 2020 Introduction The context for our approach to corporate governance is our vision, strategy, values and purpose. Our vision Our vision is to be Australia’s bank of choice. Our strategy Our strategy is to reduce complexity, invest in capability and tell our story. Our values • Teamwork: We are one team with one vision. We work together, encourage diversity and respect the contribution of each individual. • Integrity: We build a culture of trust. We are open, honest and fair. • Performance: We strive for lasting success for all our stakeholders. We seek and provide feedback and find a better way. • Engagement: We listen, understand – then deliver. We build our success through the success of others. • Leadership: We all lead by example. We show initiative, are accountable and empower others. • Passion: We believe in the importance of what we do and are proud of our bank. Our purpose Our purpose is what brings it all together, the written expression of our company’s long-held philosophy. It articulates why we’re here, what we believe in, and why we do and say the things we do. Our purpose is to feed into the prosperity of our customers and their communities, not off it. Our governance framework provides a system for the oversight of decision-making, actions and behaviour to make sure we live our values, focus on our strategy and align with our purpose. 2 CORPORATE GOVERNANCE STATEMENT 2020 Overview of our corporate governance In setting up our corporate governance framework and reviewing and enhancing it we have considered APRA prudential standards and guidance and the ASX Corporate Governance Council Principles and Recommendations. For the whole of the 2020 financial year we adopted the ASX Corporate Governance Council’s fourth edition recommendations. A summary of the ASX recommendations and our adoption of them, together with a copy of the policies and other documents referred to in this report, are available at https://www.bendigoadelaide.com.au/ corporate_governance/index.asp. This corporate governance statement is accurate and up to date as at 7 September 2020 and has been approved by the Board. We have set out the key structural elements of our corporate governance framework below by way of overview. The corporate governance framework applies across the Bank and its subsidiaries (the Group). Board and Board committee Structure Shareholders Board Audit Credit Governance & HR Risk Technology Committee Committee Committee Committee Committee Managing Director Reporting to Board and executing delegated powers Executive Committee CORPORATE GOVERNANCE STATEMENT 2020 3 Our Board Our Directors Our Directors and their Board committee roles assessed each non-executive Director as independent. For these purposes, an independent Director is a non-executive are set out below. More information about each Director who is free from any business or other association Director is in the Directors’ Report in the 2020 Annual (including those arising out of a substantial shareholding, Financial Report (available from our website). involvement in past management or as a supplier, customer or adviser) that could materially interfere with the exercise of The composition of the Board changed during the year as their independent judgment. Robert Johanson retired from the Board and his role as Chair on 29 October 2019. Jacqueline Hey commenced as Chair of There were no relevant relationships to consider for any the Board at the conclusion of the Annual General Meeting on Director other than Director tenure. The Board assessed 29 October 2019. that the Directors are independent and that they continue All our Directors, apart from our Managing Director, are non- to test and challenge Executives and senior management executive Directors. The Board assesses the independence of constructively and exercise independent judgment on matters each non-executive Director on an annual basis and, for 2020, presented for Board decision. Jacqueline Hey Appointed: 2011 Last re-election: 2017 Jacqueline worked with Ericsson Independent, Chair for more than 20 years in finance, Committees: Technology, Governance marketing and sales and in leadership BCom, Graduate & HR roles in Australia, Sweden, the UK and Certificate in Management, Jacqueline has experience the Middle East. GAICD, 54 years in information technology, Current Director and memberships: telecommunications, finance, risk Director, Qantas Airways Limited, management and marketing, including AGL Energy Limited, Cricket Australia; as CEO/Managing Director of Ericsson Member, Brighton Grammar School in the UK and in Australia. Council. Marnie Baker Appointed as Managing Director: 2018 and has been an Executive of the Bank Managing Director (employee from 1989) since 2000. BBus (Acc), ASA, MAICD, Marnie has more than 30 years’ Current Director and memberships: experience in banking and financial Deputy Chair, Australian Banking SFFin, 52 years services, including retail banking, Association Council; Member, financial planning, funds management, Business Council of Australia, La Trobe payment systems, technology and University’s Bendigo Regional Advisory treasury and financial markets. She Board, Mastercard (Asia Pacific) has held senior roles across the Bank Advisory Board. Vicki Carter Appointed: 2018 Last election: 2018 Vicki is currently employed as Executive Independent Director, Transformation at Telstra. Prior Committees: Technology (Chair), Credit, to this Vicki held several executive roles BA (Social Sciences), Dip Governance & HR at NAB, as well as senior leadership Mgt, Certificate in Executive Vicki has more than 30 years’ roles at MLC, ING and Prudential. Coaching, GAICD, experience in the financial services 56 years sector including retail banking and more recently in business technology. 4 CORPORATE GOVERNANCE STATEMENT 2020 David Foster Appointed: August 2019 Last election: with Westpac and Suncorp Bank, Independent 2019 including CEO of Suncorp Bank. B.AppSci, MBA, GAICD, Committees: Credit (Chair), Risk Current Director and memberships: Chair, Motorcycle Holdings Limited; SFFin, 51 years David is an experienced non- Director, G8 Education Limited, Genworth executive Director. He holds several Mortgage Insurance Australia Limited, directorships across a range of listed Youi Holdings Pty Ltd, Peak Services Pty and government organisations. David’s Ltd; Member, University of the Sunshine earlier executive career spanning 25 Coast Council. years was primarily in financial services Jan Harris Appointed: 2016 Last election: 2019 Cabinet, including as Deputy Secretary Independent of the Treasury. Committees: Risk (Chair), Audit BEc (Hons), 61 years Jan has had a distinguished career in Current Director and memberships: External Member, Audit and Risk the Australian public service with broad Committee of the Australian Security experience in public and regulatory Intelligence Organisation; Member, policy development, economics and Australian Office of Financial governance. Jan has held senior roles Management Audit Committee. in the Department of Treasury and the Department of the Prime Minister and Jim Hazel Appointed: 2010 Last re-election: 2017 Current Director and memberships: Independent Chair, Ingenia Communities Group Committees: Credit, Risk Limited; Director, Adelaide Football BEc, SFFin, FAICD, 69 years Jim is a professional public company Club Limited, Coopers Brewery Limited; Director who has had an extensive Chair, Adelaide Festival Centre Trust; career in banking and finance, including Pro Chancellor, University of South in the regional banking industry. Australia. Robert Hubbard Appointed: 2013 Last re-election: 2019 where he was the auditor of some of Independent Australia’s largest listed companies. Committees: Audit (Chair), Risk, Rob is now a professional non- BA(Hons) Accy, FCA, 61 years Technology executive Director. Rob is an accountant with finance, Current Director and memberships: audit and risk management experience Chair, Orocobre Limited, Healius Limited; based in Queensland. He retired as a Director, L&R Foundation Pty Ltd. Partner of PricewaterhouseCoopers in 2013 after 22 years practising in the areas of corporate advice and audit, David Matthews Appointed: 2010 Last re-election: 2019 David is involved in several agricultural Independent industry bodies. David chaired the first Committees: Audit, Credit, Governance Community Bank company in Rupanyup Dip BIT, GAICD, 62 years & HR and Minyip. Group and joint venture Directorships: Current Director and memberships: Member, Community Bank National Director, Australian Grain Technologies Council; Chair, Agribusiness Advisory Pty Limited, Farm Trade Australia Pty Committee. Limited, Rupanyup/ Minyip Finance David operates a farm and an Group Limited (Rupanyup/Minyip agricultural import and export business Community Bank branch). based in the Wimmera region of Victoria. CORPORATE GOVERNANCE STATEMENT 2020 5 Our Directors continued Tony Robinson Appointed: 2006 Last re-election: 2018 Current Director and memberships: Independent Chair, Pacific Current Group Limited; Committees: Governance & HR (Chair), Director, PSC Insurance Group Limited, BCom, ASA, MBA, Audit, Technology River Capital Pty Ltd 62 years Tony has many years’ experience in financial services, particularly wealth management and insurance. Tony’s previous roles include CEO of Centrepoint Alliance Limited, IOOF Holdings Limited and OAMPS Limited. The role of our Board The Board has the following key approving regulatory financial disclosures. responsibilities. More information is contained • Risk: This includes considering recommendations of the Risk Committee, including in relation to in the Board charter (available from our risk culture, the risk management strategy and website at https://www.bendigoadelaide. framework, risk appetite, capital adequacy, com.au/globalassets/documents/ capital management, and the effectiveness of risk management. It also includes considering bendigoadelaide/governance/charters/ recommendations from the Credit Committee for board-charter.pdf). approving the credit risk management strategy and framework and the credit risk appetite. • Vision, strategy, values and purpose: This includes As well, the Board oversees technology risk setting the vision, strategy, values and purpose, management and information security. and in doing so, setting the corporate culture, and The Board has delegated management responsibilities maintaining oversight of it. to the Managing Director. It has reserved some key • People: This includes responsibilities in relation to responsibilities for the Board and Board committees the Managing Director, Executives, remuneration, as outlined in its charter. These include corporate diversity and workplace health and safety. governance, specific responsibilities of the Board under the Board charter, the responsibilities delegated by • Customer voice: This involves oversight of the Board to a Board committee, and responsibilities customer feedback and insights. otherwise required to be exercised by the Board by the • Business, operational and financial matters: This constitution, legislation or regulatory standards. The includes reviewing and approving the strategic Board also reserves for itself matters above specific direction of the Group, approving significant delegation limits including financial and risk limits. The corporate strategic initiatives, overseeing the Board may reserve any additional matter it decides, as architecture and technology strategy and advised to the Managing Director. 6 CORPORATE GOVERNANCE STATEMENT 2020 The role of our Board committees The Board committees assist the Board in Credit carrying out its responsibilities. In deciding The Credit Committee assists the Board in relation to each of the following: committee memberships, the Board • Oversight of the current and future credit risk endeavours to make the best use of the profile and management of material credit risk range of skills and expertise across the exposures consistent with the credit risk appetite. Board and share responsibility. As well, • Oversight of the credit risk management strategy overlapping memberships take into account and framework. • Monitoring new or emerging material risks and where matters raised in one committee may treatment plans. have implications for another. Committee • Monitoring the credit risk culture. membership is reviewed on an annual basis. Governance & HR The Board receives the minutes of all Board committee meetings at the following Board meeting The Governance & HR Committee assists the Board in and is presented with a verbal report from each relation to each of the following: committee Chair on significant areas of discussion and • Board nomination matters including renewal, key decisions. To assist each committee in discharging succession, performance and remuneration. its responsibilities, each committee has an annual • Corporate governance including governance meeting planner that sets out the scheduled items of developments, practices and the corporate business and reports to be considered during the year. governance statement. Information on the number of committee meetings • Human resources matters including employee held during the year, and attendance by members at engagement, retention, wellbeing, development, those meetings, is presented in the Directors’ Report diversity, and workplace health and safety. in the 2020 Annual Financial Report (available from • Remuneration matters including the remuneration our website at https://www.bendigoadelaide.com.au/ policy, remuneration risk, cash and equity-based shareholders/annual_reports.asp). incentive schemes, remuneration outcomes for The key functions of each Board committee are roles specified under the remuneration policy, and set out below. The charter for each committee and the remuneration report. the procedural rules applying to all committees are available from our website. Under the procedural rules, Risk each committee must be composed of at least three members, a majority of independent Directors (and, The Risk Committee assists the Board in relation to with the exception of the Technology Committee, all each of the following: non-executive Directors), and an independent Chair. • Oversight of the current and future risk profile and the management of material financial and operational (including non-financial) risks Audit consistent with the risk appetite and capital base. The Audit Committee assists the Board in relation to • Oversight of implementation and operation of the oversight of each of the following: risk management strategy and framework. • External audit, including prudential audit • Monitoring new or emerging material risks and requirements. treatment plans. • Internal audit (Group Assurance) function. • Monitoring the risk culture. • The integrity of statutory financial and prudential reporting including financial reporting principles, Technology policies, controls and procedures. • The effectiveness of the internal control and risk The Technology Committee assists the Board in management framework. relation to each of the following: • Oversight of the Group’s information technology Other responsibilities include ensuring there are policies and digital strategy and its implementation. and processes in place for the reporting of employee concerns/whistleblower matters and oversight of • Monitoring technology and digital business risks assurance work in relation to organisational culture. and trends relevant to the Group. CORPORATE GOVERNANCE STATEMENT 2020 7 Board composition - what we look for in our Directors Having regard to our vision, strategy, values and purpose, the individual attributes of each Director are as critical as the skills they bring. There is an expectation that each Director should be able to demonstrate sound business judgment, a strategic view, integrity, a readiness to question, challenge and critique, and leadership qualities. At a collective level, we look for More generally, our Directors the Board meets the needs of a diversity of skills, knowledge, are expected to have a clear the Group. The Board considers experience and attributes to enable understanding of our strategy it has the appropriate mix of skills the Board to provide the oversight and knowledge of the industry and expertise and it regularly needed to develop and achieve and markets in which the business reviews the skills, knowledge our strategy. We also seek diversity operates. Our Directors must also and experience represented on in gender. In addition, experience have a good understanding of the Board against the skills and through business and economic each of the major business units to experience needed to deliver the cycles developed from length of enable them to monitor effectively strategy. A combination of internal service on the Board is valued. This the performance of the business and external Board reviews across provides a deeper understanding of and the implementation of the 2019 and 2020 have confirmed the the industry including how political, strategy. Board collectively possesses an regulatory, economic and financial appropriate standard of expertise The Board has developed a skills market developments may impact across all required skill matrix areas. matrix to help in assessing and the business, as well as providing ensuring that the composition of the benefit of corporate memory. 8 CORPORATE GOVERNANCE STATEMENT 2020 The desired skills, knowledge and Risk management strategy. They also help ensure experience in the current matrix Ability to understand risk culture, our employees continue to be include: the risk management strategy committed to actively contributing and framework, and monitor the to our customers’ and the effectiveness of controls organisation’s success. Executive leadership Risk management is fundamental Successful career as a to how we operate our business Senior Executive or CEO and critical to our performance. Technology and innovation This experience brings a senior How we manage risk ultimately Experience in information executive perspective of running impacts our capital efficiency and technology systems, digital a large organisation to board our profile with our investors. channels and information security decision-making. This includes or experience in technology perspectives on organisational governance design and management including Corporate governance Our business is highly dependent executive performance and Knowledge and experience on information technology. provides an operational outlook in sophisticated governance Innovation and disruption, on implementing our business structures and commitment to particularly from new digital plans and strategy. high standards of corporate technologies, is transforming governance the way financial organisations operate and engage with their Corporate and A sound system of governance customers. To continue to be business strategy provides the foundation for the relevant, our business must be able effective oversight of decision- to evolve and adapt to the rapidly Experience in the development making, actions and behaviour to changing environment. of strategy and oversight of ensure we live our values, focus on implementation our strategy and align with This experience brings a longer our purpose, as well as promoting term perspective and a broader investor confidence. Banking and understanding of the business financial services landscape and functioning of Experience in significant larger corporate enterprises. It components of the banking and Public and also brings an ability to critically financial services industry such as regulatory policy test and challenge strategic retail banking, funds management, Experience in public and priorities and business proposals superannuation, financial advisory regulatory policy presented by management. and treasury The banking and financial services This experience is important to industry is highly regulated and understanding and monitoring continues to be directly impacted Financial acumen business performance, evaluating by continued legal and regulatory the achievement of business plans Ability to understand financial reform as well as political decision and assessing developments in statements, capital management making and public policy. our business models, distribution and corporate finance, and to channels and product innovation. assess the adequacy of financial controls People and workplace Financial acumen is essential to understanding the financial drivers health and safety Specialist knowledge Experience in overseeing and of our business and monitoring the and expertise assessing senior management, performance of the business and Experience in specialist areas remuneration frameworks, the integrity of financial reporting. such as agriculture, marketing, workplace health and safety and e-commerce and social media strategic people management A working knowledge of the Healthy, satisfied and engaged specialist business sectors that we employees are a key foundation to operate in is extremely important our success. Our employment and for our business to exploit the workplace practices play a vital unique opportunities it has in these role in attracting, motivating and specialised areas. retaining high calibre management needed to implement the CORPORATE GOVERNANCE STATEMENT 2020 9 Board renewal and re-election of Directors The Board is committed to a process of This annual assessment process is combined with the requirements for accountable persons under the orderly succession, aiming for a blend Banking Executive Accountability Regime (BEAR) of diversity in geography, background, contained in the Banking Act 1959. Each member of the Board and each Executive is an accountable person. approach and gender. Succession planning The accountability regime establishes accountability is an ongoing process, with the Board obligations for accountable persons, requiring each discussing succession planning for its accountable person to: members and the Chair regularly and • act with honesty and integrity, and with due skill, care and diligence; robustly. Ms Jacqueline Hey was appointed • deal with APRA in an open, constructive and as Board Chair at the end of the 2019 cooperative way; and Annual General Meeting. • take reasonable steps in conducting their responsibilities as an accountable person to The process to appoint a new Director is overseen prevent matters from arising that would adversely by the Board Chair and the Governance & HR affect the Bank’s prudential standing or prudential Committee. The Governance & HR Committee’s reputation. responsibilities include recommending to the Board An accountable person is required to be registered the procedure for the selection of new Directors, the with APRA and it is our responsibility to assess proposed criteria for the selection of Board candidates whether an individual is suitable to be an accountable with particular reference to the current mix of skills, person. Each Director and each Executive has been knowledge, experience and tenure on the Board, and assessed as being suitable to be an accountable identifying and nominating a short list of candidates person. for appointment to the Board. The Board may engage the services of a professional intermediary to provide A Director appointed by the Board must seek election assistance in identifying and assessing potential at the next annual general meeting after appointment. candidates. The preferred candidates meet with all For all re-nominations, the Board takes into account current Board members before a final decision is made. the skills, knowledge, experience and attributes necessary to deliver the strategy of the Group and the Each Director and Executive has a written agreement extent to which these are represented on the Board, with the Bank setting out the terms of their the diversity of the Board and the statement provided appointment. Additionally, Directors, Executives and the by the Director seeking election that supports their lead auditor must meet fit and proper standards under election. our Responsible Persons Policy, which addresses the requirements of APRA’s Prudential Standard CPS520 The notice of annual general meeting includes all “Fit and Proper”. Directors, Executives and the lead information relevant to the decision by shareholders auditor are assessed before appointment, and then whether or not to elect or re-elect a Director. This annually to make sure that they have the competence, includes relevant information obtained by the Bank as character, diligence, experience, honesty, integrity and part of the fit and proper assessment, the accountable judgment needed to properly perform their duties, person process, a statement about the Director’s as well as the education or technical qualifications, independence and a statement about the Board’s knowledge and skills relevant to those duties. This support for the Director’s election or re-election. includes obtaining or reviewing background probity checks and an individual fit and proper declaration by each Director and Executive. 10 CORPORATE GOVERNANCE STATEMENT 2020

Description: